VN-Index is currently trading at 1,305.89 points, a decrease of 0.65%. The VN30 index, representing large-cap stocks, saw a deeper decline of 0.9%, settling at 1,396.73 points, indicating that the pressure mainly came from the blue-chip group. Meanwhile, the HNX-Index maintained a slight loss of just 0.07%, ending the day at 216.16 points. This differentiation was also evident in the capitalization-based indices: VS-LargeCap fell by 0.7%, and VS-MicroCap dropped by 0.78%, whereas VS-MidCap exhibited a gain of 0.2%, signaling that some mid-cap stocks are attracting capital inflows.

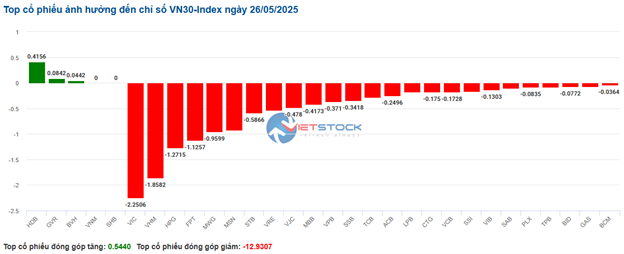

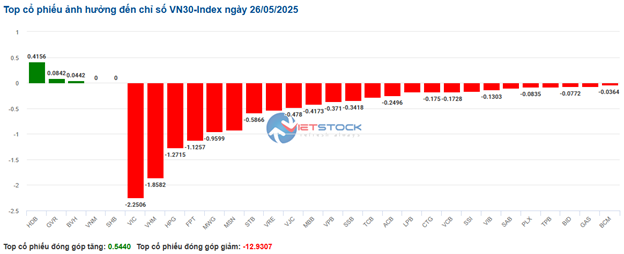

The VN30 basket witnessed a broad-based sell-off, with 25 tickers in the red, while only 3 advanced and 2 remained unchanged. The top positive contributors were HDB, adding 0.42 points, followed by GVR with 0.08 points, and BVH, contributing 0.04 points. Conversely, the major laggards were VIC, deducting 2.25 points, VHM with 1.86 points, HPG at 1.27 points, and FPT, shedding 1.13 points. The downward trend dominated the intraday price action.

Source: VietstockFinance

|

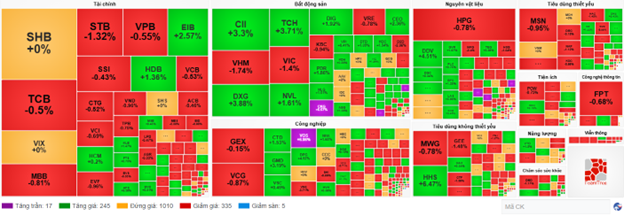

Assessing the sector landscape, the market endured substantial pressure from consumer services, which declined notably by 2.77%. The large-cap sectors couldn’t escape the bearish sentiment either: real estate dropped by 0.93%, credit institutions slipped by 0.58%, and financial services contracted by 0.72%.

On the flip side, certain sectors managed to stay in positive territory, with media and entertainment leading the pack, climbing by 1.35%, followed by insurance, which rose by 0.78%. Transportation also recorded a gain of 0.42%.

Specifically, the credit institutions sector (accounting for 29.84% of market capitalization) dipped by 0.58%, with many large-cap stocks facing selling pressure. Notable mentions include TCB, down 0.66%; MBB, decreasing by 0.81%; VPB, falling by 0.55%; CTG, losing 0.54%; and STB, declining by 1.20%…

Real estate (comprising 15.82% of market capitalization) contracted by 0.93%. Stocks like NVL dropped by 0.96%, DXG fell by 2.44%, KBC decreased by 1.93%, PDR slipped by 1.34%, TDC lost 1.87%, and LHG declined by 1.84%.

The food, beverage, and tobacco sector (making up 8.96% of market capitalization) dipped by 0.31%. Notable tickers include VNM, which fell by 0.60%, and MSN, decreasing by 0.14%.

Conversely, transportation (accounting for 7.23% of market capitalization) exhibited a relatively positive performance, advancing by 0.42%. While PHP slipped by 0.27%, other stocks in the sector likely supported the overall uptrend, such as VOS, which hit the upper circuit breaker, GMD, climbing by 3%, and VSC, ticking up by 0.23%…

As of 10:30 am, the market breadth reflected a clear differentiation, with over 1,000 stocks unchanged, indicating a prevalent wait-and-see attitude. On the bullish side, there were 17 stocks hitting the upper circuit breaker, along with 228 gainers. Conversely, 335 tickers traded lower, including 6 at the lower circuit breaker, reflecting existing selling pressure.

Source: VietstockFinance

|

Market Open: A Cautious Tone Sets In

Today’s trading session opened on a relatively positive note, with most major indices registering gains. While the VN-Index rose marginally, the indices on the HNX and UPCoM exchanges witnessed notable surges, indicating capital inflows into mid- and small-cap stocks. The VN-Index started the day with a modest increase of 0.03%, climbing to 1,314.89 points, reflecting the market’s cautious sentiment. In contrast, the HNX-Index displayed stronger upward momentum, advancing by 0.31% to reach 216.99 points.

The VN30 basket commenced with a dominant red hue. Market breadth revealed 18 declining stocks, outnumbering 11 gainers and 1 stock holding steady. On the supportive side, HDB contributed the most positively, adding 0.50 points of influence, followed by VNM with 0.37 points, SHB providing 0.22 points, and VPB chipping in with 0.13 points. Conversely, the main drags were large-cap stocks, with HPG being the most detrimental, deducting 1.01 points of influence, followed by VIC, which lost 0.81 points, MWG, shedding 0.64 points, and STB, slipping by 0.58 points. This price action reflected a cautious market sentiment from the get-go.

Overall, the stock market recorded a gain of 0.21% across 1,613 traded stocks. Sectors with significant weightings, such as credit institutions (accounting for 29.84% of market capitalization), maintained a slight increase of 0.10%, showcasing the stability of this pillar industry. Conversely, the real estate sector, with a 15.82% weighting, witnessed a 0.12% decline in its sectoral index. However, many large-cap and liquid real estate stocks advanced, including VHM, which rose by 1.02%, VIC, climbing by 1.08%, TCH, surging by 1.33%, NVL, ticking up by 0.40%, KBC, gaining 0.57%, and PDR, rising by 0.62%. This divergence within the sector was evident.

Several other sectors stood out with positive momentum, including media and entertainment, which led the gains with a 5.60% increase, specialized services and trading, climbing by 2.34%, and consumer durables and decorations, advancing by 1.20%. Within the consumer durables and decorations sector, stocks like GEE, up 2.46%, and GEX, rising by 2.67%, significantly contributed to the sector’s overall increase. The transportation sector also recorded a gain of 0.60%, with HAH, advancing by 1.14%, as a notable performer. The software sector, represented by FPT, which rose by 0.51%, also demonstrated stable growth.

The stock market opened at 9:30 am with a distinct differentiation. Notably, 1,146 stocks were unchanged, indicating a cautious sentiment. However, the number of gainers outnumbered decliners, with 294 stocks in the green and 13 at the upper circuit breaker, compared to 156 losers and 3 at the lower circuit breaker. This market breadth signaled positive undertones.

Nevertheless, after 9:30 am, selling pressure intensified, and the VN-Index plunged by over 25 points at one point, recovering to a loss of 15 points by 9:50 am.

– 10:35 26/05/2025

Expert Take: Stock-Picking Opportunities Wane as Cash Takes a Cautious Stance Ahead of Trade Talks Outcome

Let me know if you would like me to make any changes or modifications to this title.

The divergence among stocks may become more pronounced this week, as the lack of fresh supportive news may lead to a further distinction between strong and weak stocks. With limited positive catalysts, the ability to identify robust stocks becomes increasingly crucial, and cautious capital deployment is expected.

‘The Privileged Few’: A Tale of Stock Market Privilege

Mr. Nguyen Trong Minh, the son of former Ha Do Group’s Chairman, Nguyen Trong Thong, is planning to purchase 4 million HDG shares, amounting to over a hundred billion VND. Meanwhile, Mr. Le Viet Hieu, the son of Le Viet Hai – the Chairman of Hoa Binh Construction Group – will be investing approximately 3 billion VND to acquire 500,000 HBC shares.

The Capital is Calling: Over $73 Million Raised Last Week

The domestic institutional investors went on a buying spree, netting a purchase of 1,777.6 billion VND, with a remarkable 1,060.5 billion VND in matched orders alone.