Specifically, during the May 19 session, AFC Vietnam Fund purchased 65,700 EVE shares (of Everpia Joint Stock Company), increasing its holdings to over 5.1 million shares, equivalent to 12.15%.

| EVE share price movement from the beginning of 2024 to the session on May 23, 2025 |

This increase in ownership took place as EVE shares had recovered approximately 18% from their low on April 9 but were still trading around their lowest level in the past year.

On the opposite side, HDCapital sold a total of nearly 5.2 million FCN shares (of FECON Joint Stock Company) between May 15 and May 22. After the transaction, their holdings decreased from 11.18% to 7.88%, equivalent to over 12.4 million shares.

| FCN share price movement from the beginning of 2024 to the session on May 23, 2025 |

Based on the average closing price of FCN shares during this period, HDCapital is estimated to have raised over VND 75 billion from this divestment.

In terms of price movement, FCN shares had recovered about 26% from their low on April 9 during the period when HDCapital was selling, returning to the VND 14,000/share level – equivalent to the price at the beginning of 2025. However, compared to the peak set on February 21, the share price has adjusted approximately 12%.

Source: VietstockFinance

|

– 07:28 25/05/2025

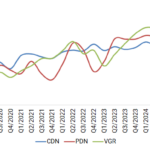

Q1 2025: A Bustling Port as Trade Surges Ahead of Tariff Changes

In early 2025, prior to the announcement of retaliatory tariffs by the US, port operators witnessed a bustling start to the year, buoyed by continued growth in cargo volumes passing through their facilities.

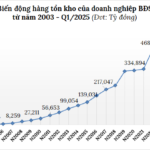

The Housing Bubble: A Ticking Time Bomb?

The Vietnamese real estate sector’s inventory picture as of Q1 2025 paints a telling tale, with a staggering figure of over VND 511 trillion, marking a 2% increase since the year’s outset. Notably, nearly a third of this substantial sum is attributable to Novaland, underscoring the significant role it plays in the country’s property landscape.

The Market Beat – 02/01: VN-Index Starts the Year on a Positive Note Despite Lackluster Liquidity

The market witnessed a rebound in the afternoon session, with the VN-Index recovering from 1,264 to 1,269.71. Meanwhile, the HNX-Index also gained 0.26 points to reach 227.69, while the UPCoM-Index dipped slightly by 0.01 points to 95.05. Overall, the liquidity of the three exchanges was relatively low, slightly exceeding 12 trillion VND.