Market liquidity decreased compared to the previous trading session, with the matching trading volume of VN-Index reaching more than 641 million shares, equivalent to a value of more than 15 trillion VND; HNX-Index reached more than 56.9 million shares, equivalent to a value of more than 967 billion VND.

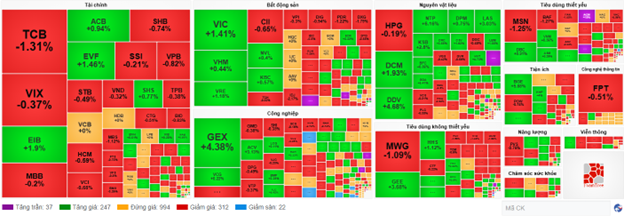

VN-Index continued to fluctuate around the reference level in the afternoon session, with buyers slightly dominating, helping the index stay in the green until the end of the session. In terms of impact, GAS, VHM, GEE, and VIC were the most positive influences on the VN-Index, contributing over 2.7 points. On the other hand, VPL, TCB, VPB, and MSN continued to face selling pressure, taking away more than 1.9 points from the overall index.

| Top 10 stocks with the highest impact on VN-Index on May 23, 2025 |

Similarly, HNX-Index also witnessed a rather pessimistic performance, negatively impacted by KSV (-3.29%), MBS (-1.86%), IDC (-1.99%), and KSF (-1.24%).

|

Source: VietstockFinance

|

The industrial sector was the strongest performer, rising 1.14%, mainly driven by ACV (+3.33%), VEA (+1.82%), VJC (+0.69%), and GMD (+0.38%). This was followed by the utilities and healthcare sectors, which increased by 0.86% and 0.48%, respectively. On the other hand, the consumer staples sector witnessed the largest decline in the market, falling by 0.28%, mainly due to losses in MCH (-1.32%), MSN (-1.25%), SAB (-0.4%), and VHC (-0.94%).

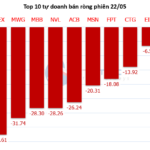

In terms of foreign trading activities, foreign investors net sold over 141 billion VND on the HOSE exchange, focusing on FPT (126.22 billion VND), MSN (108.22 billion VND), MWG (88.57 billion VND), and HCM (66.1 billion VND). On the HNX exchange, foreign investors net sold more than 44 billion VND, mainly offloading PVS (19.03 billion VND), NTP (10.51 billion VND), IDC (4.04 billion VND), and VFS (1.63 billion VND).

| Foreign investors’ net buying and selling activities |

Morning Session: Lackluster Liquidity, Market Divergence

The market continued to fluctuate around the reference level until the end of the morning session. At the midday break, the VN-Index hovered slightly below the reference level at 1,313.25 points, while the HNX-Index turned slightly green at 216.97 points. The market breadth was relatively balanced, with 311 declining stocks, 302 advancing stocks, and 937 stocks remaining unchanged.

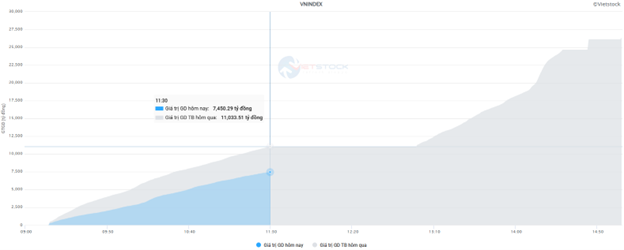

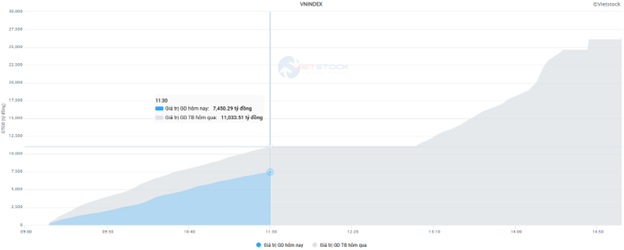

A cautious sentiment prevailed in the market this morning, as the trading value of the VN-Index reached nearly 7.5 trillion VND, a 32% decrease compared to the previous session. The HNX exchange also witnessed a significant drop in liquidity, with a trading value of over 500 billion VND, a 35% decline.

Source: VietstockFinance

|

The impact of the top 10 stocks with the highest positive and negative influences was relatively balanced. On the declining side, BID, VPL, and TCB led the losses, taking away nearly 1.5 points from the VN-Index. Conversely, the duo of VIC and VRE contributed an equivalent amount of points to the index on the advancing side.

From a sector perspective, the industrial sector temporarily took the lead on the advancing side, with notable performers such as ACV (+3.13%), HAH (+4.99%), VCG (+1.09%), VEA (+1.56%), and VNE (+4.44%).

The real estate sector also maintained its positive performance, thanks to the outstanding gains in VIC (+1.41%), VRE (+2.37%), NVL (+1.6%), SCR (+3.48%), and HDG (+1.54%). However, selling pressure was still present in some stocks, including DXG, PDR, VPI, IDC, KDH, NTL, and D2D, which declined by more than 1%.

Apart from these two sectors, the other sectors fluctuated within a narrow range, rising or falling by less than 0.5%, indicating a cautious and divergent market sentiment.

Foreign investors also reduced their trading intensity this morning, net selling over 333 billion VND across all three exchanges. FPT was the stock with the highest net selling value, at 94 billion VND. On the buying side, VIC stood out from the rest, with a net buying value of over 74 billion VND.

10:30 AM: Cautious Sentiment Around the 1,311-Point Level

Investors’ cautious attitude led the main indices to fluctuate around the reference level. As of 10:30 AM, the VN-Index decreased by 2.73 points, trading around 1,311 points. Meanwhile, the HNX-Index dropped by 0.27 points, hovering around 216 points.

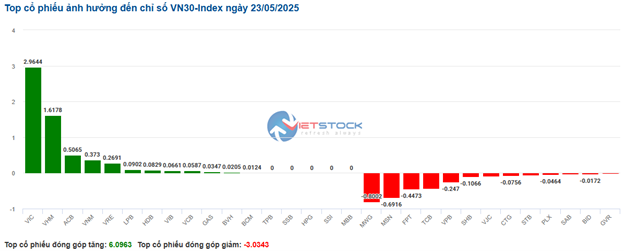

A strong divergence was observed within the VN30 basket. On the buying side, VIC added 2.96 points, VHM contributed 1.62 points, ACB gained 0.51 points, and VNM rose by 0.37 points. Conversely, MWG, MSN, FPT, and TCB faced selling pressure, taking away more than 3.7 points from the overall index.

Source: VietstockFinance

|

The real estate sector led the market recovery, despite the strong divergence within the group. Specifically, buying interest focused on stocks such as VIC, which rose by 1.73%, VHM increased by 0.88%, BCM climbed by 0.34%, and KBC gained 0.19%… Conversely, selling pressure was seen in stocks like KDH, which fell by 0.53%, PDR declined by 0.61%, DXG dropped by 2.09%, and NLG slipped by 0.15%…

Following closely, the industrial sector also contributed to the market’s rebound. Within the sector, gainers included ACV, which rose by 3.43%, VEA increased by 1.04%, HAH climbed by 2.5%, and CTD advanced by 0.13%… However, some stocks faced selling pressure, including HVN, which fell by 2.72%, VJC declined by 0.23%, VEF dropped by 1.05%, and GMD slipped by 0.38%…

In another development, the consumer staples sector witnessed a majority of its stocks trading in negative territory. Notably, MCH fell by 0.62%, MSN decreased by 1.25%, SAB dropped by 0.6%, and VHC slipped by 0.54%… Only a few stocks managed to stay in positive territory, including VNM, which rose by 0.36%, QNS gained 0.22%, SBT climbed by 0.28%, and DBC advanced by 1.45%…

Compared to the opening, the divergence continued, with the selling side slightly dominating. There were 312 declining stocks and 247 advancing stocks.

Source: VietstockFinance

|

Opening: Strong Buying Interest in VN30 Stocks

At the beginning of the May 23 session, as of 9:30 AM, the VN-Index started in positive territory, reaching 1,317.40 points. Meanwhile, the HNX-Index slightly increased, staying at 217.22 points.

The S&P 500 index traded sideways on Thursday (May 22) as investors grappled with concerns about rising interest rates and the widening US budget deficit. The yield on the 30-year US Treasury bond reached its highest level since October 2023 after the US House of Representatives passed a bill that investors feared could worsen the country’s budget deficit. At the close of the May 22 session, the Dow Jones index lost 1.35 points to 41,859.09 points. The S&P 500 index dipped 0.04% to 5,842.01 points. In contrast, the Nasdaq Composite index advanced 0.28% to 18,925.73 points.

The VN30 basket witnessed a temporary dominance of gainers, with 4 declining stocks, 20 advancing stocks, and 6 unchanged stocks. Among them, MWG, BID, VJC, and VRE were the top losers. On the other hand, BVH, VHM, ACB, and VCB were the biggest gainers.

The telecommunications services sector was one of the most prominent industries in the early morning session. Stocks in this sector traded positively from the beginning, with notable gainers including VGI, which rose by 1.02%, CTR climbed by 0.88%, and YEG advanced by 0.85%…

Following closely, the industrial sector also contributed positively to the market performance this morning. Within the sector, prominent gainers included ACV, which rose by 4.04%, VTP climbed by 1.56%, VCG advanced by 0.65%, GMD gained 0.19%, CTD increased by 0.64%, and PC1 rose by 0.45%…

– 15:20, May 23, 2025

Market Momentum: Sustaining the Uptrend

The VN-Index continued its upward trajectory, retesting the old peak formed in March 2025 (corresponding to the 1,320-1,340 range). Moreover, the trading volume maintained above the 20-day average, indicating positive signs of sustained cash flow participation. However, in the upcoming sessions, the VN-Index is likely to experience volatility as it retests this range. Currently, the MACD indicator has been signaling a buy since late April 2025. If this status quo persists, the short-term outlook for the index remains optimistic.

Stock Market Update for Week of May 19-23, 2025: Navigating Volatility Around the 1,300-Point Mark

The VN-Index demonstrated resilience by rebounding above the reference level following an extended period of volatility and below-average trading volume. This recovery indicates a cautious sentiment among investors. However, the resumption of net selling by foreign investors has introduced challenges, causing fluctuations around the 1,300-point mark and presenting obstacles to sustaining the upward momentum in the near term.

What are the Strongest Stocks on the VN-Index?

As of late May 2025, the VN-Index has climbed approximately 4.44% since the start of the year, weathering the April slump triggered by tariff headlines. Yet, not all investors’ portfolios are in the green.