Net interest margin of the Vietnamese banking system is almost double that of Chinese banks. Photo: LE VU |

For many years, China’s banking system was known for its role in supporting economic growth through large-scale credit, especially in priority sectors such as real estate and infrastructure. However, this model gradually exposed risks: increasing non-performing loans, low capital efficiency, and high dependence on interest margins, making financial performance vulnerable to market fluctuations. Since 2015, under the pressure of deleveraging policies and debt control, Chinese banks have had to restructure their operations.

The past decade has been a journey of profound transformation: from large-scale lending to quality growth; from traditional operations to comprehensive digitalization; and from pure interest income to diversified services. These strategic shifts not only impact financial indicators such as net interest margin (NIM), return on equity (ROE), and cost-to-income ratio (CIR) but also create more sustainable business models for leading banks.

Core Strategic Shift in China’s Banking System

During 2010-2015, credit growth in China maintained an average of about 16% per year, mainly focused on real estate and state-owned enterprises. However, this rapid expansion came with a buildup of hidden non-performing loans. Faced with pressure to control the capital adequacy ratio and improve credit efficiency, Chinese banks began to decelerate credit growth from 2016 onwards, while shifting their focus to safer sectors such as green credit, consumer lending, and small and medium-sized enterprises (SMEs).

|

Since the debt control period of 2017-2019, Chinese banks have reduced their real estate and state-owned enterprise loan portfolios, increasing financing for consumer lending, high-tech agriculture, and green credit instead. The proportion of consumer lending in total loans has significantly increased at many large banks. Although overall credit growth decreased from an average of 14% to around 9% during 2020-2023, the quality of growth improved considerably, as reflected in a stable capital adequacy ratio (CAR) of around 14% and reduced credit term risk.

As a result, by 2023, the non-performing loan (NPL) ratio for the entire system was maintained at a stable level of around 1.6%, with large banks such as ICBC and ABC keeping their NPL ratios below 1.5% for three consecutive years. The management of asset quality helped stabilize loan loss provisions and maintain a high loan coverage ratio, exceeding 180% in many state-owned banks.

Amid declining market interest rates and increasing competition from financial technology (FinTech) companies, Chinese banks’ NIM continuously declined. Dropping from an average of about 2.5% in 2014 to below 1.4% in 2024, banks shifted their focus away from relying heavily on interest rate differentials to developing high-value-added financial services such as asset management, investment banking, insurance, and digital payments.

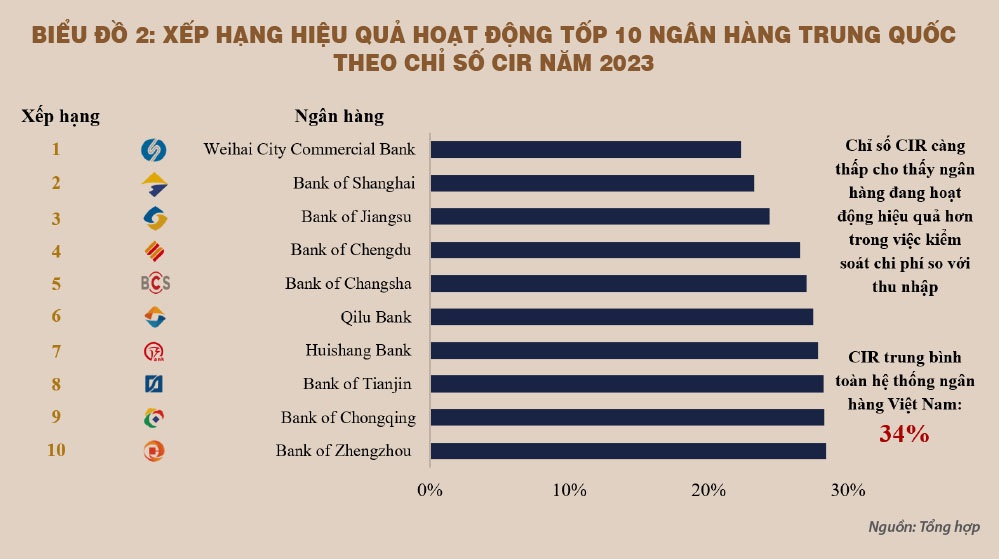

Many banks, especially CCB, reduced their CIR from over 40% in 2014 to below 30% in 2023—an impressive achievement for a large-scale bank. Additionally, the application of data and technology in operational processes enabled personalized products and services, improved customer retention rates, and enhanced operational efficiency, as evidenced by a notable improvement in the return on assets (ROA) ratio.

Impact on System-wide Operational Efficiency

Due to narrowing interest margins, banks had to restructure their income streams, resulting in a slight decline in the system-wide ROE from 14% (in 2013) to the current 11-12%. However, stable revenue sources and cost structures kept ROE at healthy and less volatile levels. Some banks focusing on asset management, such as CITIC Bank and CMB, even experienced a mild recovery in ROE thanks to the improved performance of their financial services segment.

ROA, an indicator of asset utilization efficiency, improved among banks that effectively leveraged technology, particularly among joint-stock commercial banks operating in large urban areas. The most notable aspect of China’s story is the abandonment of a growth model reliant on mass lending, prioritizing growth over quality. Instead, they adopted a strategy centered on customer selection, risk management, and efficient capital allocation.

The banks’ transformation was significantly influenced by the application of technology in internal operations, not only enhancing operational efficiency but also enabling banks to better understand and serve the diverse needs of different customer segments.

One of the most profound shifts was the systemic embrace of digital transformation. Major banks like ICBC, CCB, and BOC have heavily invested in artificial intelligence (AI), big data, cloud computing, and smart banking platforms. The adoption of branchless banking, omnichannel customer experiences, and integrated core systems optimized operational processes and improved service efficiency.

The most evident impact is reflected in the CIR, which decreased from over 40% to an average of 33-34% system-wide. Banks that invested significantly in technology, such as CCB, Zheshang Bank, and CMB, achieved a CIR of below 30%—an indicator of sustainable operational capabilities. This CIR level is considered very good when compared to the best-performing banks in Vietnam, where the best-managed CIR ratios range from 23-30%.

Notably, while the net interest margin of Vietnam’s banking system is almost double that of Chinese banks, this disparity underscores the impact of technology in enhancing the efficiency of Chinese banks. Technology not only reduces fixed costs but also aids in credit risk management and personalized customer service. The use of AI for credit evaluation, robotic process automation for transaction processing, and user data analytics has significantly lowered operating expenses.

With bank credit remaining the primary driver of economic growth, especially with a significant portion flowing into the real estate sector, the lessons from China over the past decade serve as a necessary wake-up call. Instead of solely pursuing double-digit credit growth, Vietnamese banks should focus on asset quality, targeted lending, and capital efficiency. Over-reliance on credit expansion will soon lead to pressure on loan loss provisions and weaken financial resilience.

Another lesson for Vietnam to upgrade the operational efficiency of its banking system is to seize the opportunities presented by digital transformation thoroughly. Digital transformation should not merely entail launching mobile applications or partial process digitalization. China’s experience demonstrates that effective transformation must start with core systems, data, and operational capabilities.

The development of smart digital banking systems in China has not only helped banks reduce costs but also enabled product personalization and the expansion of financial ecosystems, thereby creating long-term competitive advantages for the banking system.

Le Hoai An – Vo Nhat Anh

– 07:00 23/05/2025

“April 2025 Real Estate Credit Climbs 0.34% Higher.”

As of April 2025, Ho Chi Minh City’s real estate credit outstanding balance reached VND 1,116 trillion, witnessing a slight increase of 0.34% from the previous month and a more significant 2.85% surge compared to the end of 2024.

Which Bank is Experiencing the Strongest Profit Growth?

A slew of banks has reported robust profit growth in the first quarter of 2025, with some even announcing profits several times higher than the same period last year.