Gold Price Differential to Narrow to 1-2%

Prime Minister Pham Minh Chinh has issued new directives during the Standing Government meeting on managing the gold market held on the evening of May 24. He instructed the State Bank of Vietnam (SBV) to strengthen management and promptly narrow the domestic and global gold price differential to around 1-2%, significantly lower than the over 10% gap observed recently.

Concurrently, the SBV should implement measures to increase supply and reduce demand, closely manage and inspect, and rigorously prevent and punish illegal gold smuggling and speculation activities that disrupt the market.

The Prime Minister also ordered the revision of Decree 24 on Gold Trading through a streamlined process to align with the current situation. He further instructed the SBV to develop a gold market database, with both tasks to be completed by June.

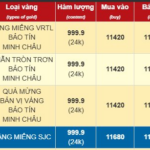

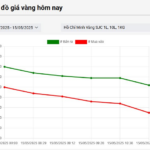

There has been a significant disparity between domestic and global gold prices. Today, SJC gold was listed at 119-121 million VND per tael. Meanwhile, the global gold price stood at approximately 3,340 USD per ounce, equivalent to 105 million VND per tael (exclusive of taxes and fees). This translates to a difference of about 11.34 million VND per tael between domestic and global gold prices. SJC gold bars were priced 16 million VND higher than their global counterparts.

This gap hasn’t always been this wide. Mid-May saw SJC gold fluctuating around 117.4-119.4 million VND per tael. During that time, global gold prices dipped by 63 USD from the previous session to 3,181 USD per ounce – the lowest level in over a month. When converted using Vietcombank’s rates, global gold was valued at roughly 100.17 million VND per tael (excluding taxes and fees). SJC gold bars commanded a premium of nearly 19.3 million VND over global prices.

At its peak, the domestic gold price exceeded the global price by over 19 million VND per tael.

Exploring the Establishment of a Gold Exchange

Prime Minister Pham Minh Chinh has also assigned the State Bank and the Ministry of Finance to explore the establishment of a gold exchange that allows citizens to freely trade gold.

According to the Prime Minister, to foster a safe, convenient, and healthy gold business environment in the long run, it is necessary to contemplate forming a gold exchange that enables citizens to trade gold freely. Additionally, a clear separation between state management and gold production and trading activities is essential.

Regulatory bodies should promote policies that boost gold jewelry manufacturing to create more jobs. They should also investigate and invest in systems that can generate electronic invoices from cash registers used in gold trading.

The proposal to establish a national gold exchange has been advocated by numerous economic experts over the years. A few years ago, the Vietnam Gold Traders Association petitioned the State Bank of Vietnam (SBV) to submit a decree to the Government, replacing Decree 24/2012 on Gold Business Management (Decree 24), which included this issue.

The Prime Minister emphasized the need to foster a safe, convenient, and healthy environment for the gold business.

Gold Prices Predicted to Drop by Up to 13 Million VND

In a Wall Street survey, 16 analysts participated, with an overwhelming 81% predicting a further rise in global gold prices. Only 19% anticipated a decline, and none expected prices to remain unchanged.

Similarly, in the Main Street online survey, out of 245 investors, 63% foresaw an increase in gold prices, while 21% predicted a decrease, and 15% believed prices would hold steady.

However, market analyst Han Tan from FXTM offered a different perspective, suggesting that gold prices might stagnate as long as US government bond yields don’t surge dramatically, and the 30-year bond yield remains below approximately 5%.

James Stanley, Senior Market Strategist at Forex.com, maintained his previous price trend forecast, stating that 3,500 USD per ounce is a critical level when prices fluctuate significantly. He added that for gold prices to advance towards the 4,000 USD per ounce mark, this level must be breached first.

Analyzing the domestic market, Mr. Nguyen Ngoc Trong, Director of New Partner Gold Company, shared his insights with Thanh Nien: “If the differential between domestic and global gold prices narrows to 1-2%, domestic gold prices could plummet by 12-13 million VND, falling below 110 million VND per tael.”

Mr. Trong anticipated unpredictable fluctuations in gold prices this week, especially with increasing gold sales by customers. This could trigger a rush to sell before the SBV intervenes, while companies might limit purchases due to a lack of outlets. Consequently, the market may experience a rapid decline in buying prices.

The Price of Gold Rings on May 19th Takes a Dip

“In today’s trading session, a prominent gold dealer slashed the price of gold rings to an impressive VND 114.2 – 117.2 million per tael.”