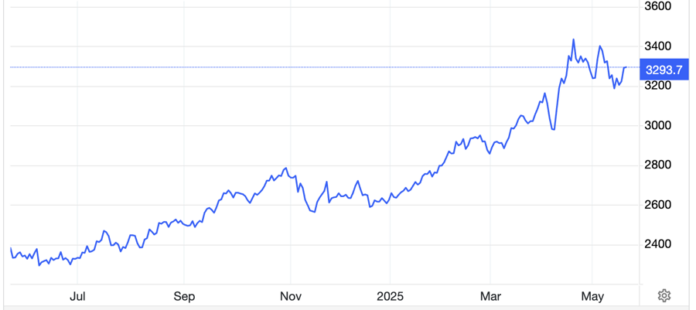

Gold prices surged overnight in the US market and continued to climb in Asian trading hours on Wednesday, propelled by a weaker US dollar and escalating concerns surrounding US trade policies and the ongoing Russia-Ukraine peace talks.

Spot gold on Kitco rose to $3,292.20 an ounce at the close in New York, marking a substantial increase of $61.90, or 1.9%, from the previous session’s close. Gold futures on COMEX also climbed by 1.6%, settling at $3,284.60 per ounce.

The US dollar weakened on Tuesday after several officials from the Federal Reserve expressed concerns about the economy. St. Louis Fed President, Mr. Alberto Musalem, highlighted the recent easing of US-China trade tensions but pointed out the apparent softening in the job market and expected upward pressure on prices.

Fed funds futures are indicating that traders are betting on at least two quarter-point interest rate cuts by the end of the year.

The dollar index, which gauges the greenback against a basket of six major currencies, closed at 100.12 on Tuesday, down from 100.43 in the previous session, according to data from MarketWatch. The dollar slid to a two-week low against the yen, dipping to 144.095 yen per dollar at one point during the session.

The dollar index extended its losses on Wednesday morning, falling by nearly 0.4% to 99.75.

As of 9:23 a.m. Vietnam time, spot gold in Asian trading rose by $1.10, or 0.03%, to $3,293.30 an ounce. Converted at Vietcombank’s selling exchange rate, this equates to approximately VND 103.7 million per tael, reflecting an increase of VND 2.4 million compared to the previous day’s morning session.

Earlier, gold prices had climbed to nearly $3,315 an ounce, as per Kitco data.

At the same time, Vietcombank quoted the dollar at VND 25,750 (buying) and VND 26,140 (selling), unchanged from the previous morning’s rates.

The Fed’s cautious stance on the US economy and the downgrade of the US credit rating by Moody’s Ratings last Friday contributed to the downward pressure on the dollar. Moody’s lowered the US rating by one notch to Aa1 from Aaa, citing fiscal challenges.

Gold, being a dollar-denominated asset, benefits from a weaker greenback.

“There is still a degree of uncertainty in the market. Notably, Moody’s downgrade of the US credit rating pushed the dollar lower and provided support for gold,” said David Meger, a metals trader at High Ridge Futures.

Additionally, investors’ risk aversion remained elevated as they awaited further trade deals from the US to reduce tariffs. The nuclear negotiations between the US and Iran, as well as the Russia-Ukraine peace talks, have made little headway, prompting investors to seek the safe haven of gold.

In the Middle East, Iran’s Supreme Leader, Ayatollah Ali Khamenei, expressed doubt on Tuesday about the prospects of nuclear negotiations with the US, even as Tehran considers a proposal for a fifth round of talks. In Eastern Europe, Russia and Ukraine have yet to initiate ceasefire negotiations.

US stock markets declined on Tuesday as investors monitored the progress of tax cut legislation in Congress, further bolstering gold’s appeal. President Donald Trump has struggled to convince key Republican members in the House to support the bill due to disagreements over the maximum deduction for state and local taxes. This opposition threatens to derail the bill, which Trump hopes to get through Congress by the end of the week.

According to Philip Streible, a strategist at Blue Line Futures, gold prices are facing a significant resistance level at $3,350 an ounce, with a weaker resistance level at $3,300. He predicts that the gold market will fluctuate within a new range of $3,150 to $3,350 per ounce.

The world’s largest gold-backed ETF witnessed its second consecutive day of net gold purchases, acquiring approximately 0.6 tons of gold on Tuesday, bringing its total holdings to 921.6 tons, as per the fund’s website.

“Investors Lose Hundreds of Millions in a Matter of Days: The Risky Business of Gold”

“Once considered a ‘safe haven’, gold is now a volatile asset. In today’s ever-changing economic landscape, the value of gold is subject to rapid fluctuations, making it an uncertain investment choice. With global markets in a constant state of flux, investors are seeking more stable havens for their wealth.”

The Debt Concern Rally Drives Gold Prices Up for 3 Consecutive Sessions, SPDR Gold Trust Sells Off Again

The depreciation of the US dollar and the surge in safe-haven demand amid economic and geopolitical concerns have been the primary catalysts for gold’s remarkable rally.

The Growth Investment Guru’s Fund Becomes Major Stakeholder in PNJ.

PNJ, or Phu Nhuan Jewelry Joint Stock Company, has a new major shareholder in the form of T. Rowe Price Associates, Inc., a prominent American investment fund. This development comes on the heels of Dragon Capital’s exit from the list of major shareholders, marking a significant shift in the company’s investor landscape.