The formation of a megacity by combining Ho Chi Minh City, Binh Duong, and Ba Ria-Vung Tau will create a powerful economic hub with significant competitive advantages, not only in Vietnam but also in Southeast Asia. This megacity will maximize the natural advantages, geographical location, and infrastructure of the three localities.

Savills experts evaluate that the adjacent locations and well-connected transportation systems among the three localities facilitate more convenient and efficient economic and urban planning. The expanded land area accommodates strategies for population dispersal, the development of satellite cities, and the construction of new modern urban areas. Additionally, the synchronization of transportation infrastructure, especially road, waterway, and seaport systems, will enhance regional connectivity and improve logistics capabilities.

“Planning on a larger land area after the merger will provide more flexibility for new planning decisions, shaping future infrastructure and residential areas. This helps address population dispersal and unlocks new housing supply. However, these areas need to ensure good accessibility to the city center to attract genuine residential demand. At the same time, there should be a strategy to develop new infrastructure and attract investors to these areas,” said Giang Huynh, Director of Research and Consultancy, Savills Ho Chi Minh City.

The “time has come” for Binh Duong’s real estate market.

With strong real demand, well-developed infrastructure, accelerated policies, and appropriate supply, the Binh Duong real estate market has always been of great interest to the market. According to batdongsan.com.vn, last year, this market witnessed stable transactions, with apartments leading the expected growth. Binh Duong ranked second in the country in terms of immigration rate, with a rate of over 26%. It is Vietnam’s leading industrial center with 38 industrial parks, with an occupancy rate of more than 87%, and 12 industrial clusters with an occupancy rate of over 67%.

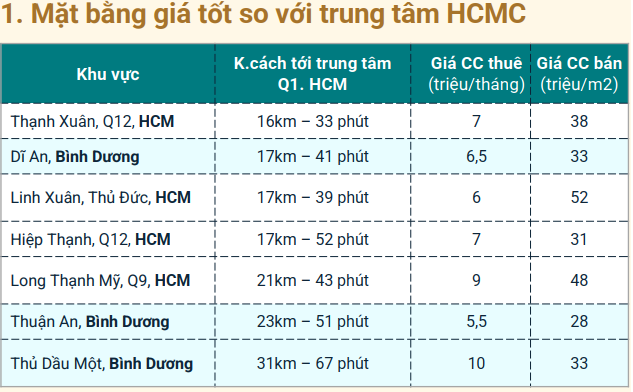

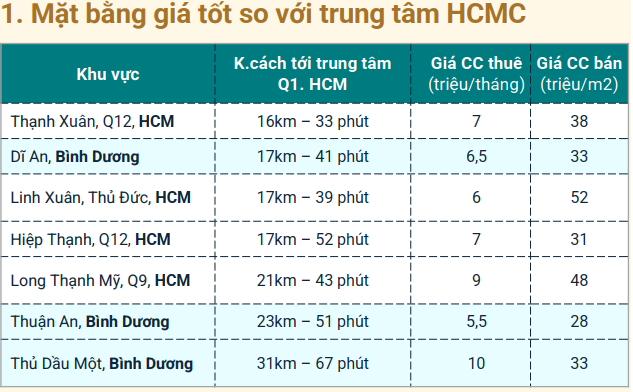

Especially, apartments in the center of Binh Duong have a higher growth potential compared to districts on the outskirts of Ho Chi Minh City.

Source: batdongsan.com.vn

|

Statistics from batdongsan.com.vn show that in the past 10 years, real estate prices in Binh Duong have increased by 700%, the highest compared to other provinces adjacent to Ho Chi Minh City. The level of interest in Binh Duong real estate in March 2025 recorded an impressive growth of 49% compared to February 2025. This was the highest increase among the peripheral areas of Ho Chi Minh City, indicating the continued attractiveness of this market due to infrastructure factors, large supply, and potential for price increases. This is also influenced by the information about the provincial merger.

In the first quarter, apartments in Binh Duong had selling prices increase by 12-15% compared to the same period last year. Thu Dau Mot had the highest increase of 14%, averaging about VND 55 million/sqm, ranging from VND 35-67 million/sqm. Next is Thuan An, with an increase of nearly 13%, averaging VND 51 million/sqm. Di An increased by more than 12%, averaging VND 39-45 million/sqm.

The emergence of some high-end supply in the area has pushed up the average apartment price in Binh Duong. Many large investors have launched high-end projects such as TBS Group with Green Tower, CapitaLand with Orchard Height, Le Phong, and Coteccons with Emerald 68, Phat Dat with La Pura, and Becamex Tokyu with Midori Park The Ten. Even Bcons has launched the high-end line Uni Valley…

In addition, the adjustment of the land price frame also creates pressure on project development costs, leading to higher apartment prices. The provincial merger and infrastructure development also affect psychology and attract attention.

Which price segment is the “hottest”?

The Binh Duong apartment market is quite diverse, but projects with prices around VND 2 billion, especially in prime locations, are becoming increasingly scarce.

According to many brokers, the price of VND 2 billion per apartment is considered suitable for most young families and middle-income earners. Buyers from Ho Chi Minh City’s neighboring provinces shared that they are looking for more spacious and airy living spaces but still easily and quickly commute to the city, so VND 2 billion apartments in Binh Duong are an attractive option.

On the other hand, the potential for price appreciation and rental returns is more favorable compared to high-end apartments.

However, with rising land prices and overall costs, the supply of VND 2 billion apartments in central locations is tending to decrease. Therefore, this segment is potential and often sells out quickly.

Di An and Thuan An, adjacent to Ho Chi Minh City, are the two apartment hubs that attract many buyers. Projects with prices below VND 30 million/sqm or below VND 2 billion/unit in these areas include The Gio Riverside, Picity Sky Park, The Felix, Diamond Boulevard, Phu Dong SkyOne, and Charm City…

After the successful introduction of the TT AVIO project, which sold out the AVIS tower, the Japanese joint venture will launch the ORION tower in June, which is expected to offer improved designs and more advanced utilities. This presents an opportunity to own a high-end apartment with flexible financial policies.

Mr. Nguyen Dinh Truong, CEO of the project development joint venture, shared that although the apartments are affordable, priced from VND 32 million/sqm, they are positioned as high-end products. With over 50 years of experience in real estate development, the Japanese joint venture carefully selects the land fund, location, legal aspects, design, construction, and handover standards.

Mr. Truong added that TT AVIO is offering a program where buyers only need to pay 30% of the apartment value to sign the sales contract. Subsequently, they can pay an interest-free installment of VND 9 million/month for two years until the apartment is handed over. After taking possession, buyers can start applying for bank loans and continue with the VND 9 million/month installment for the next five years. This payment schedule is considered affordable for most buyers. The joint venture aims to accompany young people, who may have modest initial savings but aspire to own a home. At the same time, it also helps investors maximize their profit margins with a modest initial capital outlay.

According to VARS experts, the merger of provinces and cities will positively impact the real estate market. The merger can streamline some legal procedures for project implementation, increase the supply of affordable housing, and provide more options for buyers to find reasonably priced homes. However, for real estate values to increase sustainably, there needs to be a synchronous development of transportation, economic, and social infrastructure, such as the opening of new major roads, metro lines, schools, or the ability to generate cash flow from rentals.

Areas with specific planning and ongoing infrastructure development or projects with modern and comprehensive investment and attractive policies to encourage residency will be safer choices than areas where prices are driven solely by merger rumors.

Thu Minh

– 07:07 26/05/2025

Neglecting Urban Planning Leads to a Two-Decade Wait for Homeowners to Receive Their Property Papers

Introducing the Riva Park 504 Nguyen Tat Thanh, the Tien Hung residential project, and the 9B4 – 9B8 residential project in Binh Hung: once slated for resettlement purposes, these projects have since been released to the market by the developers. However, buyers are still awaiting their pink booklets, which are yet to be issued.

Unveiling the Five-Star Property Experience: A Grand Office Opening and Brand Launch

On May 21, 2025, Five Star Property, a leading real estate company, inaugurated its head office at Home City, 177 Trung Kinh, Cau Giay, Hanoi. This momentous occasion marked the official launch of the Five Star brand and the beginning of its journey to becoming a trusted real estate development and project distribution consultant.

The Big Apple Rolls Out a Plan to End District-Level Operations

“Ho Chi Minh City leads the way with a strategic initiative: evaluating the performance of the district-level model. This evaluation will inform the development of tailored solutions for a refined two-tier local government structure.”