F88 Joint Stock Business Company (F88) has successfully secured a $30 million USD (approximately VND 780 billion) funding agreement with Lendable, an international financial organization headquartered in London, UK. The loan provided by Lendable to F88 has a three-year term.

Previously, Lendable has supported F88 multiple times in 2022 and 2023 with limits ranging from $5 to $10 million USD. With this new $30 million USD loan, the total funding provided by Lendable to F88 has reached nearly $70 million USD.

According to F88’s representative, the new loan from Lendable will be utilized to boost business operations, expand its scale, and work towards achieving its goals of a 30% revenue growth and a 30% increase in total customers in 2025.

The Q1/2025 financial report demonstrates F88’s consistent growth over five consecutive quarters. In the first three months of this year, F88 disbursed VND 3,284 billion (a 25% increase compared to the same period last year), achieved VND 820 billion in revenue (a 21.5% increase), and recorded a 204.2% surge in pre-tax profit, reaching VND 132 billion. Projections for Q2/2025 indicate a 5%-10% increase in loan balances and disbursements, along with a 20% rise in pre-tax profit compared to Q1.

On May 6, 2025, the State Securities Commission of Vietnam (SSC) confirmed that F88 Investment Joint Stock Company (F88) met the requirements to become a public company under the Securities Law. As a result, the company has 30 days to register for trading its shares on the UPCoM exchange, marking the first step towards official listing on Vietnam’s stock exchange.

Lendable is a provider of debt capital to fintech companies across frontier and emerging markets, aiming to enhance financial inclusion for underserved populations with limited access to banking services. The organization finances fintech companies specializing in consumer credit, lending to micro, small, and medium-sized enterprises (MSMEs), purchasing production tools, payments, remittances, and digital markets. Headquartered in London, Lendable currently operates in 17 countries and territories worldwide.

“OCB Prepares to Issue Over 197 Million Shares, Boosting Chartered Capital to VND 26,631 Billion”

“Orient Commercial Joint Stock Bank (HOSE: OCB) has unveiled plans to boost its charter capital in 2025 through a private placement of shares to existing shareholders, utilizing its owner’s equity. This strategic move underscores OCB’s commitment to strengthening its financial position and fueling future growth.”

“Steady Growth and Effective Risk Management: Nam A Bank’s Path to Success in 2024”

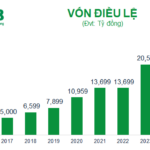

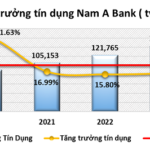

As of the end of 2024, Nam A Bank (HOSE: NAB) reported impressive growth in its business performance. The bank witnessed a significant expansion in its scale of operations, coupled with enhanced asset quality. Notably, the bank’s indicators for mobilization and credit outstanding balances demonstrated remarkable effectiveness, reflecting the bank’s strong performance and strategic success.

First Quarter of FY 2024-2025: TTC AgriS Reports Positive Financial Results, with a Threefold Increase in Revenue.

The Ho Chi Minh City-listed TTC AgriS (HOSE: SBT) kicked off FY 2024-2025 on a positive note, with robust operational performance and a threefold increase in revenue from its FBMC segment, underpinned by improved gross profit margins.

“KienlongBank Reaps 552 Billion VND Profit in H1 2024, Achieving 69% of Annual Target”

KienlongBank (UPCoM: KLB) has released its consolidated mid-year financial report for 2024, offering a glimpse into its promising financial trajectory. The report underscores the bank’s robust performance and its ambitious strategy for comprehensive digitization by 2025, marking a pivotal moment in its 30-year journey.