Petrolimex Shuts Down its Representative Office in Cambodia

The Vietnam National Petroleum Group (Petrolimex, HOSE: PLX) announces the cessation of operations and dissolution of its representative office in Cambodia after nearly 15 years of presence in the country.

According to Decision No. 449/PLX-QD-HQT, signed by Mr. Pham Van Thanh, Chairman of the Board of Directors, on May 20, 2025, the representative office in Cambodia will officially cease to exist as of June 1, 2025.

The decision was made based on a proposal from the Personnel-Salary-Wage Board and in accordance with current legal regulations, including the 2020 Enterprise Law and the Group’s internal resolutions. However, the decision did not specify the exact reasons behind the dissolution.

It is worth noting that Petrolimex established its representative office in Cambodia on August 2, 2010. The office was responsible for safeguarding the interests of Petrolimex, facilitating transactions, promoting the company’s image, conducting market research, and exploring business opportunities in the trade of goods and services related to petroleum with Cambodian partners.

This move by Petrolimex comes amid a backdrop of challenging business conditions and leadership changes at the top.

Earlier, on May 6, the Ministry of Finance decided to temporarily suspend Mr. Dao Nam Hai from his position as the state capital representative and General Director of Petrolimex, pending conclusions from authorized agencies. Simultaneously, the state capital managed by Mr. Dao Nam Hai was temporarily transferred to Mr. Pham Van Thanh, Chairman of the Board of Directors of the Vietnam National Petroleum Group.

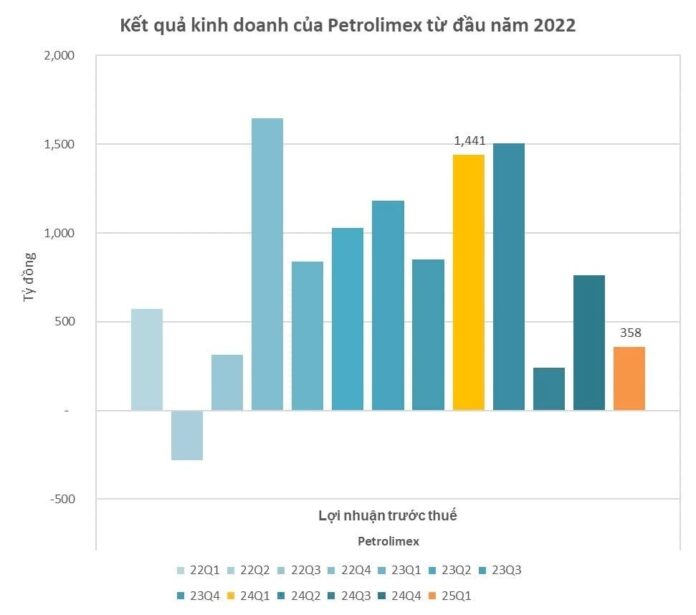

In terms of financial performance, Petrolimex reported consolidated revenue of nearly VND 67,900 billion in Q1 2025, a decrease of nearly 10% compared to the same period in 2024.

Despite the decline in revenue, selling and management expenses increased. Consequently, Petrolimex’s pre-tax profit stood at VND 358 billion, and after-tax profit was VND 211 billion, an 81% drop compared to the previous year. This is the second-lowest profit level in the last ten quarters.

For 2025, Petrolimex has set conservative business plans. Specifically, consolidated revenue is expected to decrease by 13% to VND 248,000 billion, and pre-tax profit is projected to decline by 19% to VND 3,200 billion. As of Q1, the company has achieved over 11% of its annual pre-tax profit target.

In the stock market, as of the trading session on May 23, PLX shares were priced at VND 34,350 per share, reflecting a decrease of nearly 23% compared to the beginning of March.

“Streamlining Business Operations: The Prime Minister’s Vision for a Digital Future”

Each year, a staggering 120 trillion VND is spent on administrative procedure compliance costs related to production and business operations.

The Annual Cost of Administrative Procedures Compliance Exceeds 120 Trillion Dong

According to statistics, the annual cost of administrative procedures compliance amounts to a staggering 120 thousand billion VND. In light of this, the Prime Minister has issued an urgent directive to review, streamline, and simplify administrative procedures related to production and business activities. The goal is to reduce the time, cost, and conditions for business operations by at least 30% each in 2025.

Streamlining Business Operations: Prime Minister Pushes for 100% Online Procedures

Let me know if you would like me to tweak it further or provide additional suggestions!

“The Prime Minister mandates a seamless, streamlined, and efficient online process for all business-related administrative procedures, aiming for 100% digitalization. This initiative strives to reduce red tape and enhance transparency, ensuring a smooth and effective experience for businesses.”

A Transformational Year for PGBank: Rising to New Heights

In 2025, PGBank aims to build on its transformative progress in 2024 and forge ahead with robust, efficient, and sustainable growth. This ambitious goal will be achieved through a continued focus on process optimization, strategic expansion, vigorous brand-building, and enhancing the customer experience.