Mr. Bui Cao Nhat Quan reports on the trading results of an insider-related individual of No Va Real Estate Investment Group Joint Stock Company (NVL-HOSE).

Accordingly, Mr. Bui Cao Nhat Quan, son of Bui Thanh Nhon, the Chairman of the Board of Directors, announced the successful sale of over 2.9 million NVL shares during the May 19, 2025, trading session.

The transaction was executed through the order-matching method. Following this transaction, Mr. Quan’s holdings decreased to over 75.3 million shares, representing a 3.862% stake. Based on the closing price of that day, the proceeds from the sale are estimated at approximately VND 35 billion.

Previously, Mr. Bui Cao Nhat Quan had registered to sell 2.9 million shares but was unable to sell any due to unfavorable market conditions from March 21 to April 18.

It is known that NovaGroup Joint Stock Company, the largest shareholder of Novaland, registered to sell 3.9 million NVL shares. If the transaction is successful, NovaGroup’s ownership will decrease from 17.373% to 334.85 million shares, representing a 17.171% stake.

The transaction will be executed from May 16 to June 13, 2025, to balance the investment portfolio and support debt restructuring. The trading method will be either order-matching or negotiation.

During the same period and with the same purpose and trading method, Diamond Properties, an organization related to Mr. Bui Thanh Nhon, Chairman of the Board of NVL, also registered to sell 3.2 million shares. After the transaction, the expected ownership percentage will be 8.483%, equivalent to nearly 165.4 million NVL shares.

If successful, Diamond Properties will hold over 165.43 million shares, representing an 8.483% stake in NVL.

Additionally, three individual shareholders belonging to the group of internal shareholders registered to sell 11.6 million shares, including Mr. Bui Cao Nhat Quan’s successful sale of over 2.9 million shares. Ms. Bui Cao Ngoc Quynh registered to sell over 8.44 million shares, and Ms. Cao Thi Ngoc Suong registered to sell 221,133 shares. In total, these two major shareholders and three individuals registered to sell 18,753,643 NVL shares.

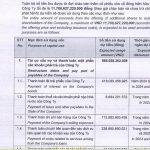

According to the latest information from HNX, Novaland has released a statement regarding the company’s bond principal and interest payments.

Specifically, as per the plan, on May 18, 2025, Novaland was scheduled to make principal payments of over VND 651.9 billion for the bond lot NVLH2123014. However, the company has only made payments of nearly VND 6.8 billion, with the remaining amount of over VND 645.1 billion unpaid.

In explanation, Novaland stated that due to a lack of funding, they were unable to make timely bond principal payments. Simultaneously, the company is in ongoing negotiations with investors regarding the delayed payment of the aforementioned bond lot.

It is known that the bond lot NVLH2123014 comprises 10 million bonds with a face value of VND 100,000 per bond, totaling VND 1,000 billion in issuance value. The bonds were issued on November 18, 2021, with an 18-month term and are expected to mature on May 18, 2023.

Previously, on April 22, 2025, Novaland announced that they had only made payments of over VND 622.1 million out of a total of nearly VND 114.7 billion in principal for the bond lot NVLH2123007, with the remaining unpaid amount being nearly VND 114.1 billion.

It is known that the bond lot NVLH2123007 was issued by Novaland on July 23, 2021. However, the issuance period ended on October 19, 2021. With a face value of VND 100 million per bond, the total issuance value was VND 137.6 billion, with a term of 2 years, and an expected maturity date of July 23, 2023.

What Proportion of Novaland’s Shares Are Held by the Group of Shareholders Related to Chairman Bui Thanh Nhon?

As of the end of 2024, the group of shareholders related to Chairman Bui Thanh Nhon held over 750 million NVL shares, equivalent to a 38.65% stake in Novaland. This significant ownership showcases a strong commitment to the company’s growth and a belief in its long-term success. With such a substantial stake, the group has a vested interest in ensuring Novaland’s prosperity and a bright future ahead.

The Elusive Interest Payment: Novaland’s Slow Dance with Bondholders

On November 25, 2024, the company will make interest payments for two bond lots, NVL2020-03-190 and NVL2020-03-140, amounting to VND 10.4 billion and VND 7.6 billion, respectively.

“Q3 2024: NVL Records Impressive Profits, Requests HOSE to Lift Warning”

Previously, HOSE placed NVL stock in alert status from September 23 onwards due to the listed entity’s delay in submitting its semi-annual 2024 financial statements, which exceeded the regulated deadline by over 15 days. Concurrently, HOSE also included this stock in the list of those subjected to margin cuts.

Novaland announces capital raising of over VND 11,700 billion for project development, staff salaries

NVL submitted through the board a resolution implementing a plan to offer additional shares to existing shareholders in the number of 1,170,062,722 shares…