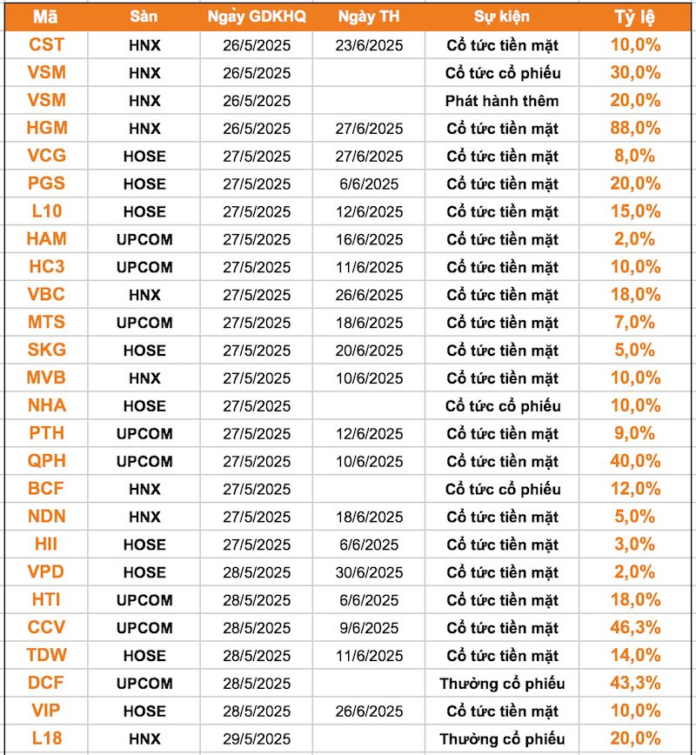

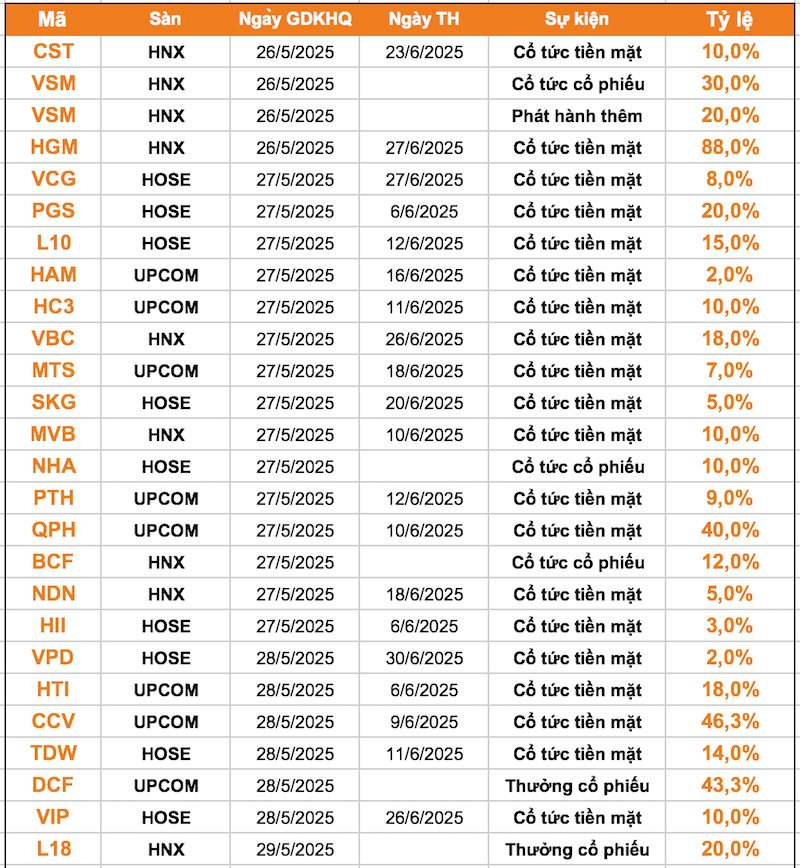

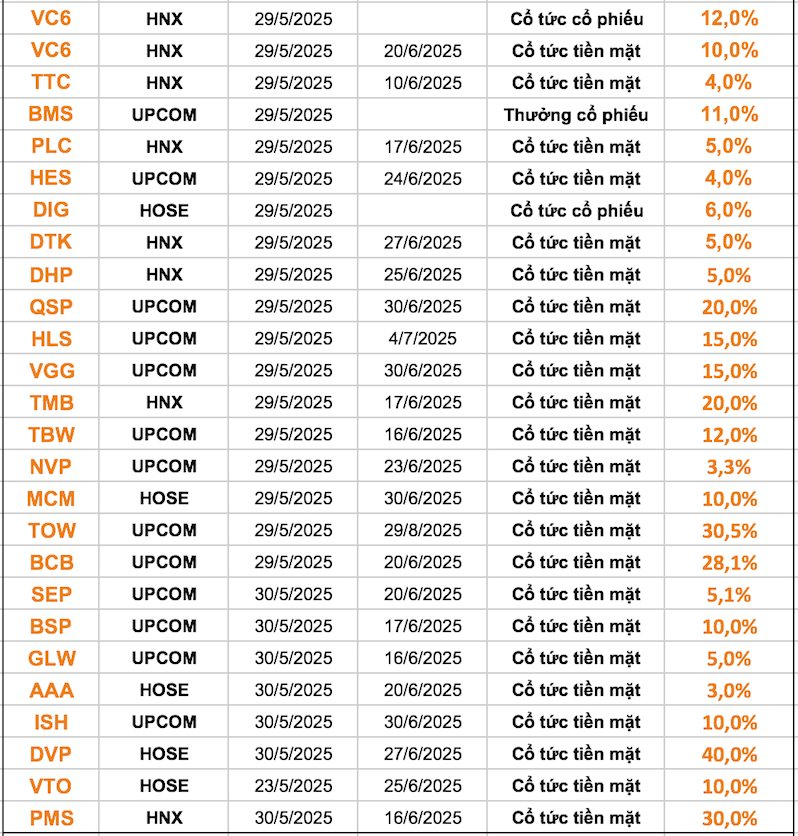

According to statistics, 50 enterprises announced dividend record dates for the week of May 26-30, with 41 enterprises paying cash dividends. The highest rate was 88%, and the lowest was 2%.

In addition, three enterprises paid stock dividends, three issued bonus shares, and two paid mixed dividends.

Hanoi Mineral and Mechanical Joint Stock Company (code: HGM) announced an interim dividend for the third time in 2024. On May 27, the company will finalize the list of shareholders eligible for an 88% cash dividend, equivalent to VND 8,800 per share. The expected payout date is June 27.

Previously, the company had made two interim dividend payments for 2024: the first in late November 2024, with a rate of 20%, and the second in late March 2025.

On May 29, Vietnam Industrial and Urban Construction Consulting Joint Stock Company (code: CCV) will finalize the list of shareholders eligible for a 2024 cash dividend with a rate of 46.3%. This equates to VND 4,630 per share, with a projected payment date of June 9.

With 1.8 million shares in circulation, CCV will need to spend over VND 8.3 billion on this dividend payment. The company’s shareholder structure shows that Vietnam Construction Consulting Corporation – Joint Stock Company (code: VGV) is the parent company, holding 51% of the capital and expected to receive more than VND 4 billion.

Construction Investment and Development Joint Stock Corporation (DIC Corp, code: DIG) announced a plan to issue shares to pay 2024 dividends at a rate of 6%.

On May 30, DIC Corp will finalize the list of shareholders to receive 2024 dividends at a rate of 6% in shares. This means that for every 100 shares owned, shareholders will receive 6 new shares.

With 609.85 million shares in circulation, DIC Corp is estimated to issue a total of more than 36.59 million new shares in this dividend payment.

Tra Noc – O Mon Water Supply Joint Stock Company (code: TOW) has just announced a record date for cash dividends for 2024 with a record-high rate. The ex-rights date is May 29, 2025.

Accordingly, the dividend will be paid at a rate of 30.5% (equivalent to VND 3,050/share). With nearly 8 million shares in circulation, TOW is expected to spend more than VND 24 billion on this dividend payment. The expected payment date is from August 29, 2025.

On June 2, Petroleum Mechanical Joint Stock Company (code: PMS) will finalize the list of shareholders for a 2024 cash dividend, with a rate of 30% (VND 3,000 per share). The expected payment date is June 16, 2025.

With 7.2 million shares in circulation, Petroleum Mechanical Joint Stock Company will have to spend about VND 22 billion on this dividend payment.

“MWG’s Fearless Leader: Confident in Strategy Execution, Dishing Out Cash Dividends and Buying Back Shares”

Let me know if you would like me to continue crafting captivating content for your website or advertisement!

“The restructuring process has fortified our core strengths, making us more agile and resilient in the face of market fluctuations,” emphasized the CEO of MWG.

The Foreign Shareholder Becomes a Major Stakeholder in PNJ

“T. Rowe Price Associates, Inc., a prominent foreign shareholder, has successfully acquired nearly 1.24 million PNJ shares. This strategic move has increased their ownership stake to 5.18%, solidifying their position as a major shareholder in PNJ. With this substantial investment, T. Rowe Price Associates, Inc. is now a pivotal player in the company’s future trajectory.”