Mr. Pham Anh Tuan, Director of the Payment Department (SBV)

Mr. Pham Anh Tuan, Director of the Payment Department (SBV), shared that alongside the digital transformation that brings convenience to citizens, the banking sector pays extra attention to safety, security, and confidentiality.

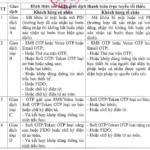

Circular 17, which will take effect on July 1, 2024, mandates the collection of biometric information for opening and using payment accounts to enable online transactions. “In other words, if there is no need for online transactions, there may be no requirement to provide biometric information or compare it with the national database. In such cases, customers must transact at the counter, where a teller verifies the information between the transactor and the citizen’s identity card,” he said.

The SBV leader also shared that they plan to amend Circular 17, which will take effect this year, and tighten regulations on transactions involving organizational accounts. This will include requiring businesses to visit banks in person to open accounts and not accepting any form of account opening by mail or authorizing others to bring documents for account opening.

Additionally, the amendments will mandate the collection of biometric information from all individuals and organizations when opening accounts to ensure account ownership. Simultaneously, the use of technology for authentication will be mandatory.

“For customers presenting their citizen identity cards at the counter, many credit institutions currently rely on tellers’ visual comparisons. However, the new circular will mandate the use of technology for verification to ensure accuracy rather than relying on the subjective judgment of tellers,” said Mr. Tuan.

Furthermore, the SBV will encourage and urge credit institutions and payment intermediaries to adopt VNeID for comparison and data matching. This will address the existing issue of user experience when scanning NFC.

In the coming time, the SBV will also amend the regulations for newly established organizational accounts, giving them a period of six or nine months (to be decided after consulting with credit institutions and enterprises) to comply with online transaction verification requirements, similar to individual customers. This will focus on organizations engaged in business activities, such as individual business households, and will not affect the operations of large enterprises and corporations.

Explaining the move to tighten transaction verification regulations for enterprises, Mr. Tuan mentioned that there have been cases of criminal organizations using corporate accounts to commit fraud.

Another notable point shared by the SBV leader is the prohibition of using aliases (unique transaction names for each customer) for accounts. This decision was made following a proposal from the Ministry of Public Security. Aliases have caused misunderstandings for senders, for instance, an individual opening an account and creating an alias like “national company” or “global,” leading senders to mistake it for a legitimate company name.

“We have received complaints from consumers who mistakenly transferred money to alias accounts and could not retrieve their funds, causing significant losses. In the new circular, we will not allow the use of aliases, and recipients must provide specific account numbers,” Mr. Tuan stated.

“Association of Banks Emphasizes on Member Organizations’ Compliance with Biometric Authentication Regulations”

On December 20, the Banking Association convened a meeting with its member organizations to review and emphasize the importance of complying with the regulations on biometric authentication as per Circulars 17/2024/TT-NHNN and 18/2024/TT-NHNN. During the meeting, the Banking Association continued to urge customers to complete their biometric authentication before January 1, 2025, to prevent any disruption to their online banking services.

What Happens to Your Money if Your Biometrics Are Not Verified?

Unfortunately, we cannot perform cash withdrawals if the account holder has not completed biometric authentication by January 1, 2025. This measure is in place to ensure the security of our clients’ funds and to comply with regulatory requirements. We apologize for any inconvenience this may cause, and we encourage you to complete your biometric authentication as soon as possible to avoid any disruptions to your banking services.

SHB Customers: Complete Your Biometric Data Update by December 31, 2024

In just over three weeks, Circulars 17 and 18 from the State Bank will come into force. To ensure a seamless financial transaction experience, SHB once again encourages its valued customers to complete their biometric updates as soon as possible and no later than December 31, 2024.

“Vietnam: The Rising E-Commerce Dragon of Southeast Asia”

The Vietnamese e-commerce market is projected to experience a compound annual growth rate (CAGR) of 28% from 2025 to 2033, underpinned by rising internet and mobile penetration, and the growing adoption of digital payments. The government’s digitalization agenda is also a key driver of this growth, setting the stage for a vibrant and dynamic online retail landscape in the country.