Photo: Getty Images.

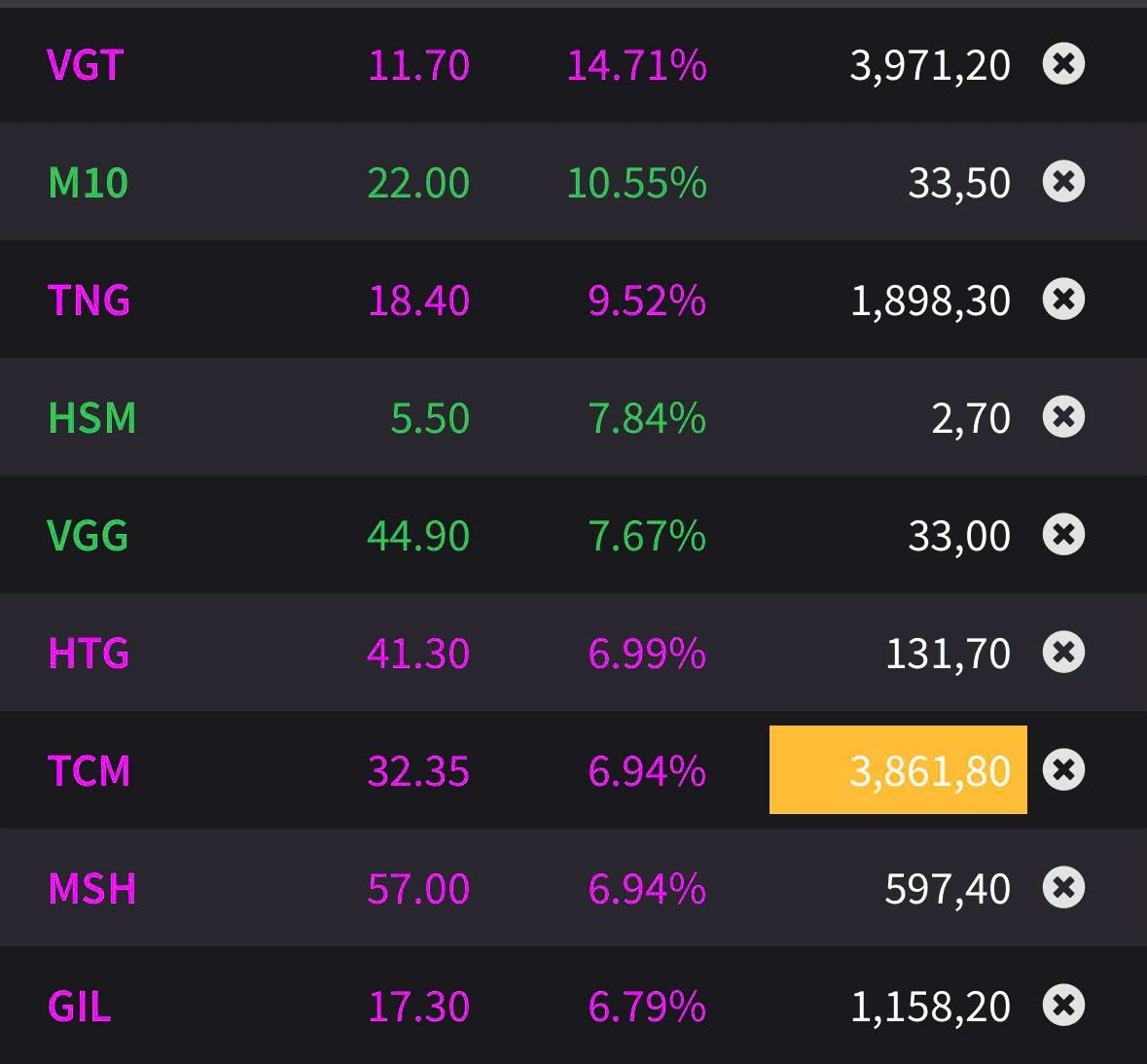

During the trading session on May 26, stocks in the textile industry surged to the daily limit, including TCM of Thanh Cong Textile Garment Investment Trading Joint Stock Company (6.9%), MSH of May Song Hong (6.9%), HTG of Hoa Tho Textile Garment Joint Stock Company (7%), TNG of TNG Investment and Trade Joint Stock Company (9.5%), VGT of Vietnam National Textile and Garment Group (14.7%), and GIL of Gilimex (6.8%).

Additionally, other textile stocks witnessed positive momentum in today’s trading session, including M10 (10.6%), STK (6.7%), ADS (3.3%), VGG (7.7%), and HDM (5.6%).

According to statistics from the General Department of Customs, exports of textile products in March 2025 surpassed $3.06 billion, marking a 25.4% increase compared to the previous month. In the first quarter of the year, the textile industry’s export turnover reached $8.69 billion, reflecting an 11.1% year-on-year growth.

As of the first quarter of 2025, the United States remained the largest importer of Vietnamese textile products, accounting for 43.6% of the market share, with a turnover of $3.78 billion, signifying a rise of over 15% year-on-year. Japan followed in second place with over $1.07 billion, while South Korea secured the third spot with $827.5 million.

The textile industry is one of Vietnam’s key export sectors. As of 2024, Vietnam had exported textile products to 113 countries and territories, with the primary export destinations being the United States, Japan, South Korea, and China.

In comparison to its competitors, Vietnam boasts the fastest growth rate in textile exports, reaching $44 billion in 2024, marking an increase of over 11% year-on-year. This impressive performance has propelled Vietnam to the second position globally in textile exports, only behind China and surpassing Bangladesh.

Notably, in 2024, Vietnam’s textile exports to the key market of the United States amounted to $16.6 billion, accounting for 38% of the industry’s export turnover.

Recently, as reported by Reuters, President Trump agreed with comments made by Treasury Secretary Scott Bessent on April 29, stating that the United States “doesn’t necessarily need a booming textile industry.” Speaking to reporters before boarding Air Force One in New Jersey, President Trump said, “We don’t want to make sneakers and t-shirts. We want to make military equipment, big things, things that matter with AI on computers,” emphasizing his preference for producing military equipment and high-tech products over textile goods.

“To be honest, I don’t want to make t-shirts and socks. We can do that very well in other locations. Instead, we’re looking to make chips, computers, and a lot of other things, as well as tanks and planes,” he added.

Earlier, at the May Seminar organized by the Vietnam National Textile and Garment Group (Vinatex), Dr. Le Tien Truong, Chairman of the Board of Vinatex, predicted that the garment industry would witness abundant order opportunities in the first half of the year, potentially extending into the third quarter of 2025.

Furthermore, Dr. Truong mentioned that by July 10, the United States might implement temporary retaliatory tariffs on Vietnam, pending the negotiation outcomes of the Ministry of Industry and Trade and the Government.

On a positive note, he pointed out that the low inventory levels in the US could sustain strong orders in the third quarter of 2025, although a 10% decline is expected in the fourth quarter due to a projected 5% decrease in US consumer demand. Additionally, the current trade negotiation strategies, which focus on specific product categories, may present opportunities for Vietnam’s textile industry.

Legamex: A Legacy of Saigon’s Textile Industry Fades Away

Once a leading garment manufacturer in Vietnam, Legamex is now embroiled in a financial crisis, with cumulative losses surpassing VND 166 billion and negative equity. The company has been compelled to halt its core contract manufacturing operations and revise its plans for utilizing capital raised through equity offerings to repay its financial obligations.

The Trade Tensions Weave Uncertainty for Vietnam’s Textile Industry

In light of the US-China trade truce, while Vietnam is still in negotiations, Vinatex forecasts a stable order volume for Q3 due to low US inventory levels. However, the company predicts a potential 10% decline in orders for Q4 as purchasing power may weaken. Chairman Le Tien Truong emphasizes the industry’s need to seize the negotiation “lull” to proactively adapt and stay resilient.

Crafting a Compelling Copy: “Empowering Vietnamese Enterprises: Navigating the American Marketplace”

“Industry leaders from prominent businesses and corporations are gearing up for an eventful period ahead. From now until June, they plan to actively engage and collaborate with American partners to bring signed agreements and memorandums to life. This proactive approach underscores their commitment to fostering meaningful relationships and turning visions into tangible outcomes.”

The Intriguing Tale of Bao Lan: CEO Rejects Family Business to Weave a Different Future with a ‘Blue Thread’ Venture.

Upon embarking on his studies abroad in New Zealand, Quách Kiến Lân made a resolute decision to forge his own path and not continue his family’s trade in the fabric business. However, over a decade ago, while visiting Vietnam and accompanying his mother to various textile fairs around the globe, he found himself captivated by the trend of ‘green fashion’, specifically green fibers. This intrigue has persisted and evolved into a lasting passion.

The Evolution of Vietnam’s Textile Industry: Navigating Challenges and Opportunities

The textile industry witnessed a remarkable recovery in 2024, paving the way for a confident and ambitious future. This resurgence lays the foundation for the sector to continue its strategic development, with a vision to thrive and excel in 2025 and beyond, marking a new era of prosperity and progress.