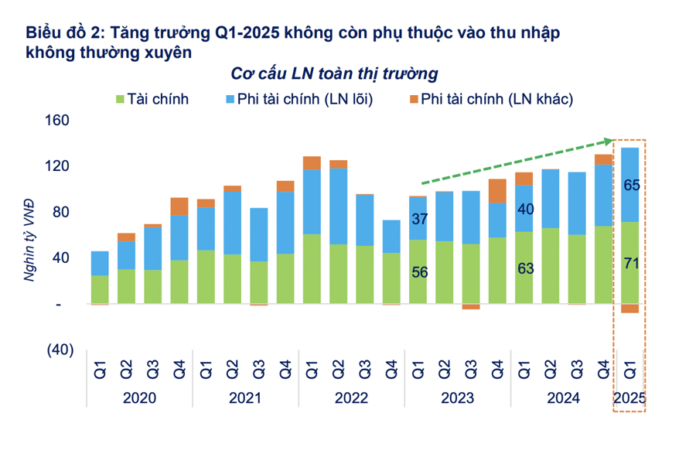

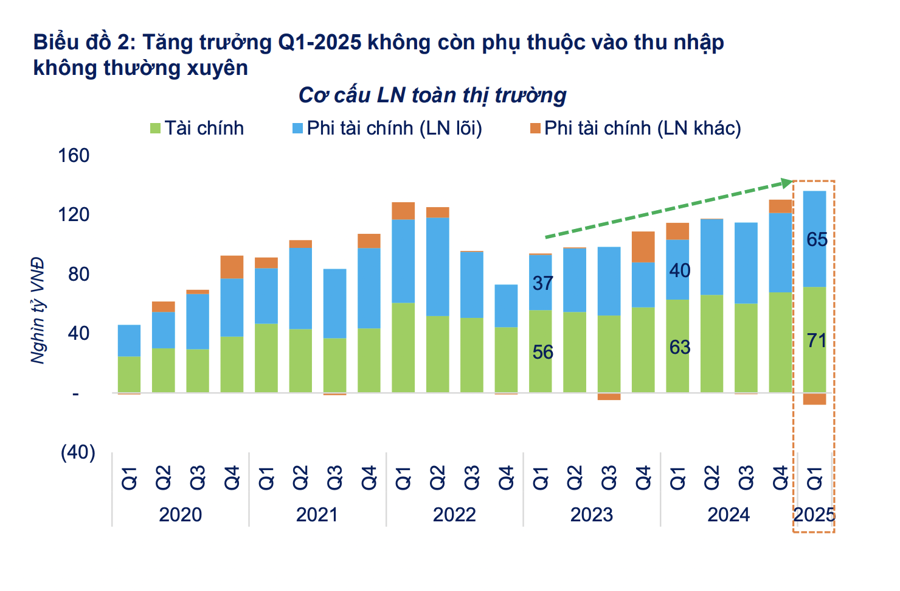

The FiinGroup’s Q1/2025 profit report reveals a normalization of growth trends after several quarters of recovery from low bases. The market’s after-tax profit increased by 12% year-on-year, significantly lower than the 2024 quarterly average (+20.5%/quarter). However, it reflects more substantial and stable growth, excluding significant contributions from financial income.

QUALITATIVE AND STABLE PROFIT GROWTH

The growth momentum continues to come from the Finance group, with a 13.4% year-on-year increase. Banks led this growth with a 15.3% rise. The Non-Financial group grew by 10.4%, a reasonable increase considering the high comparative base. Real Estate, Electricity, Information Technology, Retail, and Exports (Seafood, Textile & Garment, Chemicals, etc.) were the main contributors.

This indicates that the market is returning to a more stable and qualitative profit growth trajectory, moving away from the technical recovery seen in previous quarters.

In the growth group, Real Estate took the lead due to revenue recognition from project handovers, followed by Retail, which benefited from recovering demand for electronic and technology products and proactive cost-cutting measures by enterprises to improve margins. Meanwhile, Information Technology, Personal Goods, Basic Resources (mainly Steel), and Banks showed stable profit growth.

In the recovery group, Chemicals and Utilities signaled profit recovery from low bases due to stable input prices (mainly oil prices).

Among the decelerating groups, Food & Beverage recorded a modest profit growth of 5.5% in Q1/2025, despite previous expectations of benefiting from the domestic consumption recovery trend. Several leading enterprises witnessed declines in after-tax profits due to narrower EBIT margins and weak consumer demand, including VNM (-28.1%), SAB (-21.9%), and QNS (-26.4%). In contrast, outstanding profit increases were seen in MSN (+105.3%), Livestock (DBC, HAG), and Seafood (VHC, MPC, ANV).

For the Construction and Materials sector, which was expected to benefit from accelerated disbursement of public investment capital, the trend is also decelerating, with profit declines among leading enterprises such as VCG (-68.6%), CTD (-70.4%), and VCS (-19.6%). However, the Plastic Pipe (BMP, NTP) and Stone Mining (DHA, NNC, VLB) subgroups maintained positive growth.

In the declining group, profits continued to fall in the Oil & Gas sector but showed signs of bottoming out in Financial Services (mainly Securities). The significant improvement in stock market liquidity in April-May 2025 could become a supportive factor, opening up the potential for a return to growth for the industry in Q2. For Travel & Entertainment, the decline of -17.6% was due to the absence of abnormal income for HVN. Positively, HVN’s core business profit maintained a strong growth momentum, reaching +90.3% in Q1.

PROSPECTS FOR FULL-YEAR 2025 PROFITS

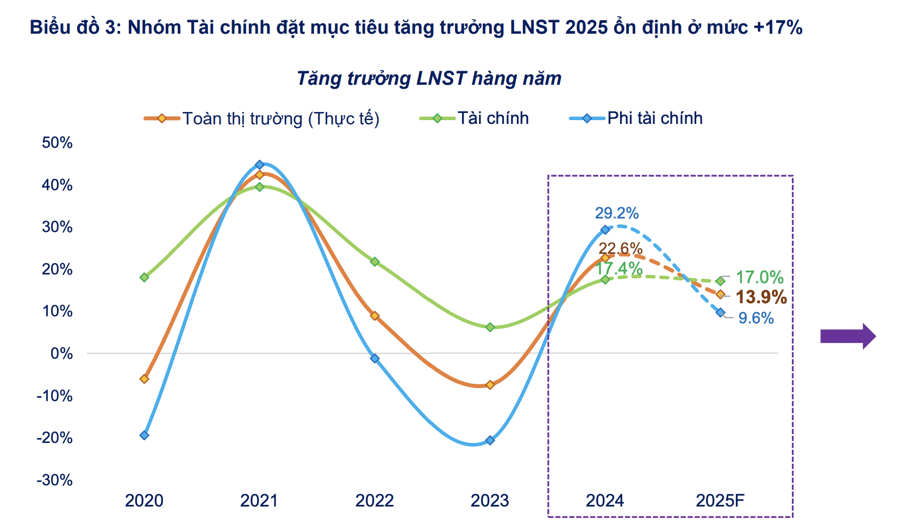

Regarding the prospects for 2025, based on the business plans announced by the management of listed companies, the market’s after-tax profit is expected to increase by 13.9%. Specifically, the Finance group targets a growth of 17%, unchanged from the 2024 performance, while the Non-Financial group sets a relatively cautious goal with a modest increase of 9.6%.

Although many large enterprises formulated their 2025 business plans before the emergence of tariff risks, this growth target (+13.9%) is still considered feasible in the context of a stabilizing economy and government efforts to boost internal strengths.

The groups that have outperformed their 2025 plans, along with improved profit growth quality (reflected in both revenue and EBIT margin increases in Q1), include Utilities (mainly Electricity such as POW, REE, GEG), Retail (MWG, FRT), and Chemicals (mainly Fertilizers such as DCM, DPM, and Rubber such as DRI).

The groups that are closely following their 2025 plans and exhibit stable growth prospects are Information Technology (FPT) and Banks (MBB, VPB, HDB).

The groups that are falling behind their 2025 profit plans include Real Estate, Food & Beverage, Construction & Materials, Oil & Gas, and Automotive & Components. While Real Estate (especially the residential segment) still holds recovery potential, Food & Beverage, and Construction & Materials show a decelerating growth trend, reflecting weaker-than-expected consumer demand and public investment disbursement progress.

Looking deeper, some sub-sectors displayed positive trends against the broader backdrop, such as Seafood and Livestock (within Food & Beverage) and Plastic Pipes and Stone Mining (within Construction & Materials), which recorded impressive profit growth in Q1/2025, outperforming their full-year plans.

The Widening of Nguyen Huu Tho Road to 60 Meters: New Developments in Nha Be and Can Giuoc’s Real Estate Market

With the expansion of Nguyen Huu Tho Road, a vital transportation corridor will be established, connecting the Ring Road 2 with the Ben Luc – Long Thanh Expressway, and eventually, the Ho Chi Minh City Ring Road 4. This strategic development addresses the critical need for efficient inter-regional transportation in the southern gateway of the city, facilitating seamless connectivity to the Eastern and Western regions of the South, as well as the network of seaports and the Long Thanh airport.

The Birth of Gold Coast Vung Tau: A Gem Among International Tourist Cities

With an unbeatable central location, premium products, attractive pricing, and the assurance of long-term ownership with a red book, Gold Coast Vung Tau has won the hearts and trust of investors. An impressive 90% of the inventory was sold at the launch event itself, a testament to its appeal and the confidence it inspires.

Grab’s CEO Seeks Government Partnership to Advance an Issue of Special Interest to Vietnam: What Did the Prime Minister Propose?

“During his visit to Ho Chi Minh City, the CEO of Grab took an early morning coffee with drivers, starting at 4 am. This initiative showcases the company’s commitment to fostering stronger relationships with its partners and improving the quality of life for Vietnamese citizens. Grab’s CEO expressed his desire to further collaborate with the Vietnamese government, emphasizing the company’s role in positively impacting the lives of people across the country.”