The market continued to rally strongly, led by the real estate sector, with the VinGroup stocks as the main drivers. The index briefly dipped below the reference level during the session but managed to close with a gain of 7.9 points, approaching the old peak of 1,323.

The trading breadth improved, with 137 gainers and 183 losers. VHM, one of the VinGroup stocks, surged for the second consecutive session, hitting the daily limit-up, while VIC gained 2.19%. These two stocks alone contributed 6 points to the Vn-Index. Additionally, NVL also hit the daily limit-up, adding another 0.36 points.

There was a stark contrast in the performance of real estate stocks, with industrial zone stocks like KBC, IDC, and SNZ falling sharply ahead of the US’s announcement of tariffs for Vietnam in the next 2-3 weeks. On the other hand, VCG and CII, which are in the infrastructure development sector, soared. The transportation sector also excelled, with HVN and HAH hitting the daily limit-up, while maritime transportation stocks like GMD, VTP, PHP, and PVT remained submerged.

A similar divide was observed in the banking sector, with ACB, MBB, VPB, and SHB in the green, especially STB surging by 5.82%, while CTG, LPB, and TCB lost ground, and VCB and BID remained unchanged. In the export sector, steel posted modest gains, minerals boomed, while rubber, fertilizer, and chemical stocks continued to slide, with the majority of stocks in this group losing over 1%, including GVR, VGC, DGC, DCM, and DPM.

On the downside, securities, information technology, telecommunications, and consumer services sectors witnessed losses, with VPL, a Vinpearl stock, retreating by 1.51%.

Broad-based profit-taking pushed the liquidity of the three exchanges to nearly VND 27,000 billion. However, as the session drew to a close, the intensity of the declines eased, and many stocks rebounded, indicating active bottom-fishing by investors. Foreign investors net bought VND 451.2 billion, and their net buying value in matched orders alone reached VND 467.0 billion.

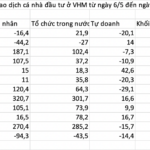

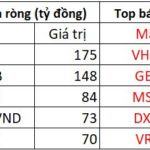

Foreign investors’ net buying in matched orders focused on the Financial Services and Banking sectors. The top net bought stocks by foreign investors in matched orders included STB, FUEVFVND, VHM, VCG, HVN, VND, NVL, MSN, GEX, and HSG.

On the selling side, Information Technology was the sector that foreign investors net sold in matched orders. The top net sold stocks by foreign investors in matched orders were FPT, VIC, VRE, VCB, HCM, SSI, HAH, GMD, and VNM.

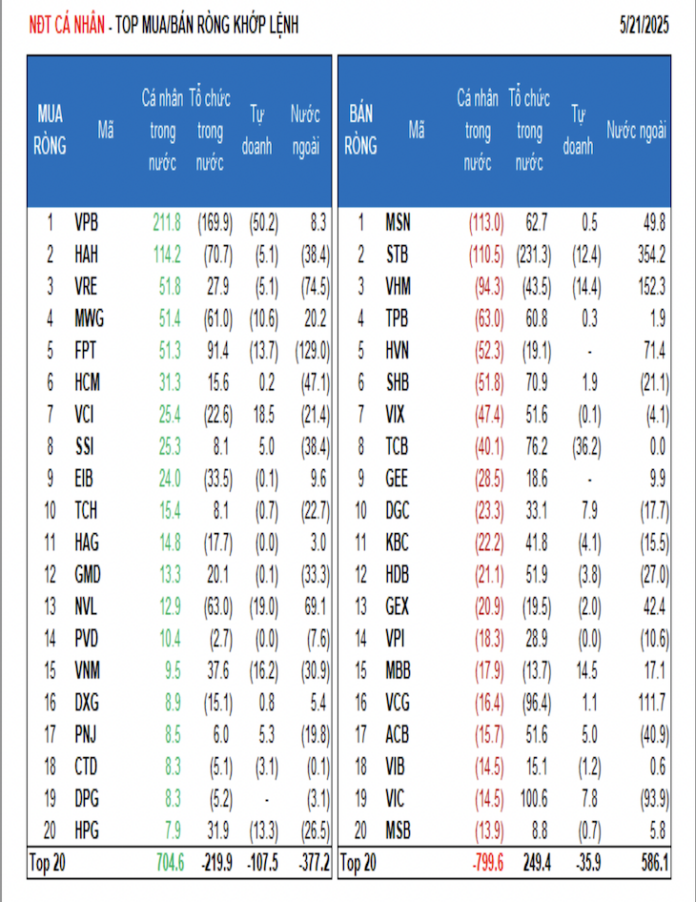

Individual investors net bought VND 12.5 billion, but their net selling value in matched orders was VND 187.3 billion. In terms of matched orders, they net bought 8 out of 18 sectors, mainly focusing on Industrial Goods & Services. The top stocks net bought by individual investors included VPB, HAH, VRE, MWG, FPT, HCM, VCI, SSI, EIB, and TCH.

On the net selling side in matched orders, they net sold 10 out of 18 sectors, mainly focusing on Banking, Food & Beverage. The top net sold stocks included MSN, STB, VHM, TPB, HVN, SHB, TCB, GEE, and DGC.

Proprietary trading groups net sold VND 394.6 billion, and their net selling value in matched orders was VND 462.4 billion. In terms of matched orders, proprietary trading groups net bought only 2 out of 18 sectors. The top net bought sectors were Chemicals and Personal & Household Goods. The top net bought stocks by proprietary trading groups in matched orders included CTG, VCI, MBB, DGC, VIC, HSG, E1VFVN30, PNJ, ACB, and SSI. The top net sold sector was Financial Services.

The top net sold stocks by proprietary trading groups included FUEVFVND, VPB, TCB, NVL, VCB, VNM, VHM, FPT, HPG, and STB.

Domestic institutional investors net sold VND 95.5 billion, but their net buying value in matched orders was VND 182.7 billion.

In terms of matched orders, domestic institutional investors net sold 6 out of 18 sectors, with the largest net selling value in Construction and Materials. The top net sold stocks included STB, VPB, VCG, HAH, NVL, MWG, VND, VHM, EIB, and HSG. The sector with the largest net buying value was Real Estate. The top net bought stocks included VIC, FPT, TCB, SHB, VCB, MSN, TPB, HDB, VIX, and ACB.

The value of negotiated transactions today reached VND 2,340.3 billion, down 19.2% from the previous session, contributing 8.5% to the total trading value. Today, there were notable negotiated transactions between domestic institutions in large-cap stocks (FPT, MSN, MWG) and the Banking sector (SSB, ТСВ).

In terms of cash flow allocation, the Banking, Construction, Food & Beverage, Electrical Equipment, and Airlines sectors witnessed increased allocation, while Real Estate, Securities, Agricultural & Seafood Farming, Retail, and Software sectors saw reduced allocation.

Specifically, in terms of matched orders, the cash flow allocation increased for mid-cap stocks (VNMID) and decreased for large-cap stocks (VN30) and small-cap stocks (VNSML).

The Tax Saga: VN-Index Recovers, But Stocks Still Stranded

After almost two months since the market took a hit with the US imposing tariffs on multiple countries, with a significant 46% imposed on Vietnam, the VN-Index has recovered and returned to its previous peak. However, numerous stocks continue to struggle, with the exception of a few standouts from the Vin family.

Market Pulse May 24: Extended See-Saw Movement, Foreigners Resume Net Selling

The market closed with the VN-Index up 0.62 points (+0.05%), reaching 1,314.46; while the HNX-Index fell 0.47 points (-0.22%) to 216.32. The market breadth was relatively balanced, with 374 gainers and 371 losers. Similarly, the VN30 basket saw a tight contest between bulls and bears, resulting in 15 gainers, 12 losers, and 3 unchanged stocks.