The consumer and retail segment is expected to be a growth driver, with strategic initiatives and Vietnam’s potential market upgrade as strong catalysts for MSN’s stock price in the 2025-2026 period.

Growth Driver: Consumer and Retail Segment

BVSC analysts forecast Masan (MSN) to achieve net revenue of VND 86,955 billion in 2025, a 4.5% increase year-over-year, and net profit after tax after minority interest (NPAT-MI) of VND 2,802 billion, a significant 40.2% surge. This growth is underpinned by the following key factors:

Masan Consumer is anticipated to be the shining star in the fast-moving consumer goods (FMCG) industry, leveraging its strong brands and innovative product portfolio. In 2025, MCH plans to further its premiumization strategy in the convenience food sector by introducing a new line under the Omachi brand named “Asian Street Food.” Simultaneously, robust brands in the seasoning category, such as CHIN-SU and Nam Ngư, will continue to dominate the market by associating their brands with Vietnamese lifestyle and culinary culture. BVSC forecasts a 10.1% and 9.2% increase in Masan Consumer’s revenue and operating profit (EBIT), respectively.

Image: Omachi’s new “Asian Street Food” line

WinCommerce (WCM) will be one of MSN’s new growth pillars as it accelerates its expansion. According to the company, in April 2025, WCM opened 68 new stores, including 46 WinMart+ Rural stores, bringing the total number of stores in the system to 4,035, with the Rural chain reaching 1,500 stores. With a monthly average of nearly 50 new WinMart+ Rural stores, the goal of reaching 1,900 stores by the end of the year is not only achievable but well within the company’s grasp. BCVS forecasts a 15.2% increase in WCM’s revenue and a remarkable 105.8% surge in EBIT, backed by its aggressive expansion strategy.

Image: WinMart+ Rural stores expansion

Regarding the meat segment, Masan MEATLife is poised for a strong comeback, benefiting from the current favorable pork prices, a focus on high-margin processed meat products, and optimized costs due to increased fresh meat output. A strategic breakthrough for Masan MEATLife in 2025 is the successful implementation of technology to enhance sow insemination productivity, allowing for an additional 24,000 pigs per year. With an average finished product value of ~VND 7.5 million per pig, this increase translates to an additional VND 180 billion in revenue for 2025. BVSC forecasts a 15.7% rise in MML’s revenue, a substantial 124.4% jump in EBIT, and a notable recovery in net profit.

Phúc Long Heritage (PLH) is undergoing a restructuring by closing down inefficient kiosks and upgrading its product offerings, leading BVSC to predict a 7.4% increase in revenue and a 30.2% surge in EBIT.

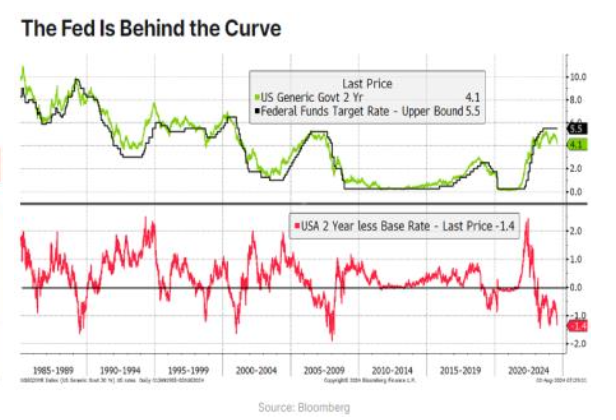

Stock Market Awaiting Upgrade

2025 is a pivotal year for Vietnam’s stock market, with efforts underway to graduate from a frontier market to an emerging market status as outlined in the approved Securities Market Development Strategy through 2030.

Image: Vietnam’s stock market upgrade potential

According to a report by Saigon-Hanoi Securities JSC (SHS), Vietnam could attract approximately USD 9 billion in foreign investment following the market upgrade. This includes USD 800 million from FTSE Russell-indexed ETFs, USD 2 billion from other passive funds, and USD 4-6 billion from active funds. This influx of capital is expected to primarily target large-cap, highly liquid stocks with sufficient room for foreign ownership.

Based on these criteria, SHS identified a group of potential stocks likely to be included in the FTSE index and benefit significantly from foreign capital inflows, mainly comprising blue-chip stocks. Notably, consumer and retail stocks are deemed promising, including MSN of the Masan Group, which is also expected to benefit directly from positive macro conditions domestically and internationally, boosting its business performance.

Image: MSN stock poised for growth

BVSC analysts share this sentiment, believing that MSN, with its large scale and market capitalization, is likely to be a preferred choice for foreign capital. With a projected profit growth of 40%, a valuation below historical averages, and long-term growth drivers, MSN presents a strategic investment opportunity for medium and long-term investors.

Why Do Businesses Claiming to Be Drug-Free Still Test Positive for Saffron in Their Durian Fruits?

The discovery of high levels of cadmium in durian is primarily due to soil pollution, prolonged use of fertilizers and pesticides in cultivation. Additionally, the use of color enhancers by some businesses during the preliminary processing stage further exacerbates the issue, resulting in the presence of Sudan Yellow, a harmful dye, in the fruit.

“Strengthening Strategic Collaboration Between Vietnam and Leading US Corporations”

The discussions with leading corporations such as Excelerate Energy, Lockheed Martin, SpaceX, and Google have paved the way for new strategic collaborations between Vietnam and the United States. These engagements have outlined key areas of cooperation in the fields of energy, aerospace, technology, and telecommunications.

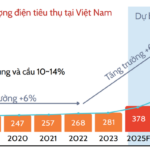

“Securing Energy Independence and Joining the Global Value Chain: The Case for LNG Development”

“Vietnam is facing an ever-growing energy demand to fuel its economic growth and industrialization goals. The utilization of liquefied natural gas (LNG) emerges as a pivotal solution, offering not just energy security but also a pathway towards cleaner energy sources. LNG presents Vietnam with an opportunity to partake in the global LNG value chain, thereby ensuring a sustainable and secure energy future.”