Credit growth outpaces deposits

In Q1 2025, the credit growth of the entire banking system outpaced that of deposits. This gap reflects a mismatch between the output and input of capital, creating certain short-term liquidity challenges, especially for banks with high loan-to-deposit ratios (LDRs).

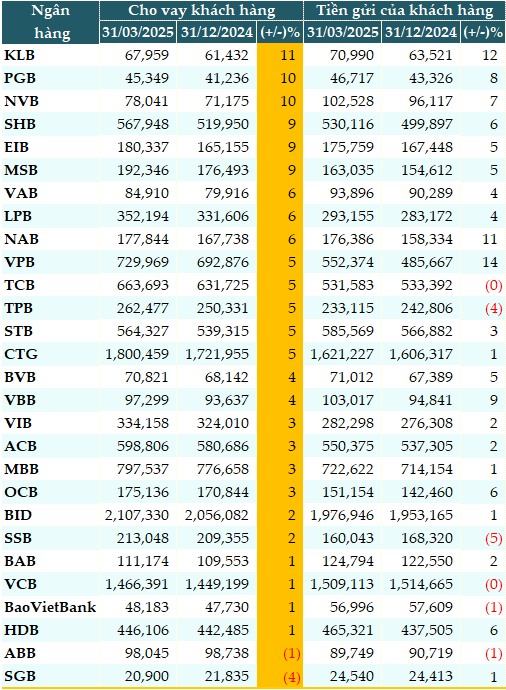

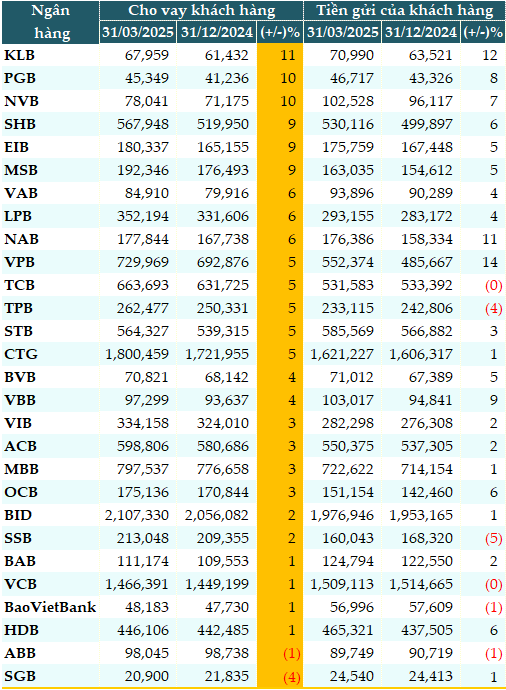

Data from VietstockFinance shows that as of March 31, 2025, the total outstanding loans of 28 banks in the system exceeded VND 12,350 trillion, up 4% from the beginning of the year.

KienlongBank (KLB) was the bank with the strongest credit growth (+10%), followed by PGBank (PGB, +10%), NCB (NVB, +10%), SHB (+9%), Eximbank (EIB, +9%), and MSB (+9%)…

Meanwhile, total customer deposits at the 28 banks amounted to over VND 11,460 trillion, a 2% increase compared to the beginning of the year.

VPBank (VPB, +14%) was the bank that attracted the most deposits, followed by KLB (+12%), Nam A Bank (NAB, +11%), and Vietbank (VBB, +9%).

|

Customer lending and deposits as of March 31, 2025 (in VND trillion)

Source: VietstockFinance

|

The mismatch between deposits and lending in Q1 resulted from low deposit interest rates, which showed a decreasing trend. Since the beginning of 2025, deposit interest rates have remained stable at low levels and even decreased slightly for short-term maturities. This trend is attributed to the State Bank of Vietnam’s (SBV) loose monetary policy aimed at supporting economic growth and reducing capital costs for businesses. However, low-interest rates discourage depositors from keeping their money in banks, especially for short-term deposits. Instead, funds are diverted to investment channels offering higher yields.

With the strong recovery in the stock market, the VN-Index surpassing 1,300 points, and domestic gold prices reaching record highs, a significant portion of the population withdrew their bank deposits to invest in gold, stocks, corporate bonds, or low-cost real estate. Consequently, deposit inflows into the banking system slowed down, particularly from the household sector.

In contrast, the demand for credit in the economy increased rapidly at the beginning of the year, mainly due to businesses requiring capital for reproduction and expansion as export orders gradually recovered. Capital inflows into infrastructure, consumption, and service sectors showed positive recovery signs. Several credit support policies from the government and the SBV reduced lending rates and eased access to capital, facilitating credit growth.

Are there liquidity pressures?

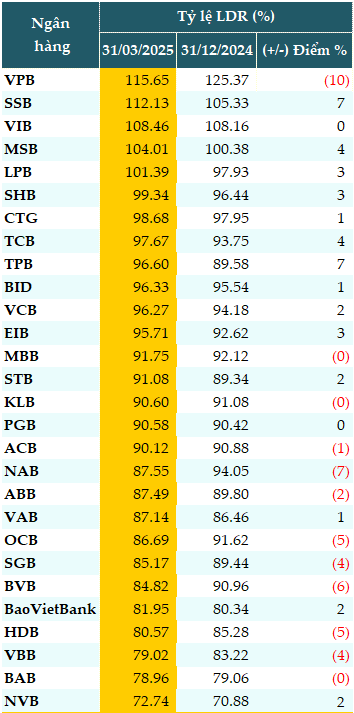

As of the end of Q1 2025, 16 out of 28 banks had higher LDRs compared to the beginning of the year, indicating that these banks were extending more credit than their deposit base.

As of March 31, 2025, 6 out of 28 banks had LDRs below 85%. On the other hand, 5 banks had LDRs exceeding 100%, including VPB (115.65%), SeABank (SSB, 112.13%), VIB (108.46%), MSB (104.01%), and LPBank (LPB, 101.39%).

|

LDRs of banks as of March 31, 2025

Source: VietstockFinance

|

Although faster credit growth than deposit growth may increase liquidity pressure for some banks, the overall system’s liquidity remains under control. The SBV’s flexible regulation through open market operations (OMOs) ensures timely liquidity provision to banks facing temporary shortages. The capital adequacy ratio (CAR) and the system-wide LDR remain within regulatory limits, and many large banks have good deposit mobilization capacity. Additionally, foreign currency sources continue to be abundant, supporting liquidity through swap transactions.

However, we must not be complacent as the continued credit-deposit growth gap could reduce the system’s resilience to external shocks such as exchange rate risks, inflation, or capital outflows.

Credit growth remains robust, and deposit mobilization is expected to improve in Q2

Mr. Nguyen Quang Huy – CEO of the Faculty of Finance and Banking, Nguyen Trai University – forecasts that credit growth may remain robust in Q2 and Q3 2025, supported by increasing export orders, stronger disbursement of public investment in infrastructure and production sectors, and favorable credit policies. However, the pace of growth could slow down if banks tighten lending conditions to manage the rising risk of bad debts.

Deposit mobilization is likely to improve in Q2 as some banks adjust their deposit interest rates upwards to compete for capital. Expected technical corrections in the gold and stock markets may also redirect funds back to savings accounts. Diversifying deposit products, especially online savings and flexible interest rate products, can help banks attract younger customers.

Meanwhile, the SBV will continue to implement a flexible and cautious monetary policy, balancing the goals of stimulating growth and controlling system liquidity. There is also an emphasis on developing the capital market and encouraging medium and long-term capital mobilization channels outside the banking system.

Commercial banks need to control lending speeds and restructure their credit portfolios to prioritize safe and quick capital turnover sectors. Banks should proactively issue bonds and other financial instruments and expand financial partnerships to supplement medium and long-term capital sources. Additionally, they should enhance digitalization and flexible savings programs to attract individual capital back into the system.

Overall, the credit-deposit growth rate gap in Q1 2025 is a notable signal that warrants attention. While it does not pose a systemic risk, it calls for banks to closely monitor liquidity, maintain credit safety, and adopt more flexible approaches to capital attraction. In the context of intensifying competition for capital across financial channels, the banking system must uphold its central role in guiding capital flow wisely and stably to support the economy’s recovery and development.

– 11:00, May 20, 2025

The Great Bank Rush: Why Money is Flooding In Despite Falling Interest Rates

According to experts, the continuous flow of deposits into banks despite low-interest rates indicates that savings accounts remain the safest investment option in the current economic climate.

The Sudden Spike: Stocks Take a Tumble

Liquidity across both exchanges soared 28.4% in the afternoon session, hitting a 19-session high. As the sea of red expanded, it confirmed that selling pressure had intensified. While the VN-Index managed to stay in the green, it had to concede closing at the day’s low.