A Market with Great Potential

The motorcycle market for students in Vietnam is entering an unprecedented growth phase, with a rising demand for personal transportation. Safety, cost, and environmental friendliness are now the top criteria for consumers. Electric motorcycles, especially those that do not require a license and have a speed under 50 km/h, are rapidly replacing electric bicycles and outdated small gasoline motorcycles.

According to the Vietnam Motorcycle Manufacturers Association (VAMM), in 2024, electric motorcycle sales in the L1 segment (under 50cc) grew by 52.9%, contrary to the overall market decline. With high school and college students as the target customers – those who are first-time vehicle owners – this segment has a lot of potential.

A few years ago, this segment was dominated by a few Chinese-made motorcycle and electric bicycle models with various types, designs, and prices, making the market somewhat chaotic. Subsequently, popular brands such as YADEA, DKBike, and Pega also targeted this segment, offering new choices for consumers.

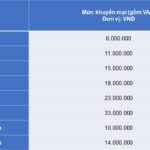

The VinFast Evo Lite Neo electric motorcycle is now priced at 14.4 million VND.

Now, the market landscape is quickly changing with the serious participation of big players such as VinFast and Honda. While smaller companies mainly approach the market through independent dealers and focus on low prices, VinFast and Honda are bringing more comprehensive strategies, from products and communications to the charging ecosystem.

VinFast Accelerates, Honda Hesitates

VinFast, Vietnam’s largest electric vehicle manufacturer, has strategically targeted students as a key demographic. Since the beginning of 2024, the company has launched several models suitable for this segment, including the Evo200, Evo Lite, Feliz S, and recently, the Motio – dubbed the “national popular electric motorcycle.” All these models have a common denominator: a maximum speed of under 50 km/h, compact designs suitable for students’ physiques, long-distance travel capabilities (over 100 km per charge), and most importantly, extremely competitive prices.

In the latest price adjustment, the Motio is listed at just 12 million VND – the lowest among the major electric motorcycle brands. The Evo Lite Neo is also reduced to 14.4 million VND, while the Evo200 – capable of traveling 205 km on a single charge – maintains its price at around 22 million VND. These are very attractive prices, especially when compared to the prices of unbranded electric bicycles.

VinFast is also taking the lead in the after-sales service with its extensive charging ecosystem of over 160,000 charging ports nationwide, mostly located in schools, bus stops, apartment block parking lots, and supermarkets. This eliminates the need for students to take the batteries home to charge, reducing risks and providing much more convenience. Along with a three-year warranty and free battery replacement during the initial period of use, VinFast is offering a “complete solution package” for students, putting pressure on its competitors.

Honda launches the ICON:e with high expectations, targeting the student electric motorcycle segment.

On the other hand, Honda, the king of motorcycles with about 80% market share in Vietnam, has entered the market cautiously. In April 2025, the company officially launched the ICON:e – the first electric motorcycle manufactured by Honda in Vietnam. With a starting price of 26.9 million VND, the ICON:e is expected to be the “answer” to VinFast in the student segment. It features a compact design, easy maneuverability, a 1.5kW motor, a maximum speed of 49 km/h, and a range of about 70 km per charge – sufficient for daily school commutes.

However, Honda’s approach seems insufficient to make a breakthrough. Instead of selling the battery with the motorcycle, Honda applies a battery rental model with a cost of 350,000 VND per month, implying an additional expense of about 4.2 million VND per year just for the “right to use” the battery. For students with limited budgets, this can be a significant obstacle. Moreover, the 70 km range – much lower than VinFast’s offerings in the same price range – puts the ICON:e at a disadvantage in situations where the motorcycle needs to travel more than a day’s distance without recharging.

Another drawback is Honda’s non-existent charging ecosystem. As the motorcycle uses a removable battery, users are forced to take it home to charge, reverting to the inconvenience that was once the “nightmare” of early electric vehicle users.

Strategically, VinFast seems to be one step ahead by choosing the student segment as its spearhead and investing comprehensively in both products and after-sales services. With the goal of capturing 60% of Vietnam’s electric motorcycle market share in 2025, VinFast is focusing its efforts on popular models – where sales volume is determined. This strategy is proving effective, as the latest market report shows VinFast holding over 45% of the national electric motorcycle market share – the highest among all brands operating in Vietnam.

In contrast, Honda’s cautious approach may cause them to miss out if the market grows faster than expected. The ICON:e is just the beginning, and more will be needed if Honda intends to challenge VinFast in the electric vehicle race, especially as young consumers increasingly prioritize technology, experience, and service ecosystems over simply “buying a vehicle.”

The Motio is another affordable option from VinFast.

Of course, everyone understands that the ICON:e is just Honda’s first step in “testing the waters.” The company has planned to launch up to 30 electric motorcycle models by 2030 and undoubtedly has many more “secret weapons” to conquer the market. In reality, Honda is considered late to the game in the electric motorcycle industry, but when they entered, their models were immediately seen as VinFast’s most significant competitor in the market, almost ignoring the other players.

At present, it can be said that the student motorcycle segment is evolving into a long-term race where price is just one factor, and the overall experience determines victory. VinFast has established a solid lead, while for Honda, the question on everyone’s mind is: What will they do next?

“VinFast Slashes Prices on Electric Scooters: Motio Now at $520, Introduces Evo Grand at $899 with Dual-Battery Support”

“On May 22, VinFast unveiled its third ‘Viet Nam Spirit – Towards a Green Future’ campaign, building upon its existing loyal customer policy. “

Honda Unveils Plans for Affordable Electric Motorcycles: Revolutionizing Two-Wheeled Travel

Let me know if you would like me to tweak it further or provide additional suggestions!

Honda is accelerating its motorcycle electrification plans, tailoring products to specific markets, and making them more accessible with competitive pricing.