Vietnam has been a favored destination for the ‘China plus one’ wave in recent years. However, sudden shifts in US trade policies can slow down new FDI inflows – a core driver of industrial real estate development.

Tariff Pressures

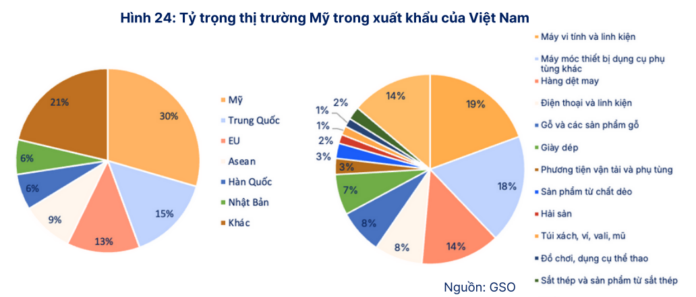

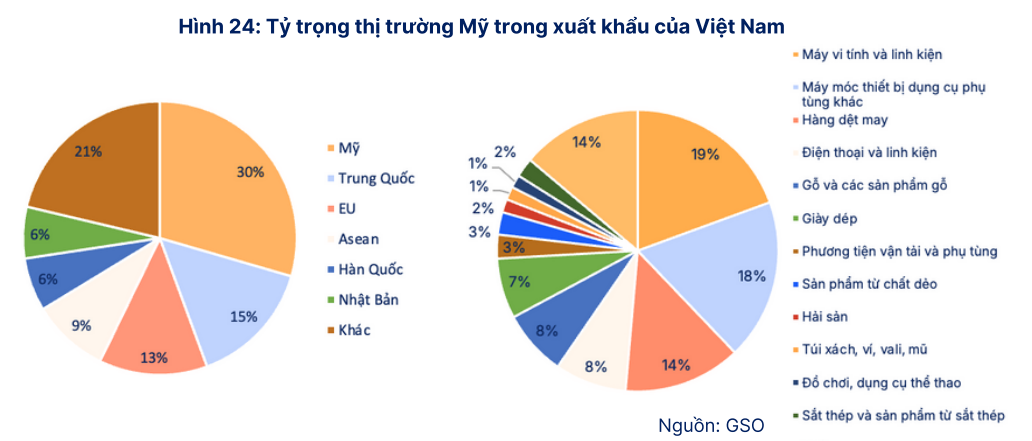

According to the latest report by Saigon-Hanoi Securities JSC (HNX: SHS), the US remains Vietnam’s largest export market in 2024, accounting for nearly 30% of total export turnover. Key export items include electronics, phones, and textiles, with respective weights of 19%, 8%, and 14%.

|

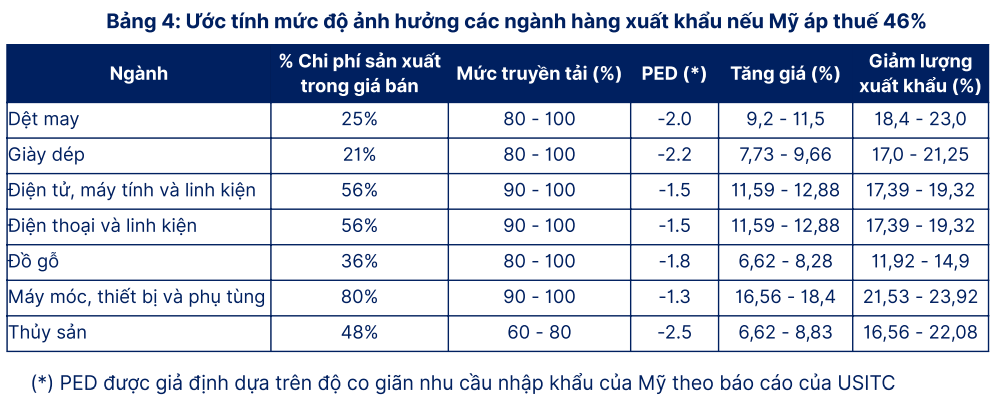

Being subjected to a 46% tax rate by the US – the highest in the ASEAN region and 10-29% higher than direct competitors for FDI such as Thailand, Indonesia, or the Philippines – diminishes Vietnam’s appeal to foreign investors, particularly businesses reliant on the American market.

This could directly decrease the demand for industrial park land leases and ancillary services like electricity and water – significant revenue streams for industrial real estate enterprises.

“High tariffs increase the prices of Vietnamese goods exported to the US, leading to reduced demand and impacting the expansion decisions of FDI enterprises,” SHS stated.

In the worst-case scenario, if negotiations fail and Vietnam is subjected to a 46% tariff, SHS forecasts a potential 15-20% decline in new land lease contracts in industrial parks, causing an 8-10% drop in rental prices compared to the previous year. Consequently, many exporting businesses will downsize, resulting in decreased occupancy rates and increased vacancy rates.

Source: SHS

|

Conversely, lower tariff rates would lessen the impact on exporting businesses, thereby minimizing indirect consequences for industrial real estate companies.

Low Probability of FDI Withdrawal from Vietnam

From a more optimistic perspective, BIDV Securities Joint Stock Company (BSC, HOSE: BSI) suggests that FDI inflows into Vietnam during 2025-2027 may slow down due to trade uncertainties. However, the likelihood of FDI businesses exiting Vietnam is low, considering that establishing large-scale production bases typically requires a minimum of 4-5 years, surpassing the term of the current US president.

More importantly, if Vietnam maintains its fundamental strengths, such as political stability, inflation and exchange rate control, legal improvements, and infrastructure development, it can still attract major players in the supply chain rather than solely accommodating satellite suppliers.

Thanh Tú

– 11:44 24/05/2025

Get Up to 50% Cashback with Lionbank Visa

“The Liobank Visa card, a powerful collaboration between digital bank Liobank and payment technology leader Visa, has been making waves in the market just two months after its launch. With its innovative features and exclusive benefits, the card has elevated the spending experience for customers, offering them unparalleled convenience and rewards of up to 50% on their transactions.”

The $300 Million Airport in Vietnam’s Town: A Global Beauty That’s Been Stalled for 3 Years. When Will Construction Begin?

After 3 long years since the groundbreaking ceremony, construction on the highly anticipated airport project, with an investment of 7 trillion VND, is yet to officially commence.