As negotiations between Vietnam and the US regarding retaliatory tariff policies on Vietnamese exports unfold, BIDV Securities Company’s (BSC) Q2 2025 industry report highlights potential stock groups that could benefit from post-tariff stimulus policies.

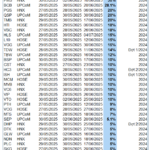

Group Benefiting from Government Stimulus and Support Policies:

According to BSC, the government will accelerate public investment disbursement for road and railway infrastructure projects. Companies that could benefit from this include VHM, HPG, DXG, TCH, DPG, VCG, HHV, CTD, and ELC.

PVB, PVS, and GAS are expected to gain from the accelerated implementation of energy and oil and gas projects.

FRT, MWG, MSN, ACV, HVN, VJC, and VRE are poised to benefit from policies promoting consumption, tourism, and visa waivers.

The policy on private sector development, Resolution 68-TW, is expected to impact companies such as VHM, VIC, VRE, MSN, Viettel, and GEX.

In the financial sector, relaxed monetary policies and increased capital supply to the economy may favor banks like BID, CTG, VCB, ACB, HDB, MBB, TCB, and VPB.

Group Benefiting from Vietnam’s Increased Imports from the US:

BSC’s report also identifies companies that could benefit from Vietnam’s increased imports from the US.

DBC and BAF are expected to reduce input costs by importing more from the US.

Importing fuel, LNG, and aircraft from the US is anticipated to benefit GAS, POW, NT2, HVN, and VJC.

Additionally, lower oil prices, which positively impact the fertilizer, plastic pipe, and logistics industries, may favor companies like DPM, DCM, BMP, NTP, HVN, and VJC.

Neutral Group – Minimal Impact/Relevance to Exports to the US:

Alongside the direct beneficiaries, BSC also draws attention to neutral companies with low exposure to US export fluctuations. These include businesses with low US export market share or those focused on other markets, such as ANV, IDI, FMC, DGC, DPM, and DCM, as well as technology and digital transformation enterprises, notably FPT.

Defensive Stock Group with High Cash and Dividend Payout: VEA, VNM, QTP, QNS, NT2, PAT, PVS, BMP, DPM, SCS, and SLS are among the defensive stocks known for maintaining high cash reserves and offering attractive dividend payouts.

For high-risk investors, BSC points to a group of stocks impacted by tariffs but currently trading at a significant discount: TNG, VHC, MSH, DRC, CSM, PTB, IDC, SZC, KBC, BCM, and more.

“VIX Brokerage Aims for 1.8X Profit Growth in 2025”

On May 23, 2025, the Annual General Meeting of Shareholders of VIX Securities Joint Stock Company (VIX) approved an ambitious profit target, aiming for an 180% increase compared to the previous year’s performance. VIX attributes this bold growth strategy to its focus on high-quality human resources and cutting-edge technology as the key pillars for success in the coming year.

The Billion-Dollar Steel Project: Unveiling the Latest Developments and Construction Timeline for Xuan Thien’s Nam Dinh Mega-Venture

With an impressive track record, the Xuan Thien Group has made significant strides in their ambitious Steel Complex project. The group’s efficient land clearance efforts for the three complexes have yielded positive results, paving the way for the next phase. Confident in their achievements, the developers have proposed commencing construction on two projects before June 17th, marking a pivotal moment in this endeavor.

The Northern Star: Vân Đồn’s Economic Renaissance

Once a quiet island region nestled in the Bai Tu Long Bay, Van Don is now poised for a strategic transformation. Located in the northeastern part of the country, this area is no longer just a vacation destination but is being shaped into a coastal economic zone in the north during the 2025-2030 phase.

Vlasta – Thủy Nguyên: The Ultimate Magnet for Top-Tier Agents

In the heart of the new Haiphong, Vlasta – Thuỷ Nguyên makes a spectacular entrance with a vibrant launch and an array of special offers. Unveiling an extraordinary opportunity with a grand debut, Vlasta offers a once-in-a-lifetime chance to win a European vacation worth 200 million VND, along with incredible discounts of up to 7% and an attractive interest rate support package for 24 months.