Social media has been abuzz recently with the story of an individual named V.D. from Lang Son, who spent 4.5 million VND on three bunches of Korean milk grapes, only to be disappointed with the quality.

In a post, V.D. shared: “I’d like to ask if this price is reasonable. I paid 4.5 million VND for three bunches of Korean milk grapes, and they all had wilted stems. They were advertised as fresh imported fruit.”

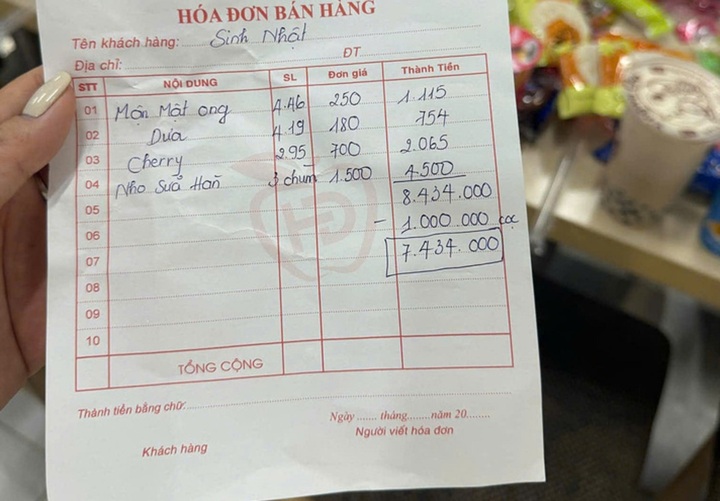

Fruit purchase receipt from Ms. V.D. (Photo: NVCC)

Speaking to the press, Ms. V.D. shared that she had ordered the fruit from a shop on Tam Thanh Street (in the old Lang Son city) for her daughter’s birthday celebration. In addition to the milk grapes, she also purchased honey apricots, melons, and cherries.

“I am frustrated not only by the exorbitant price but also by the poor quality. The grapes were wilted, and the cherries were a mix of ripe and unripe fruits, indicating that they might have been a blend of old and new stock,” she said.

After providing feedback to the shop, she received a refund of 500,000 VND due to a “staff packaging error.” However, the prices of the items were not adjusted.

The post quickly gained traction on social media, attracting thousands of shares and comments, mostly expressing disagreement with the situation. “Cherry stems from the US usually cost around 198,000 VND per kg. I’ve sold a ton of them, so I know this price is outrageous,” commented one user.

Another individual added: “Even the best quality cherries currently go for about 500,000 VND per kg, not 700,000 VND as charged in this case.”

In response to the media’s inquiry about the incident, Mr. Dang Van Ngoc, Chief of the Lang Son Province Market Management Bureau, stated: “We are aware of the situation and have dispatched officers to investigate and verify the details. We will provide official information to the press and the public once we have concrete results.”

The authorities are currently inspecting the shop to verify the origin, quality, labeling, and displayed prices of the products.

The Pre-Tet Rush: Illicit Contraband and Food Safety Concerns

In recent times, market management forces across various provinces in the country have uncovered thousands of tons of smuggled food products with unknown origins.

Enhancing Vietnam – China Relations: Fostering Trade and Collaboration

The Vietnam-China International Trade and Tourism Fair (Lang Son 2024) serves as a pivotal “bridge” for businesses from both nations to forge stronger collaborations and bolster trade. This event also plays a significant role in enhancing the cooperative and friendly relations between Lang Son and Guangxi, and more broadly, between Vietnam and China, across various domains, including commerce, tourism, and cultural exchanges.

Unlocking the Potential of Vietnam’s High-Speed Railway: Why Not Extend from Lang Son to Ca Mau?

The government has submitted a report to the National Assembly providing explanations on opinions regarding the investment policy for the high-speed North-South railway project, including a proposal to extend the project from Lang Son to Ca Mau.