The Next Generation’s Appetite for Stock Investment

Recently, Ha Do Group Joint Stock Company (HDG on HoSE) announced the registration of stock transactions by its leaders and related parties.

According to the announcement, Mr. Nguyen Trong Minh, son of the founding chairman of the Board, Mr. Nguyen Trong Thong, and General Director of Ha Do Group, registered to buy 4 million HDG shares through order matching from May 27 to June 25, aiming to increase his ownership from 0.21% to 1.4%, equivalent to over 4.7 million shares.

Assuming the share price remains at the closing price of VND 26,350 per share as of May 23, Mr. Minh is expected to spend approximately VND 105.4 billion to acquire the aforementioned number of shares.

Illustrative image

In a similar vein, Hoa Binh Construction Group Joint Stock Company (HBC on UPCoM) disclosed a transaction notice from Mr. Le Viet Hieu, Vice Chairman of the Board and Standing Vice President of the company.

Specifically, Mr. Hieu registered to purchase 500,000 HBC shares to increase his ownership from 1.21 million shares (0.35% of charter capital) to 1.71 million shares (0.49% of charter capital). The transaction is expected to take place from May 22 to June 20.

Mr. Le Viet Hieu (born in 1992) is the son of Mr. Le Viet Hai, Chairman of the Board of HBC. Mr. Hieu holds a Bachelor of Business Administration with a major in Corporate Finance from California Polytechnic State University, San Luis Obispo (USA). He previously served as CEO and was appointed Standing Vice President on July 23, 2022.

In addition to Mr. Hieu, several other family members of Chairman Le Viet Hai hold HBC shares. As of the end of 2024, Chairman Le Viet Hai held 46.98 million HBC shares (13.53% stake); his wife, Mrs. Bui Ngoc Mai, held 4.7 million HBC shares (1.37% stake); Mr. Le Viet Hung, brother of Mr. Le Viet Hai, held 1.3 million HBC shares (0.39% stake); and Ms. Le Thi Anh Thu, sister of Mr. Hai, owned 2 million shares (0.58% stake), among others…

Businesses Boost Their Holdings

Recently, CII Trade and Investment One-Member Limited Liability Company (CII Invest) reported the purchase of 1.83 million NBB shares of Nam Bay Bay Investment Joint Stock Company during the period of May 20-23, 2025.

Following this transaction, CII Invest increased its ownership from 46.71 million shares (46.64% stake) to 48.54 million shares (48.47% of NBB’s charter capital).

As CII Invest is a subsidiary of Ho Chi Minh City Technical Infrastructure Investment Joint Stock Company (CII on HoSE), the CII group has increased its total holding in Nam Bay Bay from 73.09% to 74.92% of its charter capital.

Prior to this, between May 9 and May 12, CII Invest had purchased 10,039,000 NBB shares through a negotiated deal from My Steel Trading and Service Company Limited.

Illustrative image

Additionally, Vietnam Container Shipping Joint Stock Company (Viconship, VSC on HoSE) and its two subsidiaries have reported transactions that increased their ownership in Hai An Shipping and Stevedoring Joint Stock Company (HAH on HoSE).

Specifically, Viconship purchased 473,200 HAH shares on May 20 and 681,000 HAH shares on May 21. As a result, Viconship’s ownership increased from 13.09 million shares (10.08% of HAH’s charter capital) to 14.24 million shares (10.06%).

Similarly, Viconship’s subsidiary, Green Port Service One-Member Limited Company, bought a total of 496,600 HAH shares in three sessions from May 20 to May 22. This increased their ownership from 933,700 shares (0.719% of HAH) to 1.43 million shares (1.1% of Hai An Shipping and Stevedoring).

Thus, after the transactions, the Viconship group’s ownership in Hai An Shipping and Stevedoring stood at 17.11 million shares, representing 13.18% of its charter capital.

The Stock Price Surges 37% from its Low: Vice Chairman Registers to Purchase Additional 7 Million Shares

“In a bold move, the Vice Chairman of the Board of Members at STK Fiber Corporation (HOSE: STK) has registered to purchase 7 million shares of the company’s stock, with ambitions to raise his ownership stake to 21.72%. This development comes at a time when the company’s shares have witnessed a robust recovery, and the first-quarter financial results showcase an impressive surge in growth.”

Stock Trading Leadership: Spotlight on the Real Estate and Construction Group

The trading week of May 19-23, 2025, witnessed a notable trend among corporate insiders and their affiliates. Amid a recovering market, these insiders sought to bolster their stock holdings, with a particular focus on the real estate and construction sectors. This strategic move underscores their confidence in these industries’ potential and sets the tone for investors eyeing opportunities in a rebounding economy.

The PRC Stock Soars Amid Insider Trading Scandal

Amid PRC’s impressive surge in stock price, its major shareholder and Vice President offloaded their entire stock holdings, while a Board member registered to purchase an equivalent amount.

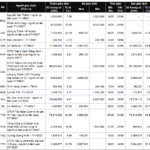

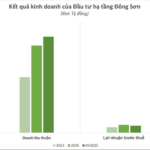

East Mountain Infrastructure Plans for 2025 Revenue of Approximately VND 700 Billion, Wins Billion-Dollar Transportation Contract in Hanoi

In 2025, Dong Son Infrastructure Investment remains committed to the timely execution of its ongoing five projects, honoring its pledges to investors. The company actively seeks out investment opportunities in industrial real estate and social housing projects, reinforcing its position in the market.

“Techcombank Prepares to Release 21.3 Million ESOP Shares at a Third of Market Price”

“Techcombank is gearing up for another ESOP share offering, this time with a planned issuance of 21.38 million shares at an attractive price of 10,000 VND per share, which is a third of the market price. This move showcases the bank’s strategy to incentivize and reward its employees, offering them a valuable opportunity to become shareholders at a discounted rate.”