In its latest announcement, the Ho Chi Minh City Stock Exchange (HOSE) has decided to remove nearly 336 million shares of Tien Phong Securities Joint Stock Company (TPS, code: ORS) from the warning list starting from August 28, 2025. This decision was made as the conclusion of the review at the semi-annual audited financial statement for 2025 of the company was fully accepted, meeting the requirements for removal from the warning list as per regulations.

Previously, HOSE decided to place ORS shares on the warning list from April 16, 2025, as the auditor of TPS’ 2024 financial statement, Ernst & Young Vietnam, expressed an exception opinion regarding the audited financial statement for 2024. Specifically, the exception opinion referred to a service fee receivable with a balance of VND 28,025,753,424 as of December 31, 2024.

By the end of Q2/2025, the aforementioned service fee receivable had been fully settled, and the company no longer had any balance in this account as mentioned in the exception opinion. TPS also published its semi-annual audited financial statement for 2025, which was reviewed by International Audit and Valuation Co., Ltd., and the conclusion was fully accepted.

The company also sent a document to HOSE explaining that it has addressed the issues that led to the warning status and requested HOSE to consider and allow the removal of ORS shares from the warning list.

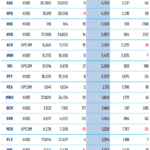

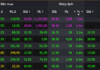

In the market, ORS shares have shown a relatively positive performance, with the session on August 27 reaching VND 14,400/share, almost doubling since the beginning of April 2025.

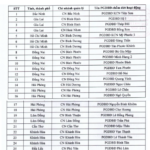

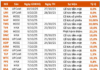

However, the business performance of this securities company has not been stable after the events related to its senior leadership and the Bamboo Capital bond issue. In Q2/2025, operating revenue decreased by 48% to VND 291 billion, with most activities such as proprietary trading and lending declining. As a result, TPS recorded a net loss of VND 105.5 billion in Q2, bringing the net loss for the first half of the year to approximately VND 113 billion.

A Bank Shutters 25 Branches Across Multiple Provinces and Cities

As of September 1st, this bank will be closing 25 of its postal counters across 9 provinces and cities.

Unveiling the Counterfeit: Ho Chi Minh City Securities Exchange’s Decisions and Contracts Fabricated

“These documents, marked as “decisions” and “contracts”, are sealed with the official stamp and signature of the Ho Chi Minh City Stock Exchange’s leadership.”