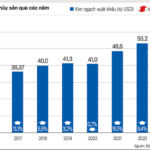

Vietnam Textile and Apparel Industry races to meet production targets before potential new US tariff policy takes effect – Illustrative image

|

Accelerating production to seize new orders

At the May workshop, Chairman of the Vietnam Textile and Apparel Association (Vinatex) – Mr. Le Tien Truong predicted that order opportunities would concentrate in the first half of the year, extending into Q3 2025. He emphasized: “Enterprises need to complete at least 2/3 of their annual profit plan during this period to prepare for possible fluctuations in the latter half of the year.”

Vinatex May Workshop – Image: Vinatex

|

In reality, before the 90-day deadline for the US tariff suspension ends (on July 10), many enterprises have accelerated production and renegotiated delivery schedules while also expanding into new markets to diversify risks.

General Director of May Duc Giang (Dugarco, MGG) – Mr. Pham Tien Lam shared that his company is taking advantage of the 90-day tariff suspension to export to the US. When negotiating tariff sharing, May Duc Giang displays flexibility based on the type of cooperation (FOB or CM) and the scale of the partnership to minimize costs.

Apart from the US, May Duc Giang has expanded into Australia and Japan, receiving positive signals from China as well. The company focuses on high-value-added customers to stabilize production and avoid price pressure. Orders are stable until the end of July, and they continue to receive orders for August and September.

Hoa Tho (HTG) has also adjusted its daily production to meet diverse delivery requirements from the US, with most orders requested to be delivered before July 10 to avoid tariffs. After this deadline, Hoa Tho witnessed a significant decrease in orders for August and beyond, as US customers temporarily halted new orders, reduced quantities, negotiated lower prices, or shifted orders to Bangladesh and China.

However, the company has received some orders diverted from China, focusing on deliveries in June and July, and is actively seeking orders to fill the production gap in August. Regarding the EU and Japan, orders are sufficient until the end of 2024, and the company continues to deeply explore these two markets.

May 10 (M10) has orders secured until the end of July, with some items extended until the end of the year. Executive Director Nguyen Thi Phuong Thao shared: “Customers requested early delivery in early July, forcing us to work overtime.” Apart from the US, M10 boosts exports to Japan, Russia, Australia, South Korea, and China, although it cannot compensate for the US market share. The company diversifies its raw material sources from India, Taiwan, and Vinatex members to reduce reliance on China.

Meanwhile, May Nam Dinh (NJC) maintains its role as a strategic backup supplier. General Director Pham Minh Duc shared that customers did not reduce orders but focused on optimizing prices and checking origins, helping the company maintain stability.

Price pressure mounts as customers demand cost-sharing

The new US tariff policy is causing noticeable pressure on order prices at most enterprises. May Hung Yen (Hugaco, HUG) has maintained CM unit prices, but had to negotiate a 1% price reduction with some South Korean customers. Orders extend until mid-August, and the company continues to seek new contracts.

Hue Textile and Garment Joint Stock Company (Huegatex, HDM) witnessed a decrease in order confirmation in April compared to the previous year, largely due to the impact of President Trump’s tariff announcement. Old customers simultaneously requested price sharing, including a 3-5% reduction for orders delivered from May to June.

Nevertheless, Q3 orders are on track. Huegatex has secured orders for July and continues to receive FOB orders in Q3. Specifically, Chinese raw material suppliers agreed to reduce prices by 25-27% to support Vietnamese enterprises in retaining customers if the tariffs take effect.

Regarding Hanosimex (HSM), despite its small scale, the company has orders locked in until the end of August and cooperates with Huegatex to stabilize production until the end of the year. Deputy General Director Nguyen Ba Khanh Tung opined that prices from August onwards would be more competitive, requiring careful consideration.

In the meantime, Southern Garment Corporation (VSC) has not reduced prices immediately despite some requests from customers. According to General Director Nguyen Hung Quy, orders at VSC are sufficient until the end of August. The company proactively increases the proportion of orders from the UK and Europe amid uncertainties in the US market. VSC also awaits clearer signals from the US to decide on an appropriate pricing policy.

According to Mr. Quy, if the retaliatory tariff increases by only about 15-20%, the Vietnamese market can still accept it. Enterprises propose ensuring transparent certificates of origin, especially for raw materials from China.

Cautious but not pessimistic

In addition to cost challenges, technical requirements, social assessments, and quality standards are becoming stricter. For Huegatex, competitive pressure is expected to intensify in Q4 as customers demand more criteria, including social responsibility and management systems. Nevertheless, the company remains optimistic about retaining FOB orders and receiving price support from suppliers.

Hoa Tho and May Duc Giang are closely monitoring the US market dynamics to determine their strategies from Q3 onwards. May Hung Yen and Southern Garment Corporation have also planned production until mid-Q3, proactively preparing price scenarios to respond flexibly to market changes.

Overall, major textile and garment enterprises are taking advantage of the crucial 90-day suspension period of US tariffs. Market expansion, price negotiation, customer retention, and flexible production coordination are the central strategies to ensure growth targets and mitigate year-end risks.

– 1:13 PM, May 26, 2025

Unveiling the Five-Star Property Experience: A Grand Office Opening and Brand Launch

On May 21, 2025, Five Star Property, a leading real estate company, inaugurated its head office at Home City, 177 Trung Kinh, Cau Giay, Hanoi. This momentous occasion marked the official launch of the Five Star brand and the beginning of its journey to becoming a trusted real estate development and project distribution consultant.

The Green Revolution: 2024 Sees a Stellar Rise in Agricultural Exports

2024 was a landmark year for Vietnam’s agricultural, forestry, and seafood exports, with a record turnover of 62.5 billion USD, an impressive 18.7% increase from 2023. This remarkable growth, the highest in two decades, was driven by strong performance across key agricultural products, including rice, coffee, fruits and vegetables, timber, cashew nuts, and seafood, all of which experienced significant increases.

The Evolution of Vietnam’s Mechanical Industry: Immense Potential Yet to Hatch a “Leading Crane”

The mechanical engineering industry has taken strides in enhancing domestic content, serving as a catalyst for the growth of other industries and the economy. This sector has directly and indirectly created employment opportunities for millions, setting a precedent for the development of various sectors.