According to Clause 2, Article 1 of the Law on Amending and Supplementing the Law on Health Insurance 2024, the health insurance contribution rate is determined as a percentage of the salary basis for compulsory social insurance as prescribed by the Law on Social Insurance, retirement pension, allowance, or reference level (replacing the current regulation based on the basic salary level).

This means that instead of being based on the basic salary level as it is now, from July 1, 2025, the government will base it on the reference level.

According to Article 14 of the Law on Health Insurance 2008, amended and supplemented by Clause 12, Article 1 of the Law on Amending the Law on Health Insurance 2024, the salary, wages, and allowances used as the basis for health insurance contributions are prescribed as follows:

(1) For employees subject to the State-regulated salary regime, the basis for health insurance contributions shall be the monthly salary according to the rank, rank, military rank, and the allowances for the position, seniority, and professional seniority, if any.

(2) For employees receiving salaries and wages as prescribed by the employer, the basis for health insurance contributions shall be the monthly salary and wages specified in the labor contract.

(3) For those receiving retirement pensions, allowances for loss of working capacity, or unemployment benefits, the basis for health insurance contributions shall be the monthly retirement pension, allowance for loss of working capacity, or unemployment benefit.

(4) For subjects not mentioned in (1), (2), and (3), the basis for health insurance contributions shall be the reference level.

(5) The maximum monthly salary for calculating health insurance contributions is 20 times the reference level.

Health Insurance Contribution Rates for Different Groups from July 1, 2025

Clause 11, Article 1 of the Law on Amending and Supplementing the Law on Health Insurance 2024 amends and supplements Article 13 of the Law on Health Insurance 2008, detailing the contribution rates and responsibilities for health insurance. Specifically:

Contribution Rates Paid by Employers or Employees or Shared Between Them

(1) A maximum of 6% of the monthly salary, with the employer contributing 2/3 and the employee contributing 1/3

Applicable subjects: Subjects specified in points a, c, d, and e, Clause 1, Article 12 of the Amended Law on Health Insurance 2024

– Employees working under an indefinite-term labor contract or a fixed-term labor contract with a term of at least one month…

– Foreign employees working in Vietnam under a fixed-term labor contract with a term of at least 12 months with an employer in Vietnam…

– Employees working under an indefinite-term labor contract or a fixed-term labor contract with a term of at least one month…

– Officials, civil servants, public employees…

(2) A maximum of 6% of the monthly salary basis for compulsory social insurance, paid by the subject

Applicable subjects: Subjects specified in point b, Clause 1, Article 12 of the Amended Law on Health Insurance 2024

– Enterprise managers, controllers, representatives of state capital, and representatives of enterprise capital as prescribed by law;

– Members of the Board of Directors, General Directors, Directors, members of the Supervisory Board or supervisors, and other elected managerial positions of cooperatives and cooperative alliances as prescribed by the Law on Cooperatives, who do not receive salaries;

(3) A maximum of 6% of the monthly salary basis for compulsory social insurance, paid by the subject

Applicable subjects: Owners of business households with registered business activities who are subject to compulsory social insurance according to the law on social insurance (point d, Clause 1, Article 12 of the Amended Law on Health Insurance 2024)

(4) A maximum of 6% of the reference level, with the employer contributing 2/3 and the employee contributing 1/3

Applicable subjects: Non-specialized collaborators at the commune level as prescribed by law (point g, Clause 1, Article 12 of the Amended Law on Health Insurance 2024)

(5) A maximum of 6% of the monthly salary, with the contribution rate determined by the Government

Applicable subjects: Military personnel and public employees in the military; public security personnel in the public security force; personnel working in the cryptographic sector as prescribed by the Law on Cryptography (point h, Clause 1, Article 12 of the Amended Law on Health Insurance 2024)

(6) A maximum of 6% of the reference level, with the contribution rate determined by the Government

Applicable subjects: Family members of military personnel and public employees in the military; family members of public security personnel in the public security force (point i, Clause 1, Article 12 of the Amended Law on Health Insurance 2024).

Contribution Rates Paid by the Social Insurance Agency

(1) A maximum of 6% of the retirement pension or allowance for loss of working capacity

Applicable subjects: Subjects specified in point a, Clause 2, Article 12 of the Law

(2) A maximum of 6% of the reference level

Applicable subjects: Those receiving monthly retirement pensions or allowances for loss of working capacity (subjects specified in points b and c, Clause 2, Article 12 of the Law)

(3) A maximum of 6% of the unemployment benefit

Applicable subjects: Those receiving unemployment benefits (subjects specified in point d, Clause 2, Article 12 of the Law)

Contribution Rates Paid by the State Budget and Contribution Support

(1) A maximum of 6% of the monthly salary, paid by the state budget

Applicable subjects: Subjects specified in point a, Clause 3, Article 12 of the Law:

– Officers of the People’s Army, professional soldiers, officers and non-commissioned officers of the professional cadre in the People’s Public Security, and those working in the cryptographic sector who receive salaries like military personnel.

(2) A maximum of 6% of the reference level, paid by the state budget

Applicable subjects: Subjects specified in points b, c, d, d, e, g, h, i, k, l, m, o, p, q, r, s, t, and u, Clause 3, Article 12 of the Law, such as:

– Non-commissioned officers and soldiers of the People’s Army who are in active service; non-commissioned officers and soldiers in the People’s Public Security; military, public security, and cryptographic students who receive allowances and are Vietnamese citizens;

– Military, public security, and cryptographic students who receive allowances and are foreign nationals;

– Military academy students training to become reserve officers for at least three months who have not yet participated in social insurance and health insurance;

– Full-time militia members;

– Individuals with meritorious services to the revolution as prescribed by the Ordinance on Preferential Treatment for Individuals with Meritorious Services to the Revolution; former revolutionary fighters;

(3) A maximum of 6% of the reference level, paid by the state budget through the agency, organization, or unit granting the scholarship

Applicable subjects: Subjects specified in point n, Clause 3, Article 12 of the Law

Foreign nationals studying in Vietnam and receiving scholarships from the state budget of Vietnam.

(4) A maximum of 6% of the reference level, with the subject contributing and the state budget providing partial support

Applicable subjects: Subjects specified in Clause 4, Article 12 of the Law:

The group receiving contribution support from the state budget includes:

– Individuals from near-poor households;

– Students;

– Individuals participating in ensuring security and order at the grassroots level;

– Individuals from agricultural, forestry, aquatic, and salt-making households with a medium living standard as prescribed by law;

– Village health workers, village midwives…

Contribution Rates for Household or Individual Participants

Contribution Rate: A maximum of 6% of the reference level

Applicable subjects: Subjects specified in Clause 5, Article 12 of the Law, such as:

The group paying health insurance contributions by themselves includes:

– Individuals from households participating in health insurance in the form of household participation;

– Individuals living and working or being cared for in charitable and religious organizations;

– Employees during their unpaid leave or temporary suspension of labor contracts;

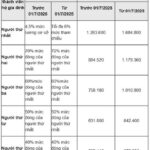

For household members participating in health insurance together in the same financial year, the contribution rates shall be reduced as follows:

– The first person contributes a maximum of 6% of the reference level;

– The second, third, and fourth persons contribute 70%, 60%, and 50%, respectively, of the contribution of the first person;

– From the fifth person onwards, the contribution rate is 40% of the first person’s contribution.

“Understanding Health Insurance Contributions for Families: Updates as of July 1st, 2025”

From July 1st, 2025, there will be changes to the basis for household health insurance contributions (referencing the new base salary level) and an increase in the maximum contribution amount for each family member.