The afternoon trading session witnessed a surge in liquidity on both exchanges, soaring 28.4% compared to the morning session and reaching its highest level in 19 sessions. This was accompanied by a widespread sell-off, indicating heightened selling pressure. While the VN-Index managed to stay in positive territory, it closed at its intraday low.

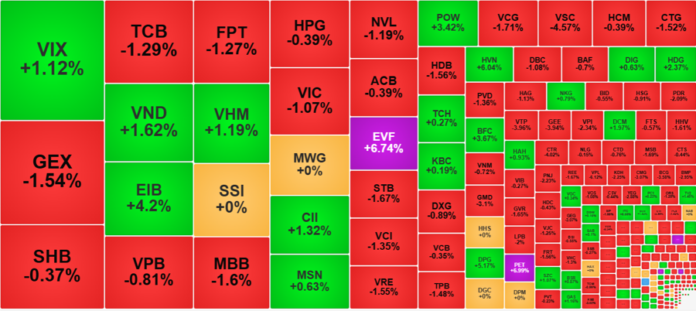

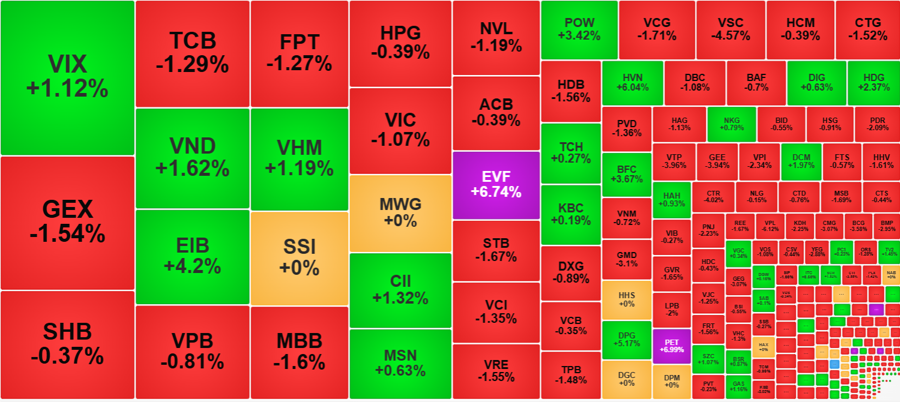

The index closed 9.21 points lower, or -0.7%, a slightly stronger decline compared to yesterday’s gain (+7.9 points). VHM’s resilience was a faint bright spot, as it managed to gain 1.19%, contributing 0.76 points. In reality, VHM had already lost 3.4% from its morning session price. Among the VN30 basket, only three other stocks joined VHM in the green: GAS with a 1.16% gain, MSN with a 0.63% increase, and SAB with a modest 0.1% rise.

Statistics reveal that 25 out of 30 blue-chip stocks witnessed declines in the afternoon session compared to the morning, with SAB being the only one to inch up slightly. Apart from VHM, VIC also experienced a shocking slide. It peaked at 5.24% above the reference price in the morning session but ended up closing 1.07% lower. TCB and CTG, two major banking pillars, experienced a chaotic last 30 minutes. TCB closed 1.29% lower than the reference price, equivalent to a 1.61% loss from its morning session price. CTG closed with a 1.52% loss, indicating a further decline of approximately 1.4% in the afternoon.

Other stocks that witnessed declines of over 1% in the afternoon session included GVR, MBB, LPB, BVH, HDB, STB, and VPB. Although not part of the VN30 basket, VPL is also a highly influential stock with the eighth-largest market capitalization. After falling 3.88% in the morning session, it dropped another 2.34% in the afternoon, closing 6.12% lower for the day.

The VN30-Index closed 0.69% lower, with 4 gainers and 24 losers. This was a stark contrast to the morning session, which saw the index up 0.93%. Half of the basket (15 stocks) declined by more than 1%, indicating significant damage that was not reflected in the index’s performance.

The rest of the market followed a similar pattern: the VN-Index fell slightly by 0.7%, but the breadth was wide, with 211 decliners and 91 advancers. Among the decliners, 130 stocks fell by more than 1%, accounting for nearly 40% of the total matched orders on the HoSE. Both the breadth and capital distribution indicated significant damage to a large number of stocks.

The selling pressure was evident in the liquidity: HoSE’s afternoon trading volume surged 31% compared to the morning session, and the average price level deteriorated significantly (only 56 stocks declined by more than 1% in the morning session). Furthermore, among the deepest decliners in the morning, only 17 stocks had liquidity exceeding VND10 billion, with selling pressure concentrated mainly on FPT and PVD, the only two stocks with liquidity exceeding VND100 billion. In the afternoon, 24 stocks with declines of over 1% had liquidity exceeding VND100 billion, ranging from blue chips like TCB, FPT, MBB, and VIC to mid-cap stocks like GEX, NVL, VCG, VSC, and GMD…

On the upside, the brokerage group, which was very strong in the morning, contracted to less than ten gainers. VIX rose 1.12% with a liquidity of VND1,465.2 billion, while VND gained 1.62% with a liquidity of VND811.3 billion. These were the two most notable representatives of this group. EIB (+4.2%), CII (+1.32%), EVF (+6.74%), POW (+3.42%), HVN (+6.04%), HDG (+2.37%), BFC (+3.67%), DPG (+5.17%), and DCM (+1.97%) were other prominent gainers, all with liquidity exceeding VND100 billion.

The money flow remained individualistic and somewhat effective, but it only added a few positive notes. The market has lost almost all its pillars, and the breadth is also poor. The probability of investors finding stocks that move against the overall trend is decreasing.

Foreign investors were another rare bright spot, reversing to net buy about VND276.4 billion on HoSE after net selling VND162 billion in the morning. The best bought stocks were VIX (+VND147.5 billion), MWG (+VND134.1 billion), VHM (+VND111.9 billion), EIB (+VND110.8 billion), STB (+VND90.2 billion), and HVN (+VND67.7 billion)… On the selling side, FPT (-VND131.7 billion), VPB (-VND95.4 billion), VRE (-VND71.2 billion), SSI (-VND68.3 billion), GEX (-VND53.1 billion), and GMD (-VND41.6 billion) were among the top sold stocks.

The Vanishing Liquidity: A Market Tug-of-War

The weakening of Vin stocks remains a key signal for investors to exercise caution. The blue-chip group’s attempts to push higher were met with strong resistance, resulting in a retreat that kept the VN-Index confined to a narrow range around the reference level throughout the session. A 40% plunge in HoSE’s liquidity to a 15-session low underscores the return of cautious sentiment.

Stock Market Blog: How Long Can We Hold On?

The recent volatility in the large-cap group has once again posed challenges for the VN Index, reminiscent of the struggles faced on May 16th. While the index is being pulled and pushed, the damage to individual stocks is evident. The window of opportunity for a counter-trend rally is narrowing, and accurate stock picking is becoming increasingly difficult.

Surprising Drop in Liquidity, Stocks Soar.

The liquidity in many stocks suddenly contracted, with a notable decline of 45% in the VN30 blue-chip stocks compared to yesterday’s morning session. Despite this contraction, the market didn’t perform too badly, as funds continued to flow dynamically, and today it was the turn of securities stocks to take the lead.

The Art of Market Manipulation: VN-Index’s Dangerous Dance with Blue Chips

The robust upward momentum witnessed right after the morning session opened today propelled the VN-Index into the March peak zone. However, this rally was solely driven by large-cap stocks. As these heavyweight stocks started to lose steam, the index gave back almost all of its gains, ending the day with a marginal increase of less than 1 point, despite being up nearly 16.5 points earlier.