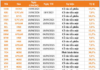

2 Sessions

3 Sessions

4 Sessions

5 Sessions

High-Frequency Trading

– 06:58, September 3rd, 2025

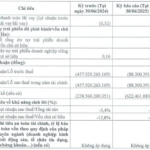

The Top Stocks to Watch This Morning

“Uncover the stock market’s best-kept secrets with Vietstock’s insightful statistics. Witness the dramatic rise and fall of stock codes, as we unveil the top gainers and losers from recent trading sessions. Prepare to be intrigued as we present a captivating narrative of the market’s dynamics, offering a glimpse into the stories behind these intriguing numbers.”

The Top Stocks to Watch This Morning: August 28th

“Unveiling the movers and shakers of the stock market, this list showcases the top-performing and worst-performing stock codes from recent sessions. These stocks have experienced significant volatility, capturing the attention of investors and traders alike. As we delve into this list, we uncover the stories behind these codes, revealing the potential opportunities and pitfalls that lie within.”

The Top Stocks to Watch at the Start of the Trading Day on August 26th

“Uncover the stock market’s best-kept secrets with Vietstock’s insightful statistics. Witness the dramatic rise and fall of stock codes, as we unveil the top gainers and losers from recent trading sessions. Prepare to be intrigued as we present a captivating narrative of the market’s dynamics, offering a glimpse into the stories behind these intriguing numbers.”

The Top Stocks to Watch at the Start of the 20/08 Trading Session

The stock market is a dynamic and ever-changing landscape, and keeping track of the biggest movers is crucial for investors. This introduction paragraph aims to provide a snapshot of the Vietnamese stock market’s recent performance by highlighting the top gainers and losers, as per Vietstock’s statistical insights.