Dragon Capital, a prominent foreign investment fund, recently offloaded a total of 3.75 million DXG shares of the Dat Xanh Group during the August 29 trading session. This move involved sales by several constituent funds: Amersham Industries Limited sold 1 million shares, DC Developing Markets Strategies Public Limited Company sold 500,000 shares, Norges Bank sold 2 million shares, and Vietnam Enterprise Investments Limited offloaded 500,000 shares.

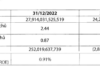

Contrarily, the Samsung Vietnam Securities Master Investment Trust [Equity] fund purchased 250,000 shares during the same period. Following these transactions, Dragon Capital’s total holdings decreased from 132.87 million shares (representing a 13.04% stake) to 129.12 million shares (amounting to a 12.67% stake). The effective date of this change in ownership ratio is September 4.

At the close of the August 29 trading session, DXG shares stood at VND 22,800 per share, indicating that the group of funds involved in these transactions netted an estimated VND 85.5 billion in profits.

Dragon Capital has been actively trading DXG shares recently. On August 25, the investment fund sold a total of 3.9 million DXG shares through three of its member funds.

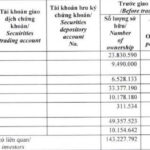

In addition to foreign investors, several executives of the Dat Xanh Group have also been involved in DXG share transactions. For instance, Deputy General Director Do Thi Thai sold 413,300 shares between August 15 and August 27, 2025, reducing her holdings to 479,785 shares, equivalent to a 0.05% stake.

Unleashing the Dragon: Dragon Capital Divests 3.9 Million DXG Shares of Dat Xanh Group

On August 25, 2025, Dragon Capital, through three of its member funds, sold 3.9 million DXG shares, reducing its ownership to 13.6745% in the Dat Xanh Group.

Unlocking Profits: Navigating the VN-Index’s Surge Past the 1,600-Point Milestone

“During the week of August 11–15, 2025, selling pressure from investment funds intensified as the VN-Index rallied for four consecutive sessions, breaching the psychological threshold of 1,600 points and approaching the 1,660 zone. However, the index faced corrective pressures during the week’s final trading session.”