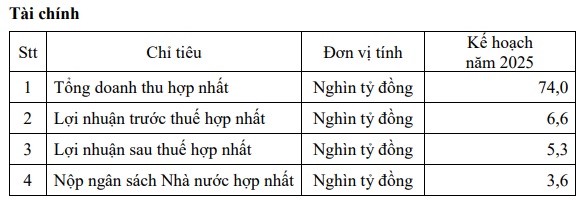

Specifically, GAS targets consolidated revenue of VND 74 trillion in 2025, a 29% decrease, and consolidated after-tax profit of only VND 5.3 trillion, 50% lower than in 2024. It is important to note that GAS typically sets plans lower than actual performance.

| GAS’s business performance |

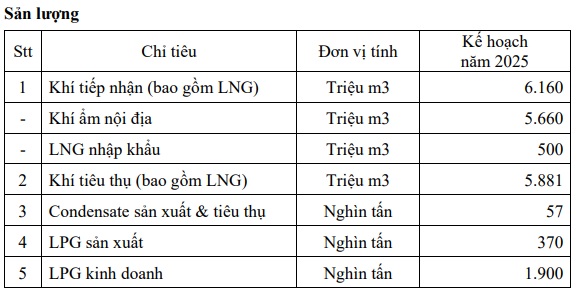

In terms of output targets, GAS plans to receive nearly 6.2 billion cubic meters of gas (including imported LNG) and consume over 5.88 billion cubic meters of gas (including LNG). LPG production is targeted at 370,000 tons, while LPG trading is planned at 1,900 tons.

Source: PV GAS

|

Regarding the basis for these plans, GAS states that 2025 is expected to continue witnessing global economic fluctuations, increased competitive pressure, declining domestic gas sources, and a rising trend of upstream incidents. Meanwhile, the imported LNG market and consumption are predicted to be unstable, and the emergence of a new LNG provider (Hai Linh Company Limited) and fierce competition in the LPG market also pose challenges.

In the LPG market, rivals are willing to offer lower prices than PV GAS to attract customers and are more flexible with financial policies, such as waiving contract performance guarantees and payment guarantees. Other potential foreign competitors are also entering the Vietnamese LPG market, directly competing with PV GAS. Additionally, illegal LPG refilling and charging activities using the PV GAS brand continue to impact retail operations.

|

PV GAS’s 2025 production plan

Source: PV GAS

|

Nevertheless, the company aims to achieve an 8% increase in consolidated revenue compared to the previous year, contrary to the planned decrease. As of Q1/2025, GAS recorded revenue of VND 25.7 trillion, a 10% increase year-on-year, and a net profit of nearly VND 2.76 trillion, a 10% rise, mainly due to increased LPG output and LNG prices. The company has accomplished 35% of its revenue target and over 52% of its after-tax profit plan in the first quarter.

According to PV GAS, in 2025, they will focus on modern management methods, rejuvenating old motivations, and adding new ones, preparing to shift their business model. The company will actively develop the gas, LNG, and gas products markets, especially the domestic LNG market and international business.

In terms of investment plans, the expected investment value for 2025 is VND 2.9 trillion, with an investment disbursement of VND 3.3 trillion (entirely from equity capital).

18.5% Dividend Payout, Issuing 70 Million Shares to Increase Capital

GAS proposes a 21% cash dividend (equivalent to over VND 4.9 trillion) for 2024 to the Annual General Meeting of Shareholders. For 2025, the expected dividend rate is 18.5%.

Notably, GAS will suggest a plan to increase its charter capital by issuing shares to existing shareholders. The maximum number of shares to be issued is nearly 70.3 million, with a par value of nearly VND 703 billion. The entitlement ratio is 3% (for every 100 shares held, shareholders will receive 3 new shares). These shares will not be restricted from transfer and will be issued after the Annual General Meeting of Shareholders’ approval and the SSC’s notification of receiving sufficient documents (expected from Q2 to Q4/2025).

The Annual General Meeting of Shareholders of PV GAS will be held at 8:00 AM on May 30, 2025, at the PV GAS Tower, Nguyen Huu Tho Street, Nha Be District, Ho Chi Minh City.

Chau An

– 14:25 27/05/2025

“CSM to Pay Out Nearly VND 31 Billion in Dividends in June”

The Southern Rubber Industry Joint Stock Company (Casumina, HOSE: CSM) plans to pay a cash dividend for fiscal year 2024 at a rate of VND 300 per share, equivalent to a value of over VND 31 billion, on June 20th.

“VIX Brokerage Aims for 1.8X Profit Growth in 2025”

On May 23, 2025, the Annual General Meeting of Shareholders of VIX Securities Joint Stock Company (VIX) approved an ambitious profit target, aiming for an 180% increase compared to the previous year’s performance. VIX attributes this bold growth strategy to its focus on high-quality human resources and cutting-edge technology as the key pillars for success in the coming year.

The Viconship Group Raises Stake to 13.18% in Port Haiphong

From May 20 to 22, Viconship and its two subsidiaries continued to purchase a significant number of HAH shares, bringing their total ownership to 17.11 million HAH shares, representing a substantial 13.18% stake in Hai An Port and Shipping Joint Stock Company.