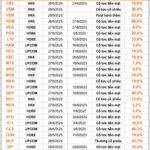

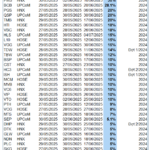

This week, 50 companies announced record closing rights to pay dividends, including 41 companies paying cash dividends, 3 companies paying stock dividends, 3 companies offering stock rewards, and 2 companies paying mixed dividends.

Capital Increase of Thousands of Billions

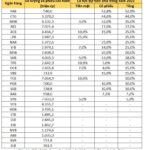

The Orient Commercial Joint Stock Bank (stock code: OCB) announced a resolution to approve the implementation of the 2025 capital increase plan by issuing shares from owner’s equity.

OCB’s charter capital will increase by VND 1,973 billion, from VND 24,658 billion to over VND 26,630 billion.

Accordingly, OCB will issue more than 197 million shares from the owner’s equity with an issuance ratio of 8%, meaning that shareholders owning 100 shares will receive 8 rights. The par value is VND 10,000/share, and the total issuance value is nearly VND 1,973 billion.

The source of funding is from owner’s equity as of December 31, 2024. If the above issuance is completed, OCB’s charter capital will increase by VND 1,973 billion, from VND 24,658 billion to over VND 26,630 billion.

As of March 31, OCB’s charter capital was VND 24,658 billion, ranking 15th in the banking industry in terms of charter capital scale. In 2024, OCB increased its charter capital from VND 20,548 billion to nearly VND 24,658 billion by issuing shares to pay dividends to shareholders.

With the additional charter capital, OCB will supplement its business, investment, and lending capital by VND 1,258 billion and spend VND 714 billion on purchasing and constructing physical facilities.

Chuong Duong Joint Stock Company (stock code: CDC) announced the minutes of the 2025 Annual General Meeting of Shareholders with a plan for revenue of VND 3,053 billion (up 161% over the same period) and expected profit of VND 48.5 billion (up 316% compared to the performance in 2024).

CDC presented to shareholders a plan for a private placement of 30 million shares, with an offering price of not less than VND 12,000/share, expected to be implemented in 2025. Privately placed shares are restricted from transfer for one year.

Chuong Duong Joint Stock Company plans to privately place 30 million shares at a price of not less than VND 12,000/share.

The minimum amount of mobilized capital is VND 360 billion, which Chuong Duong plans to use in the following order of priority: VND 98 billion to contribute capital to Chuong Duong Homeland Joint Stock Company, over VND 67 billion to implement the social housing project at Lot No. 3 in Area B – Nam Cam Le Residential Area, and nearly VND 135 billion to restructure short-term bank loans.

Thus, if the issuance is successful, CDC’s charter capital will increase from over VND 439 billion to over VND 739 billion.

Ton Dong A to be Listed on HoSE

Ton Dong A Joint Stock Company (stock code: GDA) will organize the 2025 Annual General Meeting of Shareholders, expected to be held on June 12 in Ho Chi Minh City. In 2025, Ton Dong A sets a business plan with a total output of 780,000 tons, total revenue of VND 18,000 billion, after-tax profit of VND 300 billion, and a maximum dividend rate of 20%.

Ton Dong A presented to shareholders a plan to offer shares to existing shareholders at a ratio of 3:1, meaning that shareholders owning 3 shares will have the right to buy 1 more share. The offering price is not less than the par value and is determined based on the market price at the time of offering or the book value. The proceeds from the offering will be used by Ton Dong A to supplement working capital and serve production and business activities.

Ton Dong A also presented to shareholders the plan to issue shares under the ESOP program with a maximum issuance ratio of 3% of the total circulating shares. ESOP shares are restricted from transfer for 2 years and are expected to be implemented in 2025-2026.

Ton Dong A will present to shareholders the plan to list shares on the Ho Chi Minh City Stock Exchange.

At the General Meeting, Ton Dong A will present to shareholders the plan to list shares on the Ho Chi Minh City Stock Exchange (HoSE), with the expected time for submitting the application left to the Board of Directors to decide at a suitable time.

Regarding dividends, Ton Dong A will present to shareholders the plan to pay 2024 dividends at a maximum rate of 40%, including 10% in cash (record date on May 13 and expected payment date on June 12) and 30% in shares. The time for issuing shares to pay dividends is expected in the third quarter of 2025, corresponding to the issuance of an additional 34.41 million shares.

Thus, if the issuance of shares to pay 2024 dividends is successful, the expected charter capital of Ton Dong A will increase from nearly VND 1,147 billion to nearly VND 1,491 billion.

Week 26-30/05: Riding the Dividend Wave

The week of May 26-30, 2025, marks another peak in dividend payouts for listed companies on the stock exchange. A total of 43 businesses will be finalising their cash dividend distributions, with rates as high as 88%—meaning shareholders owning one share will receive a substantial 8,800 VND.

“OCB to Issue 197.2 Million Bonus Shares to Boost Chartered Capital”

OCB is set to issue a bonus share dividend, offering 197.2 million new shares to its shareholders. This move will increase the bank’s charter capital from VND 24,657.8 billion to VND 26,630.5 billion.