Dr. Nguyen Duc Thach Diem, born in 1973, holds a doctorate in Business Administration from the Academy of Finance. She took on the role of CEO in 2017 when Sacombank officially commenced its restructuring plan post-merger. This move aimed to separate governance and operations, adhering to Sacombank‘s operating standards.

Under Ms. Diem’s leadership for almost eight years, Sacombank has witnessed a remarkable turnaround, with impressive growth across its business metrics. Specifically, from 2016 to 2024, total assets increased by over 125%, lending grew by 169%, total mobilization climbed by 121%, and pre-tax profits surged from VND 156 billion to over VND 12,270 billion. Key performance indicators such as ROA, ROE, and CAR showed significant improvement, with CAR consistently maintained above 9% and reaching 10.14% in 2024 (surpassing the 8% requirement set by the State Bank of Vietnam). Meanwhile, ROA and ROE witnessed a remarkable 49-fold increase.

Ms. Nguyen Duc Thach Diem continues as Vice Chairwoman of the Board of Directors at Sacombank

|

Despite limited resources, Sacombank not only strengthened its business performance but also actively addressed a significant portion of its non-performing loans and completed its financial obligations under the restructuring plan. In 2024, the bank recovered and handled nearly VND 10,000 billion in bad debts and residual assets, bringing the cumulative total to VND 103,988 billion (including VND 76,695 billion under the plan). Non-performing loans and residual assets under the plan decreased by 80.5%, reducing their proportion in total assets from 28.1% to 2.4%. Notably, Sacombank fully settled VND 21,576 billion in accrued interest income arising from the plan and made 100% provisions for the remaining non-performing loan portfolio. Retained earnings (after 2024 distribution) stood at VND 25,425 billion, 1.35 times the chartered capital.

As a result of these achievements, Sacombank received consecutive upgrades in its credit ratings from Fitch Ratings and Moody’s. The bank’s Board of Directors highly commended Ms. Diem’s efforts and outstanding fulfillment of her role as CEO over the past eight years. This strong foundation sets the stage for her continued significant contributions to the bank’s development strategy in the years ahead.

Mr. Nguyen Thanh Nhung appointed as Acting CEO of Sacombank

|

The new Acting CEO, Mr. Nguyen Thanh Nhung, brings fresh perspectives to Sacombank while boasting a reputable and extensive background in the financial and banking industry. Mr. Nhung holds a bachelor’s degree in economics and law from Ho Chi Minh City University of Law, as well as a master’s degree in finance and banking from Ho Chi Minh City University of Economics. With over 30 years of experience in crucial banking-related fields such as accounting, legal, credit, and monetary operations, Mr. Nhung has proven his leadership capabilities through various senior positions, including his role as Deputy CEO of Eximbank and CEO of Vietbank.

Mr. Nhung is expected to build on the bank’s achievements and steer Sacombank towards continued safe, efficient, and sustainable development. As Sacombank progresses on its restructuring journey, aiming to become a leading bank in Vietnam, its operations remain stable and closely aligned with the orientations and plans approved by the Annual General Meeting of Shareholders.

– 11:50 22/05/2025

The Evolution of China’s Banking Strategy and Lessons for Vietnam

The Chinese banking system has undergone a strategic transformation over the past decade. Moving away from a model reliant on large-scale credit growth, fueled by real estate lending and state-owned enterprise loans, the industry has embraced a new paradigm. This paradigm shift involves a comprehensive approach to finance, diversifying revenue streams, and embracing digital transformation. This evolution reflects a conscious effort to adapt to the demands of risk management, improved operational efficiency, and sustained growth.

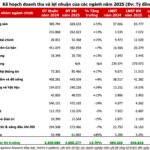

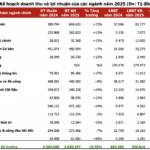

“Sifting Through Sand for Gold”: Unveiling the Industries Poised for a New Growth Cycle in 2025’s Business Plans

The market’s profit outlook for 2025 is positive, according to Agriseco, but there is a distinct divergence between industry sectors.

What Business Sectors Have the Strongest Growth Plans for 2025?

As of May 20, 2025, listed companies’ earnings reports revealed a promising outlook for the market. According to Agriseco, net profits for the year 2025 exhibited a significant growth of 16.47% compared to 2024. Moreover, excluding the banking group, total revenue plans indicated a remarkable surge of 13.75% year-over-year. These figures showcase the market’s robust health and promising trajectory for the upcoming year.