There were indications of a shift in cash flow towards mid- and small-cap stocks during the afternoon session, with many of these stocks experiencing significant price increases. While the blue-chip VN30 stocks still held the largest proportion of the HoSE market, it was the mid- and small-cap stocks that presented the most attractive opportunities for individual investors.

The afternoon trading volume for the VN30 basket was relatively low, decreasing by 38.3% compared to the morning session. In contrast, the total matched value for the entire market only decreased by 17.8%. Specifically, the VN30 basket decreased by approximately VND 3,219 billion, while the whole market decreased by VND 2,272 billion. The nearly thousand-billion-dong difference was attributed to transactions in stocks outside the basket.

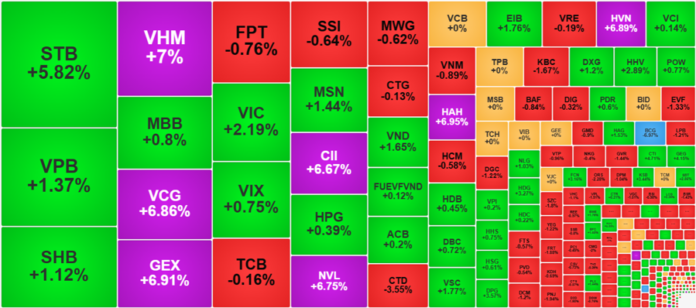

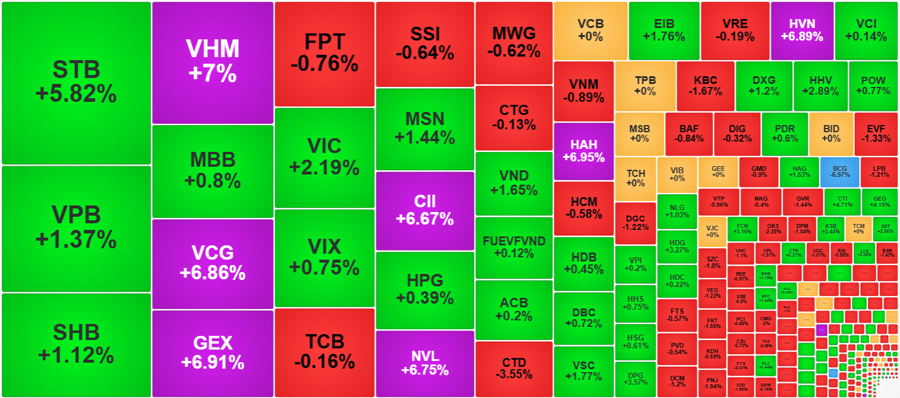

Out of the 20 stocks on the HoSE with matched orders exceeding VND 300 billion, 6 were mid-cap stocks. These stocks witnessed impressive price increases, such as VCG, which hit the ceiling price with a 6.86% increase and a transaction value of VND 739.1 billion; GEX, which also hit the ceiling price with a 6.91% increase and a transaction value of VND 714.1 billion; CII, up 6.67% at the ceiling price with a transaction value of VND 527.7 billion; NVL, at the ceiling price with a transaction value of VND 447.5 billion; and VND, up 1.65% with a transaction value of VND 338.2 billion…

Although the representative index for mid-cap stocks only increased by 0.32%, the stocks that attracted large cash inflows still performed exceptionally well. In addition to the aforementioned stocks, VSC, EIB, HHV, NLG, DXG, HAG, HT1, BWE, HDG, and SBT also witnessed price increases of over 1%, and quite a few of these stocks had transaction values of over one hundred billion dong each.

A similar trend was observed in the small-cap group, with its representative index rising by a modest 0.26%, but several stocks experiencing increases of over 1% with good liquidity. This group even included stocks with transaction values exceeding VND 100 billion, such as HAH, which rose to the ceiling price of 6.95%, and DPG, which increased by 3.57%. Stocks with transaction values of tens of billions included CTI, up 4.71%; KSB, up 3.44%; FCN, up 3.16%; LCG, up 2.25%; and BFC, up 1.58%…

Among the blue-chip stocks, VHM and VIC continued to be the most impressive duo. VHM was among the top stocks in the VN30 basket in terms of cash inflows, with approximately VND 312.1 billion in additional transactions, causing its price to surge to the ceiling price. While VIC’s performance was not as strong as VHM’s, it still managed to increase by 2.41% compared to the morning session’s closing price, ultimately closing the day 2.19% higher than the reference price. Apart from these two pillars, only SHB, PLX, and BCM experienced positive price movements during the afternoon session. VIC and VHM alone contributed nearly 6 points to the VN-Index, helping it close with a gain of 7.98 points, or 0.6%.

Overall, the stock prices in the VN30 basket showed a notable improvement during the afternoon session. Statistics revealed that 17 out of 30 stocks in the basket had increased by the end of the session, while only 6 stocks declined. The VN30-Index closed with a gain of 11.84 points, or 0.84%. By the end of the day, 8 stocks in the basket had increased by more than 1%, with VIC and VHM contributing 9.5 points. The remaining stocks that performed well included STB, MSN, PLX, VPB, BVH, and SHB.

The HoSE market breadth at the end of the session showed 125 gainers and 181 losers, a significant improvement compared to the morning session (92 gainers and 208 losers). This clear differentiation was evident even within the same capitalization groups, with many stocks experiencing significant increases or decreases in opposite directions. For instance, while the mid-cap group included strong performers like those mentioned above, it also witnessed sharp declines in stocks such as CTD, PPC, SIP, CMG, and PNJ. Similarly, in the small-cap group, over 40 stocks decreased by more than 1% at the closing bell.

This differentiation emerged as the VN-Index approached its previous peak, indicating that investor sentiment remained relatively stable. Instead of fearing a market reversal at the previous peak, investors continued to seek out individual opportunities.

Foreign investors slightly reduced their trading intensity in both buying and selling during the afternoon session, but the net value still reached VND 168.7 billion, following a net buy value of VND 311 billion in the morning session. The FUEVFVND fund certificate did not see much change in transaction volume, while the cash inflows were concentrated in stocks. STB witnessed a net buy value increase of VND 353.9 billion, VHM of VND 152.5 billion, VCB of VND 112.3 billion, HVN of VND 72.2 billion, VND of VND 70.2 billion, NVL of VND 69.6 billion, and MSN of VND 49.8 billion… On the net selling side, FPT decreased by VND 123.1 billion, VIC by VND 93.9 billion, VRE by VND 74.5 billion, VCB by VND 48.9 billion, and HCM by VND 47.3 billion…

“SHB’s Market Capitalization Surpasses $2 Billion: A Testimony to its Robust Financial Foundation and Relentless Pursuit of Excellence”

With a robust and ever-growing financial foundation, Saigon-Hanoi Commercial Joint Stock Bank (SHB) sets its sights on an ambitious goal: to reach VND 1 quadrillion in total assets by 2026. This bold target underscores SHB’s determination to solidify its leading position in Vietnam’s financial landscape and expand its regional presence, all while supporting the nation’s journey into a new era of prosperity.

“SHB’s Market Capitalization Surpasses $2 Billion: A Testament to its Robust Financial Foundation and Relentless Pursuit of Excellence”

With a robust and ever-growing financial foundation, Saigon-Hanoi Commercial Joint Stock Bank (SHB) sets its sights on an ambitious goal: to reach VND 1 quadrillion in total assets by 2026. This bold target underscores SHB’s commitment to solidifying its position in the domestic financial market while expanding its regional presence. As SHB forges ahead, it stands as a proud partner in the nation’s journey towards a new era of prosperity and progress.