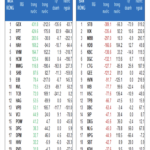

The small-cap group also showed uneven strength. Out of the 30 most liquid stocks, only 18 saw gains of more than 1%. Money flow was more selective in small-cap stocks. Stocks like HAH, TCM, NTL, LCG, DPG, VOS, KHG, and KSB not only stood out in terms of liquidity but also impressive price gains, despite only two stocks having high liquidity (over 100 billion VND). In the mid-cap group, the spread was wider, with more than half of the basket (38 stocks) achieving liquidity of over 100 billion VND, and the majority of them rose (only 5 stocks fell).

Overall, with nearly 36% of stocks on the HSX floor (only counting stocks with transactions) rising by 1% or more, the opportunity for investors to choose strong stocks is quite large. This ratio is higher in the mid- and small-cap groups, which aligns with the preferences of most retail investors. With this situation, whether the VN Index rises or falls is not a big deal.

However, credit must be given to the large-cap stocks, as this group’s ability to maintain a positive VN Index creates favorable conditions for mid- and small-cap stocks to rise, and hot money to be more active. In today’s session, the VN Index dipped several times but only turned slightly red or near the reference level. This dip was due to some large-cap stocks pulling down, and the ability to balance the score in the remaining large caps helped stabilize market sentiment, unlike yesterday. Simply put, even if they didn’t rise much, the large caps were the group that coordinated opportunities for other stocks.

With no new information, the market is moving based on fast money flow. In this situation, speculative stocks remain the most effective. The market is witnessing a state of few gains in points, but many stocks are rising, contrary to the situation a week or two ago when the VN Index rose mostly due to large caps, while retail investors missed out.

Today’s combined liquidity of HNX and HSX reached approximately 25.4k billion VND, which is relatively high. As mentioned above, money is flowing into mid-cap stocks, and this group is driving the overall liquidity. However, whether this money flow is sustainable is another question. Therefore, opportunities should be seized, but there is no need to be overly excited. Stocks targeted by hot money will rise naturally, so just pay attention to risk management as this is a short-term opportunity.

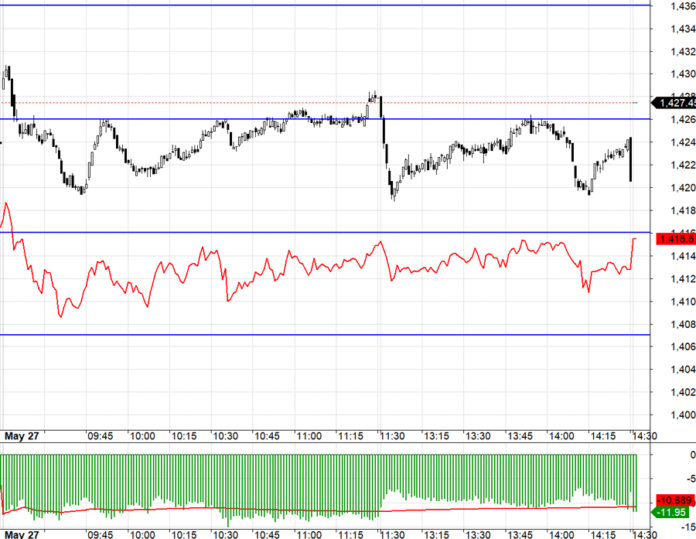

Today’s derivatives market was much more uncomfortable than the underlying market. VN30 fluctuated sideways in a narrow range, and F1 was overly discounted. With an average basis of nearly -11 points, it was impossible to short, and there was no large-cap stock to lead a long position. During the session, VN30 repeatedly touched 1426.xx and retreated, but F1 barely moved. This situation could be the derivatives market pricing in the risk of VN30 falling, or it could be a reaction to the large-cap group’s inability to demonstrate the necessary strength.

With money still flowing quickly and strongly in the short term, the opportunity is clear in stocks, but there is no need to chase prices. Buying late is also a risk because if the index is heavily pressured, any enthusiasm will fade. The strategy is to hold stocks for the short term, aiming for quick profits, and to be flexible with long and short positions in derivatives.

VN30 closed at 1427.45. The nearest resistance levels for tomorrow are 1437, 1442, 1448, 1459, 1465, and 1473. Support levels are 1425, 1417, 1407, 1399, 1393, 1387, and 1377.

“Blog chứng khoán” reflects the personal views of the investor and does not represent the opinions of VnEconomy. The views, assessments, and investment advice are those of the individual investor, and VnEconomy respects the author’s views and writing style. VnEconomy and the author are not responsible for any issues arising from the published assessments and investment advice.

Market Beat: Afternoon Surge, VN-Index Soars Over 18 Points

The trading session concluded on a positive note, with the VN-Index climbing 18.05 points (+1.37%) to reach 1,332.51, while the HNX-Index gained 3.09 points (+1.43%), closing at 219.41. The market breadth tilted in favor of advancers, with 509 gainers versus 216 decliners. A dominant blue hue was observed in the VN30 basket, as 21 stocks advanced, 4 retreated, and 5 remained unchanged.

The Flow of Funds: Is the Market Still Poised for a Breakthrough at the Old Peak?

The experts’ cautious sentiment was evident as the leading stock group showed signs of fatigue. Indeed, the VN-Index last week was heavily influenced by the pair of stocks VIC and VHM, which rose 12.4% and 10.8%, respectively. These two stocks alone contributed a significant 34.9 points to the index’s total weekly gain of 13.07 points.

The Crypto King Reigns Supreme: Bitcoin Smashes Records as VN-Index Hovers at 1,300

The crypto market witnessed a historic milestone last week as Bitcoin surpassed the $110,000 mark for the first time, ushering in a new era in its journey to unprecedented heights. Meanwhile, the VN-Index conquered the 1,300-point mark once again, ending on May 23 with a 1% weekly gain to close at 1,314.46 points. But while the markets soar, individual investor portfolios may tell a different story.