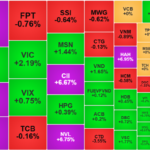

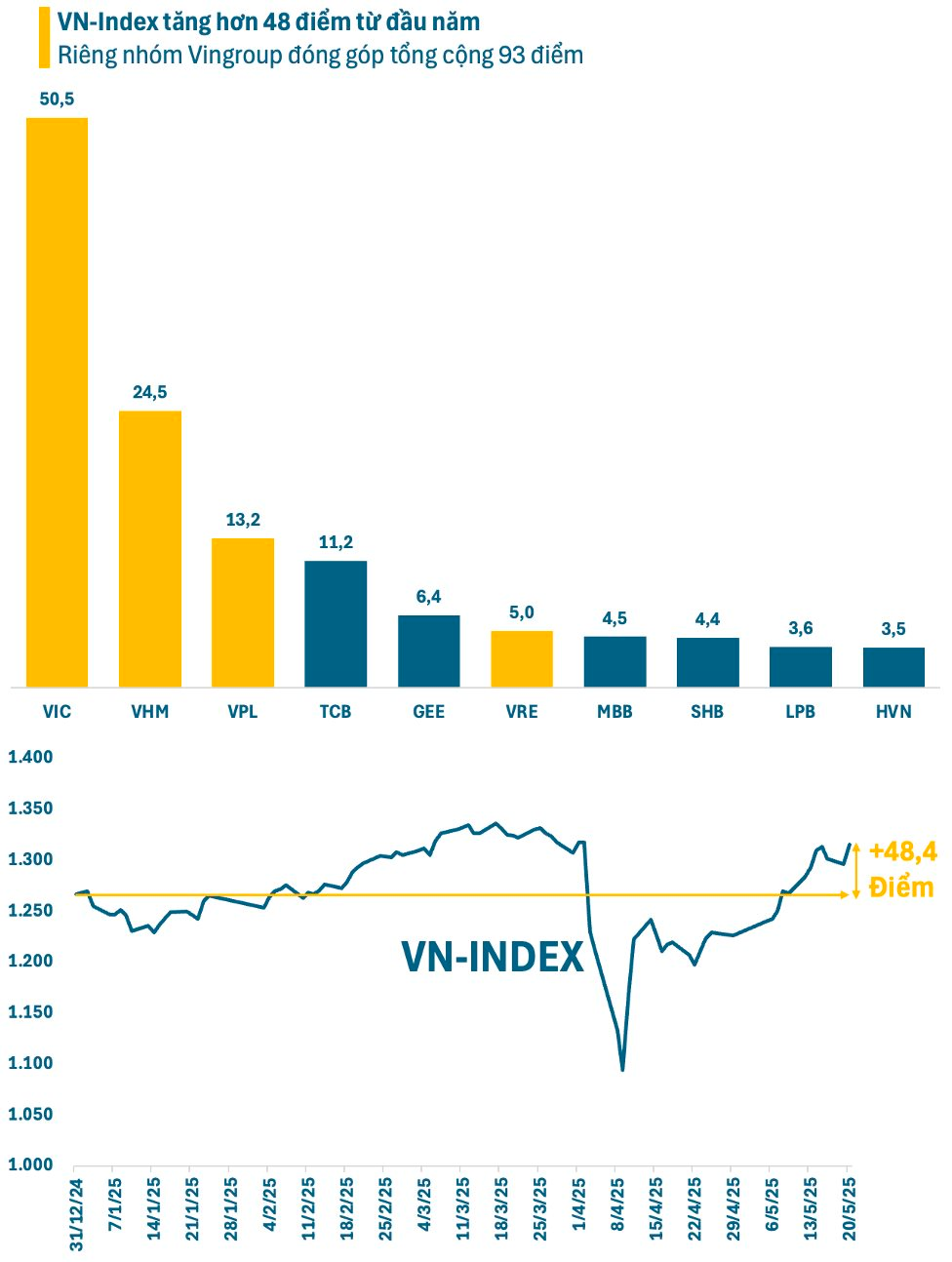

The stock market has just witnessed a strong surge with the leading role played by the Vingroup stock. The VN-Index gained nearly 19 points, thereby recovering all the losses after the tariff shock. Notably, just four stocks, VIC – Vingroup, VHM – Vinhomes, VRE – Vincom Retail, and VPL – Vinpearl, contributed almost 11 points to the index’s gain on May 20.

It is no stranger to investors that the Vingroup stocks have been carrying the VN-Index in recent times. Since the beginning of the year, these four stocks, VIC, VHM, VRE, and VPL, have contributed a total of more than 93 points to the VN-Index, while the index has increased by less than 50 points (~4%). These stocks have all skyrocketed recently.

As of this year, VIC’s market price has surged by 125%, reaching a 40-month high. During the same period, VHM has risen by 57%, attaining its highest level since August 2023; VRE has climbed over 47%, marking its highest point since March last year. The “newcomer” VPL, which just debuted in mid-May, has also rapidly increased by nearly 40%.

The soaring stock prices have propelled the market capitalization of the “Vingroup family” to new heights. The combined market capitalization of Vingroup, Vinhomes, Vincom Retail, and Vinpearl now stands at nearly VND 850 trillion, accounting for 15% of the total capitalization on the HoSE. With such a significant weightage, the fluctuations of these stocks considerably influence the VN-Index. Some investors worry that when the Vingroup stocks cool down, the market may be affected.

However, many experts believe that the market still has ample room for growth. Mr. Nguyen Viet Duc, Director of Digital Business at VPBank Securities (VPBankS), opined that since 2022, the market has been in an upward trend and has not experienced a 20% decline at any point. Nonetheless, the growth rate is the lowest in history (only 38%) as the economy has not met expectations.

The VPBankS expert presented two scenarios for the Vietnamese stock market. In the first scenario, the market will pause its upward momentum and enter a corrective phase. However, the second scenario suggests that with the current growth rate of only about 38%, which is significantly lower than previous bull market cycles that typically witnessed increases of over 100%, there is still considerable upside potential, estimated to be at least 70%. This would correspond to the VN-Index reaching 1,900 – 2,000 points.

Even more optimistically, Mr. Petri Deryng, the head of Pyn Elite Fund, stated in a report earlier this year that the fund’s long-term target for the index remains unchanged at 2,500 points. This target is based on the expectation of strong earnings growth over the next 2 to 3 years and a market P/E valuation of 16.

According to Pyn Elite Fund’s calculations, with Vietnamese-listed companies maintaining strong earnings growth in 2025, the market’s P/E ratio will drop to 10.1. The fund believes that the risk of a price decline, which investors feared last fall, is no longer an issue, and the focus will shift to the robust earnings growth of Vietnamese-listed companies and their extremely attractive corresponding valuations in the market.

Sharing a similar viewpoint, a report by SGI Capital in early May assessed that, after three years, many listed companies continue to grow their profits and consistently accumulate intrinsic value, but their stock prices are still not reflecting these changes. As a result, the P/E and, more notably, the P/B ratios are currently at historically low levels. The market valuation is much more attractive than in previous 1200-point milestones.

SGI Capital emphasized that, in investing, a low valuation is a prerequisite for ensuring low risk and high returns. The 1200-point threshold of the VN-Index has now become a robust support level. Compared to other asset classes, stocks are once again becoming a more appealing investment channel in terms of risk/return correlation.

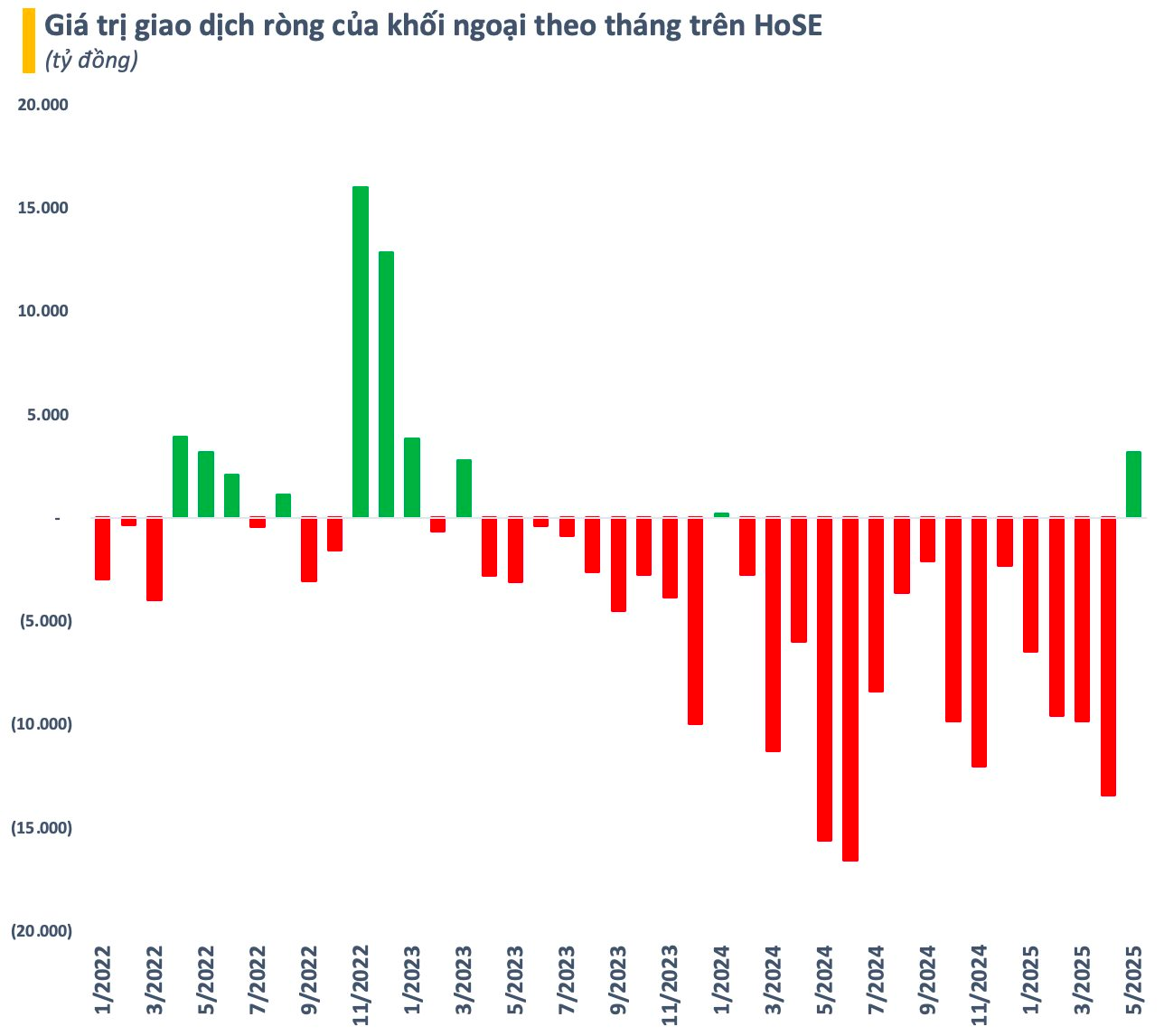

Notably, foreign investors have resumed net buying since the beginning of May (valued at over VND 3,000 billion) after a prolonged period of net selling. Although it is too early to confirm a reversal in foreign capital flows, the recent actions of foreign investors indicate optimistic signals, especially with the prospect of an upgrade becoming increasingly clear.

VPBankS’ expert opined that the Vietnamese stock market is at a very attractive point and could continue to rise. Firstly, the market valuation is not expensive. Secondly, profit growth in the past quarters has not been high, avoiding a FOMO situation. Thirdly, macroeconomic factors continue to support the economy. “Therefore, it is reasonable for foreign investors to return to net buying at this time. If they don’t come back now, it’s unclear when they will,” the expert emphasized.

According to several assessments, Vietnam’s stock market could receive an announcement of approval for an upgrade to emerging market status by FTSE Russell in September 2025, and MSCI is considering including it in the watchlist in June 2025. The MSCI reclassification will take more time as it depends on achieving a comprehensive and sustainable solution related to foreign ownership limits in the stock market.

According to a report by BSC Research in March, foreign investors will engage in net buying two to four months before FTSE releases the acceptance announcement (T0) and the start of the transition period (T1). For MSCI, foreign investors act earlier, four to five months in advance, due to the larger size of the reference funds and the more significant impact of MSCI compared to FTSE Russell.

To attract the substantial foreign capital inflows, bank stocks (with available room) and the “Vingroup family” stocks are considered to have better opportunities due to their scale advantage. Moreover, the significant waves in Vietnam’s stock market have often been driven by these two groups of stocks because of their higher weightage in the index basket compared to the rest of the market.

“Vinfast VF 9: An Impressive Alternative to the Prado and Explorer?”

VinFast VF 9 has made a remarkable impression on Vu Ngoc Hai, who was so enamored with its performance that he purchased three of these vehicles. The impressive capabilities of the VF 9 have led Hai to recognize its potential for both his business and family needs.

“Vingroup to Complete Top 10 Global Exhibition Center in Record Time: 10.5 Months”

Vingroup is set to break records with its ambitious plan to construct a world-class exhibition center, aiming for a top 10 global ranking, in an unprecedented 10.5-month timeline.

The Great Divide: Mid-Range Stocks on the Rise

The money flow showed a shift towards mid- and small-cap stocks in the afternoon session, with many of these stocks witnessing a sharp rise in prices. While the large-cap VN30 stocks still hold the majority weight on the HoSE exchange, it is the smaller stocks that are currently the main attraction for individual investors.