I. MARKET ANALYSIS OF STOCKS AS OF MAY 20, 2025

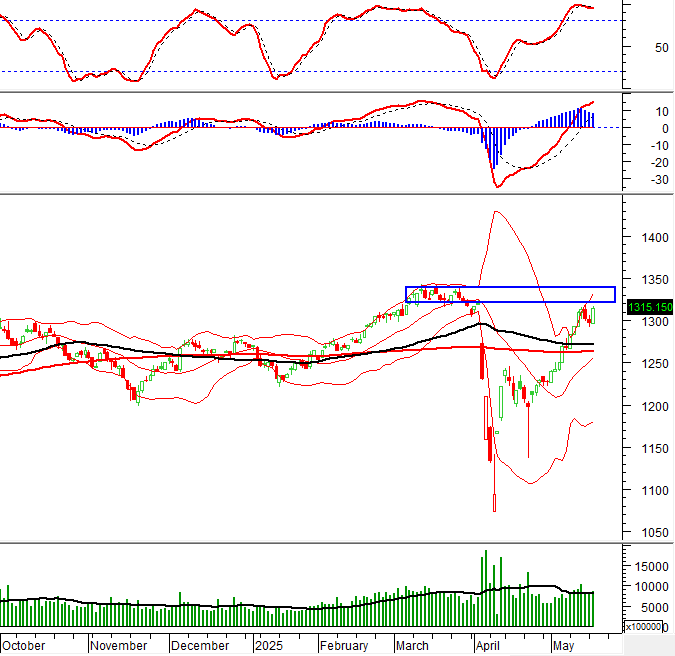

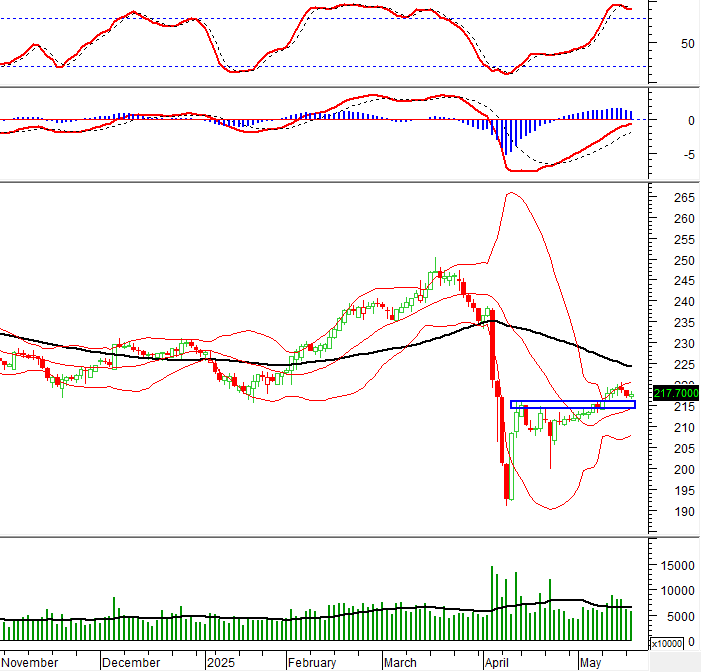

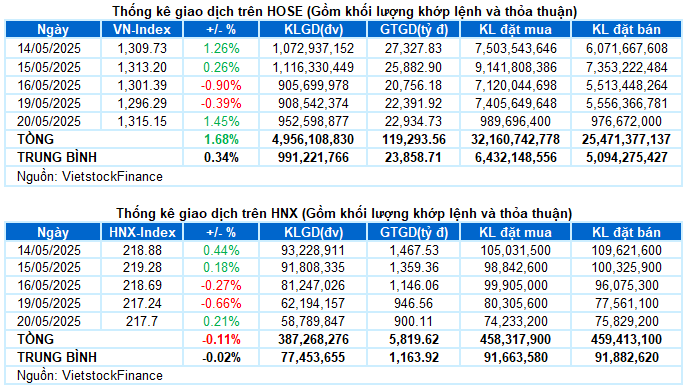

– The main indices resumed their upward trajectory during the May 20 trading session. The VN-Index rose by 1.45% to 1,315.15 points, while the HNX-Index reached 217.7 points, a slight increase of 0.21%.

– The trading volume on the HOSE floor slightly increased by 3.4%, reaching nearly 857 million units. Meanwhile, the HNX floor recorded a volume of almost 57 million units, a 6.6% decrease compared to the previous session.

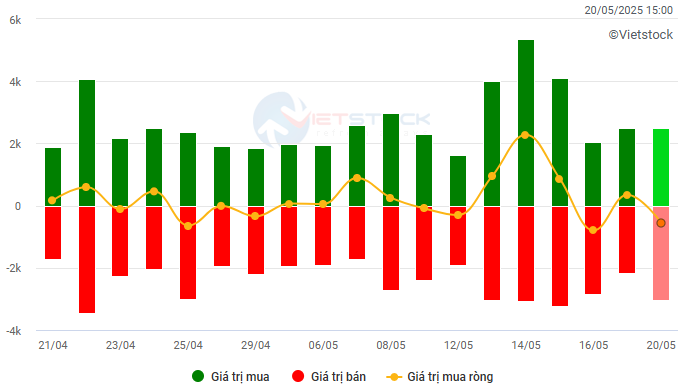

– Foreign investors net sold with a value of over 506 billion VND on the HOSE and 53 billion VND on the HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM. Unit: Billion VND

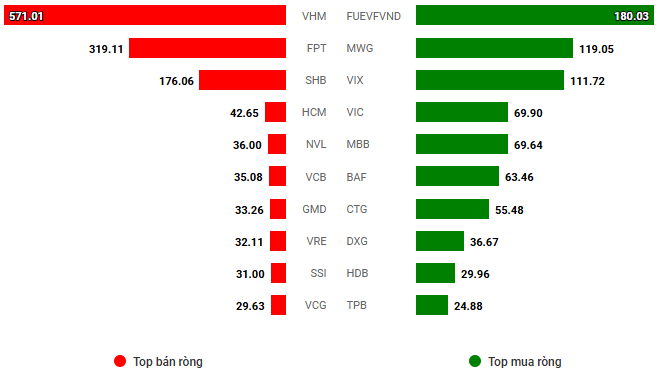

Net trading value by stock code. Unit: Billion VND

– The Vietnamese stock market opened the May 20 session on a positive note, with the VN-Index quickly reclaiming the 1,300-point mark just minutes into the trading day. The upward momentum was further extended, led by large-cap stocks. Strong buying pressure propelled the index higher, and it maintained its solid gains throughout the remainder of the session. At the close, the VN-Index surged by 18.86 points (+1.45%) to 1,315.15 points, recouping all losses from the previous week and reaching its highest closing level since early May.

– In terms of impact, the duo of VIC and VHM continued to shine brightly, rising to the maximum daily limit and contributing nearly 10 points to the VN-Index‘s gain. Stocks such as TCB, VRE, and VPL also added more than 3.5 points. In contrast, the selling pressure was negligible, with the top 10 negative-impact stocks taking away less than 1 point.

– The VN30-Index posted a strong performance, climbing by more than 2% to reach 1,407.52 points. Buyers dominated with 22 gainers, 3 losers, and 5 unchanged stocks. In addition to VHM and VIC, which topped the chart with their ceiling-hitting increases, stocks like TCB, VRE, and BVH also recorded gains of over 3%. Conversely, PLX, GAS, and VNM were the only 3 decliners in the basket.

Green dominated most industry groups, with real estate continuing to take the lead, outperforming with a nearly 4% gain. In addition to the Vingroup trio, money flowed into notable names such as DXG (+2.77%), TCH (+1.11%), VPI (+1.99%), SZC (+1.37%), and SIP (+2.89%).

Additionally, the industrial, materials, and financial sectors rose by more than 1%, propelled by a host of prominent names, including HAH, which hit the ceiling, VSC (+5.12%), ACV (+2.08%), GMD (+1.47%); GVR (+1.84%), BMP (+2.13%), MSR (+4.09%); TCB (+4.92%), MBB (+1.05%), STB (+1.28%), HDB (+1.36%), EIB (+2.84%), and VIX (+3.91%).

On the flip side, telecommunications was the only group that witnessed red dominance, mainly due to the decline of CTR (-1.05%), VGI (-1.13%), FOX (-0.55%), YEG (-0.81%), and VTK (-1.23%).

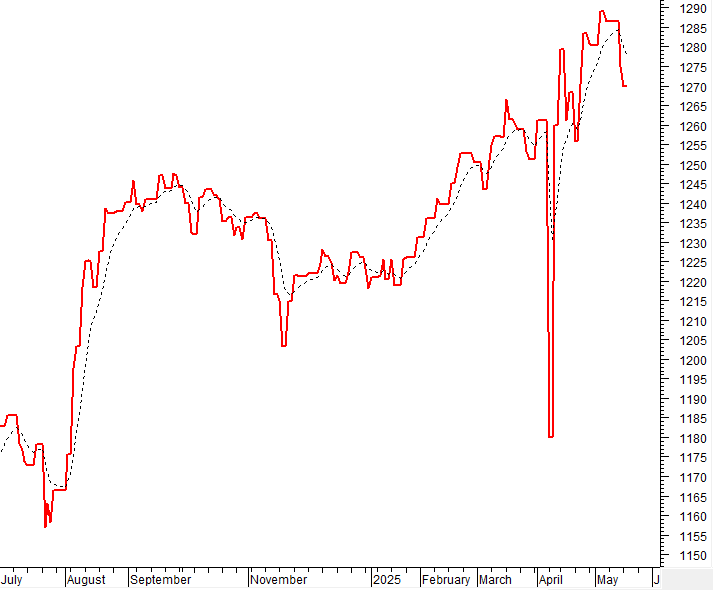

The VN-Index witnessed a strong rebound, erasing the previous two days’ losses, and forming a White Marubozu candlestick pattern. This reflects the optimistic sentiment among investors. However, trading volume needs to show a significant improvement for the index to sustain its upward trajectory. In the coming days, if the VN-Index manages to hold above this level, it may have the opportunity to retest the March 2025 high (around the 1,320-1,340 point region). Currently, the MACD indicator has maintained a buy signal since late April 2025, and if this status quo is preserved in the near term, the short-term outlook for the index remains positive.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Stochastic Oscillator has given a sell signal in the overbought zone

The VN-Index witnessed a strong rebound, erasing the previous two days’ losses and forming a White Marubozu candlestick pattern. This reflects the optimistic sentiment among investors. However, trading volume needs to show notable improvement for the index to sustain its upward trajectory. In the near term, if the VN-Index can maintain its position above this level, it may have the chance to retest the March 2025 high (around the 1,320-1,340-point region).

Presently, the MACD indicator has maintained a buy signal since late April 2025. Should this status be preserved in the upcoming period, the short-term outlook for the index remains positive.

HNX-Index – Trading volume remains low

The HNX-Index returned to positive territory, despite trading volume remaining below the 20-day average. This indicates that participating capital is still relatively limited. If this situation persists, the index may retest the previous peak formed in April 2025 (around the 214-216-point region).

On the other hand, the Stochastic Oscillator has given a sell signal in the overbought zone. Investors should exercise caution if the indicator falls out of this zone in the coming days.

Money Flow Analysis

Movement of smart money: The Negative Volume Index of the VN-Index has dropped below the 20-day EMA. If this status continues into the next session, the risk of a sudden downturn (thrust down) will increase.

Foreign capital flow: Foreign investors continued to net sell during the trading session on May 20, 2025. If foreign investors maintain this stance in the coming sessions, the situation may become less optimistic.

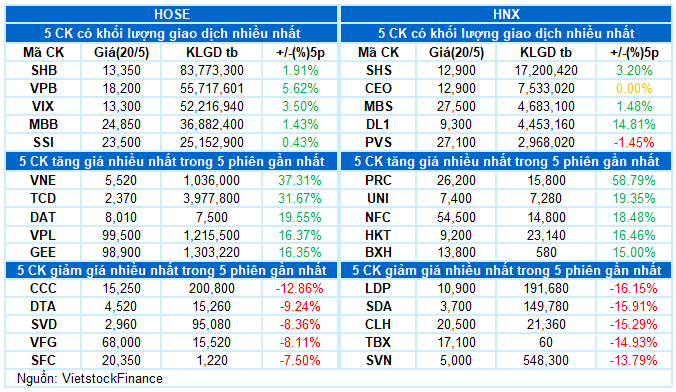

III. MARKET STATISTICS AS OF MAY 20, 2025

Economics & Market Strategy Division, Vietstock Research Team

– 17:20 May 20, 2025

Market Momentum: Sustaining the Uptrend

The VN-Index continued its upward trajectory, retesting the old peak formed in March 2025 (corresponding to the 1,320-1,340 range). Moreover, the trading volume maintained above the 20-day average, indicating positive signs of sustained cash flow participation. However, in the upcoming sessions, the VN-Index is likely to experience volatility as it retests this range. Currently, the MACD indicator has been signaling a buy since late April 2025. If this status quo persists, the short-term outlook for the index remains optimistic.

Stock Market Update for Week of May 19-23, 2025: Navigating Volatility Around the 1,300-Point Mark

The VN-Index demonstrated resilience by rebounding above the reference level following an extended period of volatility and below-average trading volume. This recovery indicates a cautious sentiment among investors. However, the resumption of net selling by foreign investors has introduced challenges, causing fluctuations around the 1,300-point mark and presenting obstacles to sustaining the upward momentum in the near term.

Technical Analysis for May 21: Deciphering Market Polarization

The VN-Index and HNX-Index exhibited a contrasting performance amid a weakening ADX indicator, hinting at a potential sideways trend with interspersed gains and losses in upcoming sessions.

Top Stocks to Watch Ahead of the Bell on May 22nd

The stock market is a dynamic and ever-changing landscape, and keeping up with the biggest gainers and losers is crucial for investors. Vietstock’s statistical insights offer a glimpse into the rising and falling stocks, providing valuable information for those seeking to make informed investment decisions.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-218x150.jpg)