SSI Securities Corporation (Stock Code: SSI, trading on HoSE) announced on May 20th its plan to issue 10 million shares under the employee stock ownership plan (ESOP) at VND 10,000 per share. The issuance ratio is 0.51% of the circulating shares.

On the stock market, SSI shares are currently trading around VND 23,500 per share. Thus, the ESOP issuance price is 57% lower than the market price.

The payment period for the share purchase is from May 21st to May 30th, 2025. In terms of transfer restrictions, 50% of the issued shares will be restricted from transfer for 2 years, and the remaining 50% will be restricted for 3 years.

The purpose of the issuance is to align the interests of employees and increase working capital for the company. If the ESOP issuance is completed, SSI will increase its circulating shares from 1961.8 million to 1971.8 million, thereby raising its charter capital to VND 19,718 billion.

On May 19th, the State Securities Commission received the report on SSI’s ESOP issuance plan.

Previously, in a resolution announced on April 18th, SSI published a list of 307 individuals and the number of ESOP shares allocated to them. Mr. Nguyen Duy Hung, Chairman of the Board, was allocated the highest number of shares at 1 million. Following him, Mr. Nguyen Hong Nam, Member of the Board and CEO of SSI, was allocated 650,000 shares.

Also, on May 20th, Vietcap Securities Joint Stock Company (Stock Code: VCI) announced its plan to issue ESOP shares.

Accordingly, Vietcap Securities plans to issue 4.5 million ESOP shares at VND 12,000 per share. As of May 23rd, the market price of VCI shares stood at VND 36,400 per share, three times higher than the offering price.

With the expected proceeds of over VND 54 billion from this offering, VCI will use the entire amount to supplement working capital and reduce debt.

The ESOP shares in this issuance will be restricted from transfer for one year. Vietcap Securities published a list of 176 officers and employees eligible to purchase shares in this offering but did not disclose the allocation for each individual.

The issuance is expected to take place in 2025. Upon completion, VCI’s charter capital will increase from VND 7,180.99 billion to VND 7,226 billion.

This is Vietcap Securities’ only plan to increase charter capital in 2025, and it has been approved by the annual general meeting of shareholders.

Earlier, DNSE Securities Joint Stock Company (Stock Code: DSE) proposed to issue 9.9 million ESOP shares in the first quarter of 2025. The issuance will be funded by surplus capital according to the 2024 audited financial statements, amounting to over VND 572.7 billion.

The ESOP shares in this issuance will be restricted from transfer for 12 to 60 months and will be gradually unlocked at a rate of 20% per year. The issuance price is VND 10,000 per share, approximately 45% of the market price of VND 23,400 per share (as of May 23rd).

DNSE published a list of 180 individuals eligible to purchase ESOP shares in this offering. Mr. Nguyen Hoang Giang, Chairman of the Board, and Mr. Le Anh Tuan, Vice Chairman, will be allocated the highest number of shares at 2.1 million each. Ms. Pham Thi Thanh Hoa, a member of the Board, is allocated 274,500 shares. Another member of the Board, Ms. Nguyen Thi Ha Ninh, is allocated 264,100 shares…

After completing the issuance of 9.9 million shares mentioned above, DNSE will proceed with the second ESOP issuance of 2.7 million shares. Subsequently, the company will offer shares to existing shareholders and pay dividends in shares if applicable.

Previously, the 2024 annual general meeting of shareholders of DNSE approved the plan to issue 9.3 million bonus shares to employees. However, due to market fluctuations, DNSE was unable to implement the ESOP in 2024.

The 2025 annual general meeting of shareholders of DNSE, held on March 19th, decided to “materialize” the plan to issue the entire 9.3 million ESOP shares intended for the years 2022, 2023, and 2024, along with an additional 3.3 million bonus shares for employees for the year 2025.

Thus, in 2025, DNSE plans to issue a total of 12.6 million ESOP shares, equivalent to 3.82% of the circulating shares. The maximum expected proceeds from the issuance are VND 126 billion, funded by surplus capital and/or post-tax profits.

“SHB’s Market Capitalization Surpasses $2 Billion: A Testament to its Robust Financial Foundation and Relentless Pursuit of Excellence”

With a robust and ever-growing financial foundation, Saigon-Hanoi Commercial Joint Stock Bank (SHB) sets its sights on an ambitious goal: to reach VND 1 quadrillion in total assets by 2026. This bold target underscores SHB’s commitment to solidifying its position in the domestic financial market while expanding its regional presence. As SHB forges ahead, it stands as a proud partner in the nation’s journey towards a new era of prosperity and progress.

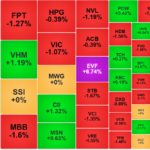

The Sudden Spike: Stocks Take a Tumble

Liquidity across both exchanges soared 28.4% in the afternoon session, hitting a 19-session high. As the sea of red expanded, it confirmed that selling pressure had intensified. While the VN-Index managed to stay in the green, it had to concede closing at the day’s low.

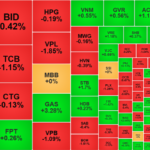

The Vanishing Liquidity: A Market Tug-of-War

The weakening of Vin stocks remains a key signal for investors to exercise caution. The blue-chip group’s attempts to push higher were met with strong resistance, resulting in a retreat that kept the VN-Index confined to a narrow range around the reference level throughout the session. A 40% plunge in HoSE’s liquidity to a 15-session low underscores the return of cautious sentiment.