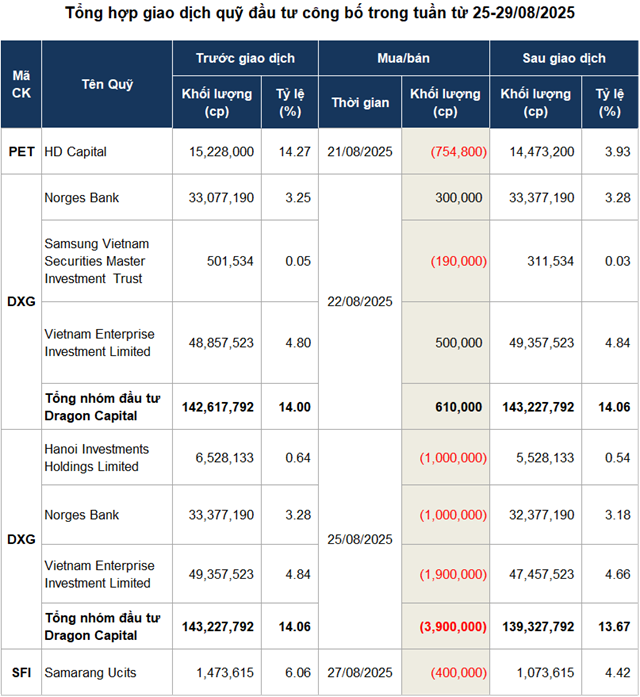

The spotlight falls on Dragon Capital’s recent trade activities. On August 25, the firm sold 3.9 million DXG shares (of the Dat Xanh Group), reducing its ownership from 14.06% (over 143 million shares) to 13.67% (over 139 million shares).

Based on the closing price, the fund is estimated to have pocketed around VND 80 billion. Prior to this, on August 22, Dragon Capital had purchased 610,000 DXG shares but quickly reversed course and sold a large chunk.

| DXG share price movement over the past 6 years |

On the exchange, DXG shares have staged a strong recovery. After plunging to a low of VND 10,500 per share on April 9 (during a market-wide shock due to tariff changes), the stock surged and ended August at VND 23,400 per share – more than doubling in just five months and reaching its highest level since mid-2022.

| SFI share price movement from the beginning of 2024 to August 29, 2025 |

Following a similar selling trend, the foreign fund Samarang Ucits also reduced its stake in SAFI Joint Stock Company (SFI) from 6.06% to 4.42%, equivalent to 1.1 million shares, and is no longer a major shareholder after offloading 400,000 shares on August 27, earning approximately VND 11 billion.

In the market, SFI shares have declined by 5% over nearly two months (from VND 28,100 per share on July 4 to VND 26,400 per share on August 29). However, compared to its April low of VND 22,300 per share, the stock is still up by 19%.

Source: VietstockFinance

|

– 07:28 31/08/2025

Unlocking Profits: Navigating the VN-Index’s Surge Past the 1,600-Point Milestone

“During the week of August 11–15, 2025, selling pressure from investment funds intensified as the VN-Index rallied for four consecutive sessions, breaching the psychological threshold of 1,600 points and approaching the 1,660 zone. However, the index faced corrective pressures during the week’s final trading session.”

Dragon Capital: After a Strong Rally, Sensitivity to Negative Factors May Increase

Overall, Dragon Capital maintains a positive outlook. The firm believes that the recent setbacks are only temporary and that the economy will rebound in the coming months. With a strong foundation and positive fundamentals, the future looks bright, and Dragon Capital is confident in the potential for growth and success.