Illustrative image

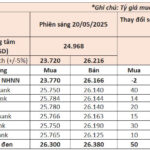

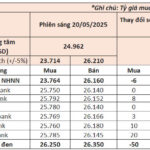

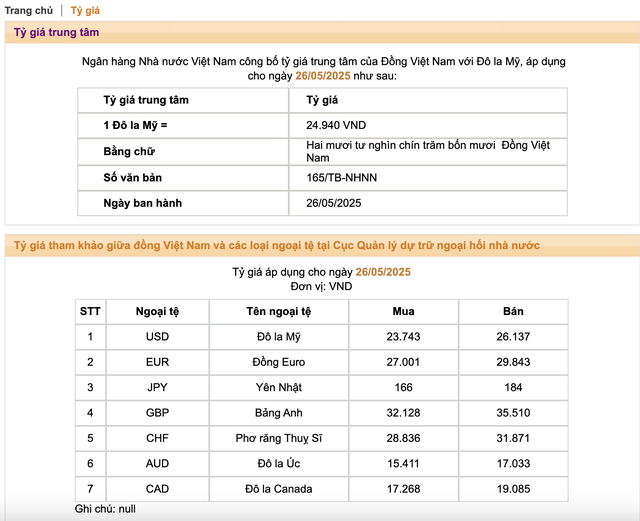

Today (May 26th), the central exchange rate set by the State Bank of Vietnam stands at 24,940 VND/USD, a decrease of 20 VND from the previous week. With a fluctuation margin of 5%, commercial banks are allowed to trade USD within the range of 23,693 – 26,187 VND/USD.

The reference buying and selling rates at the State Bank of Vietnam’s trading bureau also decreased accordingly to 23,743 – 26,137 VND/USD.

In the banking system, most banks are showing a downward trend in USD exchange rates.

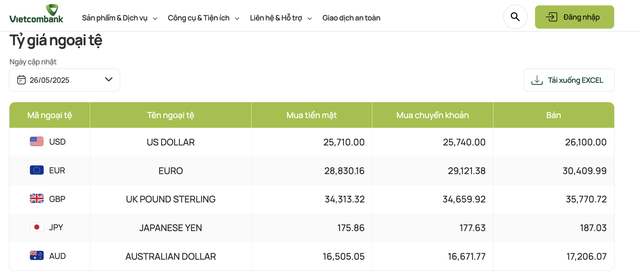

At 9:00 am, Vietcombank, the bank with the largest foreign currency transaction volume in the system, listed the USD buying and selling rates at 25,710 – 26,100 VND/USD, a decrease of 30 VND compared to the previous week’s closing level.

BIDV also decreased its rates by 45 VND for both buying and selling, while VietinBank increased its buying rate by 111 VND and decreased its selling rate by 39 VND.

In the group of private banks, Techcombank decreased its buying rate by 35 VND and its selling rate by 48 VND. Eximbank and Sacombank followed suit with reductions of 60 VND and 10 VND, respectively, in both buying and selling rates.

In the black market, as of 9:15 am, USD was being traded at 26,240 – 26,340 VND/USD.

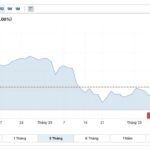

Internationally, the US Dollar Index (DXY), which measures the strength of the US dollar against a basket of major currencies, has fallen below the 99-point threshold.

The US dollar weakened significantly last week as investors dumped the greenback following President Donald Trump’s renewed threats in the global trade war. Trump warned of a 50% tariff on imports from the European Union, effective June 1st, citing the EU’s difficult negotiation stance and lack of progress in trade talks. This proposed tariff rate is two and a half times higher than the EU’s countervailing duties on US goods.

Subsequently, President Trump delayed the implementation of the 50% tariff on EU goods until July 9th to allow for negotiations. However, his statement raised concerns about the potential impact of these tariffs on the global economy and trade.

Over the past week, the US dollar has weakened by 2.2% against the Japanese yen, marking its biggest weekly loss since April 7th. The euro also strengthened against the dollar, posting its biggest weekly gain in six weeks. As a result, the dollar recorded its sharpest weekly decline since early April.

The Greenback’s Rally Comes to an End

“In a dramatic turn of events, the USD witnessed a downturn in the week of May 19-23, 2025, as former US President Trump threatened to impose a hefty 50% tariff on imports from the European Union (EU), effective June 1st. This unexpected development sent shockwaves through global markets, causing the USD to retreat.”

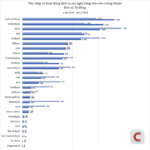

The New Kings of Banking: Techcombank Dethrones BIDV in Fee Income, as Vietcombank Lags in Ninth Place

The first quarter of 2025 witnessed a significant shift in the fortunes of many banks’ service operations. The industry saw a notable decline in net interest income, falling over 10% from the previous quarter. While Techcombank, VietinBank, and HDBank soared to impressive heights, BIDV, VPBank, SHB, and Eximbank experienced double-digit decreases, some even surpassing 80%.

The Dollar’s Midwife: Easing Pressure on the USD/VND Exchange Rate

Although the exchange rate may come under pressure in the short term, positive factors such as the trade surplus, FDI inflows, and international tourism are expected to contribute to a more favorable outlook for the USD/VND exchange rate. Instead of facing abrupt and intense upward pressure as witnessed recently, experts anticipate a more positive trajectory.