“More Than 30 Banks Cut Interest Rates Since the Beginning of the Year”

VPBank joins over 30 banks that have lowered interest rates since the beginning of May. On May 23, VPBank announced a 0.1%/year reduction in deposit interest rates across all terms. This move brings their rates down to some of the lowest in the market, with a 1-month term earning depositors 3.6%/year, and 2–5-month terms only slightly higher at 3.7%/year.

The bank also cut rates for longer-term deposits, with 6–11-month terms now earning 4.6%/year, 12–15-month terms at 5.1%/year, and 24–36-month terms earning 5.2%/year. These rates are for accounts with less than 3 billion VND in deposits. For accounts with more than 3 billion VND, VPBank offers slightly higher rates, with the 24–36-month term earning 5.3%/year.

Despite lower interest rates, bank deposits are on the rise (Photo: Nhu Y) |

This trend of decreasing interest rates is not unique to VPBank, as the State Bank of Vietnam reported that over 30 domestic commercial banks have lowered their deposit interest rates since the end of February, with rates now at their lowest in a year. For a 12-month term deposit, only one bank in the market offers a rate of 6%/year.

The Prime Minister has taken a keen interest in these developments, instructing the State Bank of Vietnam to inspect and strictly handle banks that have recently increased deposit interest rates. The Governor of the State Bank of Vietnam has been empowered to use tools such as credit growth limits and license revocation to ensure compliance.

How Banks Compete

Despite the low-interest rates, bank deposits have reached record highs. As of the end of February, deposits by individuals at credit institutions hit 7.36 quadrillion VND, a 4.2% increase from the end of 2024. This trend has continued, with deposits increasing by 178 trillion VND from the end of January to February, and by 301 trillion VND from the end of 2024 to February.

Credit growth has also been robust, with total system credit reaching nearly 16.3 quadrillion VND as of April 18, reflecting an increase of nearly 4.3% compared to the end of 2024 and a surge of over 18.2% from the same period in 2024.

With a targeted credit growth rate of 16% for the year, banks are vying to attract deposits. Assoc. Prof. Dr. Nguyen Huu Huan, an expert from the University of Economics Ho Chi Minh City, shared his insights on the current competitive landscape among banks of different sizes. He noted that some banks are leveraging technology to optimize deposits, offering products that automatically maximize returns, such as payment accounts with savings account-like interest rates. Additionally, banks are focusing on enhancing security and convenience through improved functionality.

Mr. Huan attributed the continued inflow of deposits to the perceived safety of savings accounts compared to other investment options. “The stock market is still volatile, and the real estate market, though recovering, is doing so slowly,” he explained. “In the current context, people tend to tighten their belts and opt for the security of bank deposits while waiting for opportunities in other investment channels.”

Ngoc Mai

– 16:25 23/05/2025

“KIS Research: Banking Sector – On a Steady Growth Trajectory”

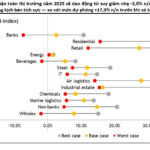

The banking sector witnessed positive growth in the first quarter of 2025, and KIS anticipates that this upward trajectory will persist, with industry profits expected to maintain a moderate growth rate in the second quarter of 2025.

The Ever-Expanding Metropolis: Extending Vo Van Kiet Street to Reach Long An

With a length of nearly 15km, a width of 60m, and impressive design speeds of 80km/h for motor vehicles and 60km/h for mixed-use lanes, the Vo Van Kiet Road extension project from National Highway 1 to Long An province is set to be a standout infrastructure development for Ho Chi Minh City. This ambitious project, scheduled for the 2026-2030 period, will undoubtedly enhance connectivity and ease transportation woes in the region.

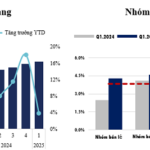

The Credit Growth Picture in Q1: A Snapshot

The financial landscape has witnessed a positive shift this year, with a strong growth in credit right from the get-go. This is in contrast to the modest growth observed in the first quarter of last year. However, consumer credit has yet to show significant improvement despite the efforts of the State Bank to implement policies geared towards boosting credit growth in this sector.