The decline of the Vin group of stocks continues to be a signal for investors to exercise caution. Efforts to push the index higher were met with strong resistance, resulting in a narrow range for the VN-Index throughout the session. HoSE’s liquidity dropped sharply by 40%, reaching the lowest level in 15 sessions, indicating a return to cautious sentiment.

The total matching value on the HoSE in the last session reached just over VND 15,000 billion, with weak trading in both the morning and afternoon sessions. This is a notable drop in liquidity, as the average value for the first four sessions of this week was over VND 22,000 billion per day. Last week also saw strong liquidity with an average of VND 21,600 billion per day.

The decrease in trading volume can be partially attributed to the recent “super liquid” stocks such as STB, VIX, GEX, SHB, and FPT, which no longer saw thousand-billion sessions. For example, while SHB led the market today with a matching value of over VND 600 billion, it still decreased by 42% compared to yesterday. VIX ranked second with VND 574.9 billion, also a decrease of 61%; GEX decreased by 63%…

However, we cannot solely attribute the sudden drop in liquidity today to these stocks. There was a general decrease in trading volume across many stocks. For instance, if we exclude the transactions of the five most liquid stocks, the liquidity of the two exchanges still fell by 37% compared to yesterday. The HoSE’s VN30 basket decreased by 31%, Midcap by 43%, and Smallcap by 30%.

This general decrease in trading volume can only mean that the money flow has slowed down. Investors, whether they have taken profits or are still holding their positions, are mostly staying on the sidelines and observing. This is a notable change in sentiment because liquidity reflects investors’ willingness to buy and sell, regardless of whether the market is rising or falling. When this activity slows down, it means that nothing is capturing the “interest” of investors.

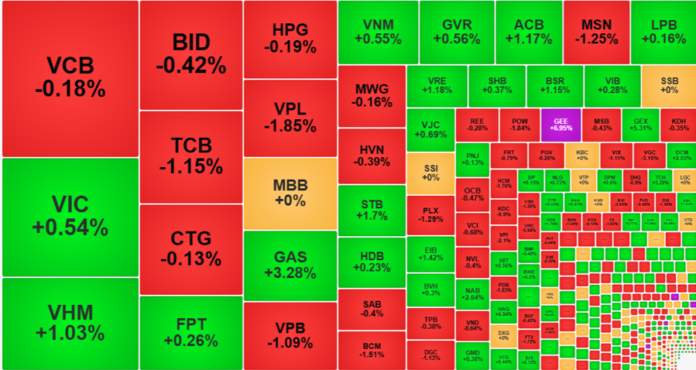

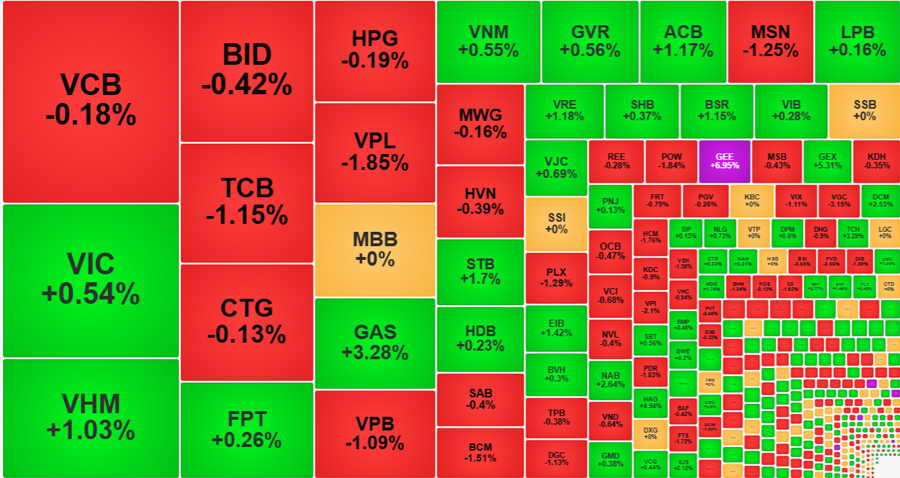

However, today’s market was not entirely negative. The very low liquidity in a balanced situation indicates that neither side dominated the other. The HoSE’s breadth at the end of the day recorded 154 gainers and 148 losers, with the VN-Index up slightly by 0.62 points. The VN30-Index decreased by 0.16 points, with 15 gainers and 12 losers. Midcap increased by 0.28% with 31 gainers and 34 losers. Smallcap increased by 0.52% with 74 gainers and 72 losers.

It can be seen that a tug-of-war situation occurred across all groups of stocks. The VN-Index was balanced by the largest caps. VHM increased by 1.03%, and GAS increased by 3.28%, contributing 1.7 points, while VPL decreased by 1.85%, and TCB decreased by 1.15%, taking away 1.3 points. VIC and FPT posted slight gains, offsetting the minor losses of VCB, BID, and CTG.

The maximum fluctuation range of the VN-Index during the day was only 0.87%, or more than 11 points, the smallest fluctuation in the last 15 sessions. In this overall tug-of-war, there were still some stocks with strong price movements. Out of the 154 gainers, 87 stocks increased by more than 1%, accounting for 30% of the total HoSE liquidity. Among the 148 losers, 63 stocks decreased by more than 1%, accounting for 21.8% of the liquidity. Many stocks attracted notable money flow, such as GEX, which increased by 5.31% with VND 477 billion; TCH, which increased by 3.29% with VND 245.7 billion; HAG, which increased by 4.94% with VND 230.1 billion; GEE, which increased by 6.95% with VND 219.6 billion; DCM, which increased by 2.53% with VND 181.9 billion; and HHS, which increased by 4.12% with VND 141.6 billion…

On the downside, the strong pressure pushed more than ten stocks to plunge by more than 1%, each with a transaction value of hundreds of billions of VND. VIX, CII, HCM, PDR, DGC, DIG, VPI, and POW were notable representatives.

Thus, while the overall market was relatively calm, waves were still forming in some specific stocks. This creates a certain attraction for speculators.

Foreign investors also reduced their trading intensity today, with a net value of around VND 136 billion on the HoSE. In fact, this block net sold in the morning session at nearly VND 316 billion and net bought in the afternoon session at VND 179 billion. The stocks that were net sold strongly were FPT (-VND 126.7 billion), MSN (-VND 108.1 billion), MWG (-VND 89.1 billion), HCM (-VND 66.1 billion), HPG (-VND 53.4 billion), GMD (-VND 38.1 billion), SSI (- 37.4 billion dong) and VRE (-31.5 billion dong). On the net buying side, there were GEX (VND 78.7 billion), VHM (VND 68.3 billion), VIC (VND 61.1 billion), STB (VND 61 billion), and TCH (VND 42.8 billion).

Stock Market Blog: How Long Can We Hold On?

The recent volatility in the large-cap group has once again posed challenges for the VN Index, reminiscent of the struggles faced on May 16th. While the index is being pulled and pushed, the damage to individual stocks is evident. The window of opportunity for a counter-trend rally is narrowing, and accurate stock picking is becoming increasingly difficult.

Surprising Drop in Liquidity, Stocks Soar.

The liquidity in many stocks suddenly contracted, with a notable decline of 45% in the VN30 blue-chip stocks compared to yesterday’s morning session. Despite this contraction, the market didn’t perform too badly, as funds continued to flow dynamically, and today it was the turn of securities stocks to take the lead.

The Art of Market Manipulation: VN-Index’s Dangerous Dance with Blue Chips

The robust upward momentum witnessed right after the morning session opened today propelled the VN-Index into the March peak zone. However, this rally was solely driven by large-cap stocks. As these heavyweight stocks started to lose steam, the index gave back almost all of its gains, ending the day with a marginal increase of less than 1 point, despite being up nearly 16.5 points earlier.

“Markets Soaring High: Vietstock Daily Overview for May 21, 2025”

The VN-Index surged, dismissing the previous two sessions’ losses with the emergence of a White Marubozu candlestick pattern. This reflects a highly optimistic sentiment among investors. However, trading volume needs to show a marked improvement for the index to sustain its upward trajectory. If the VN-Index firmly holds above the current level, it may have the potential to revisit the old peak of March 2025 (around the 1,320-1,340 range). Notably, the MACD indicator has maintained a buy signal since late April 2025, boding well for the short-term outlook if this status quo persists.