I. MARKET ANALYSIS OF SECURITIES ON MAY 27, 2025

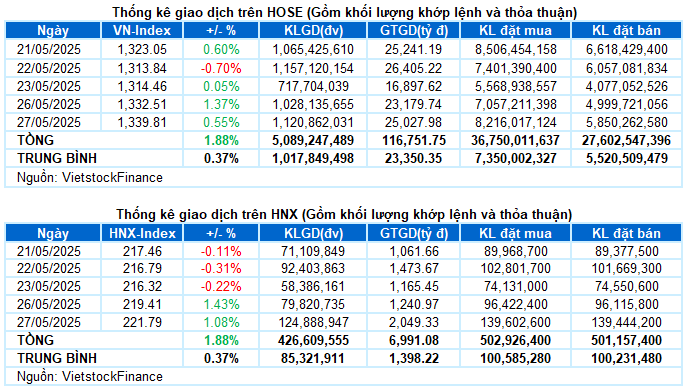

– The main indices maintained their upward momentum during the May 27 trading session. The VN-Index gained 7.3 points, equivalent to a 0.55% increase, reaching 1,339.81 points; while the HNX-Index also rose by 1.08% to 221.79 points.

– The trading volume on the HOSE increased by almost 10%, surpassing 1 billion units. Meanwhile, the HNX witnessed a stronger surge in volume, climbing by over 54% compared to the previous session, to nearly 123 million units.

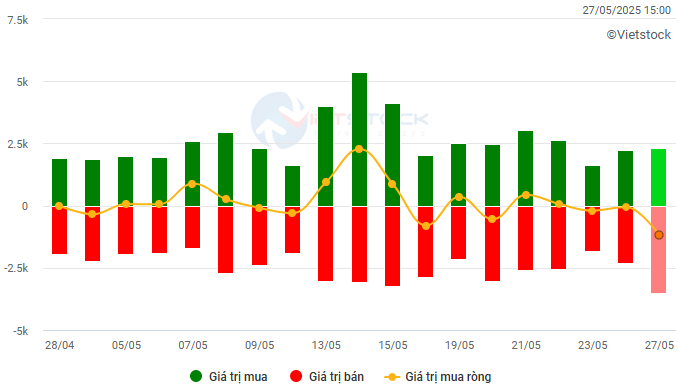

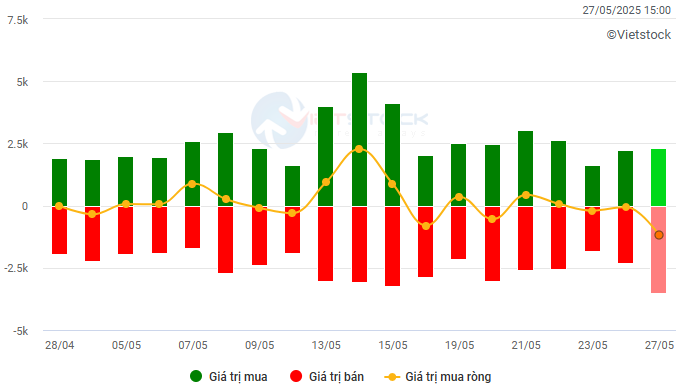

– Foreign investors intensified their net selling, with a value of more than VND 1.1 trillion on the HOSE and nearly VND 61 billion on the HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM on May 27. Unit: VND billion

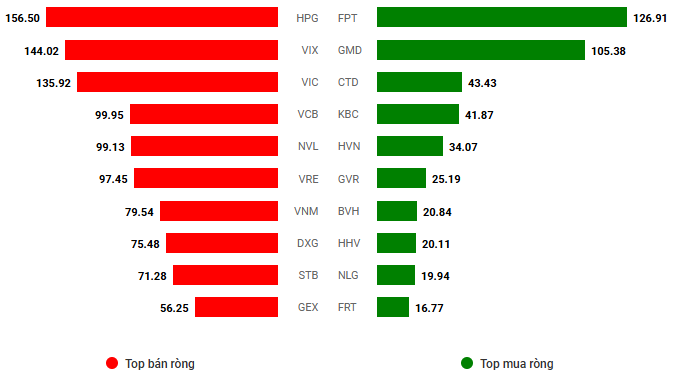

Net trading value by stock. Unit: VND billion

– The securities market remained resilient in the green territory during the May 27 session. However, unlike previous sessions where large-cap stocks were the main driving force, today’s session witnessed a greater focus on mid- and small-cap stocks. Despite profit-taking pressure on pillar stocks that caused fluctuations in the index throughout the day, buying pressure prevailed for most of the trading session. At the close, the VN-Index rose over 7 points to 1,339.81 points.

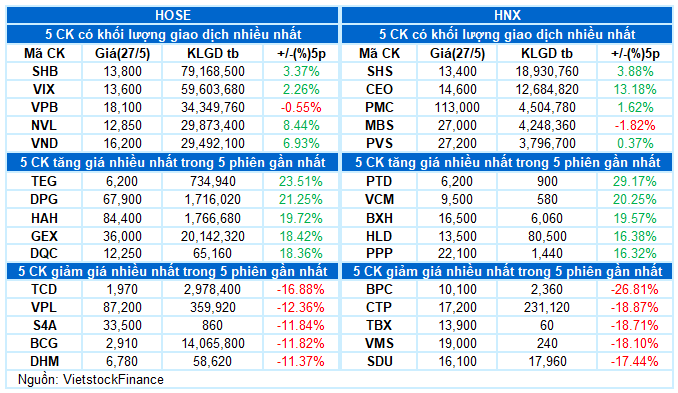

– In terms of contribution, HVN, VHM, and BID were the top performers, adding more than 2 points to the VN-Index. On the other hand, only VPL notably dragged the index down by over 1 point.

– The VN30-Index ended the session with a modest gain of 0.25%, reaching 1,427.45 points. The basket showed a mixed performance, with 14 gainers, 11 losers, and 5 stocks closing unchanged. On the positive side, VIB and BVH led the gains with an increase of over 2%. Conversely, SSB, LPB, and VRE were among the top losers, each declining by approximately 1% compared to the previous session.

Most industry groups continued their positive momentum. The industrial group made a strong impression with a nearly 1.5% surge, driven by a host of outstanding performers coupled with explosive trading volume, including GMD and HAH hitting the ceiling price, VSC (+6.48%), CII (+1.27%), HHV (+3.28%), CTD (+4.76%), HVN (+4.15%), PVT (+1.81%), DPG (+3.51%), VOS (+3.38%), PC1 (+1.54%), and LCG (+4.47%).

The information technology group also kept pace with a similar increase, led by FPT (+1.45%), CMG (+2.22%), HPT (+3.86%), SMT (+4.21%), and VBH hitting the ceiling price. The real estate group remained vibrant with numerous impressive gainers, such as DIG, CEO, L14, and NHA also hitting the ceiling price, PDR (+6.67%), HDC (+4.29%), NLG (+3.94%), KDH (+3.27%), and NTL (+6.62%).

On the downside, the healthcare and non-essential consumer groups closed in the red under pressure from several large-cap stocks, including IMP (-3.47%), OPC (-0.63%), DVM (-1.41%); VPL (-3.11%), TLG (-1.15%), and TBD (-10.67%).

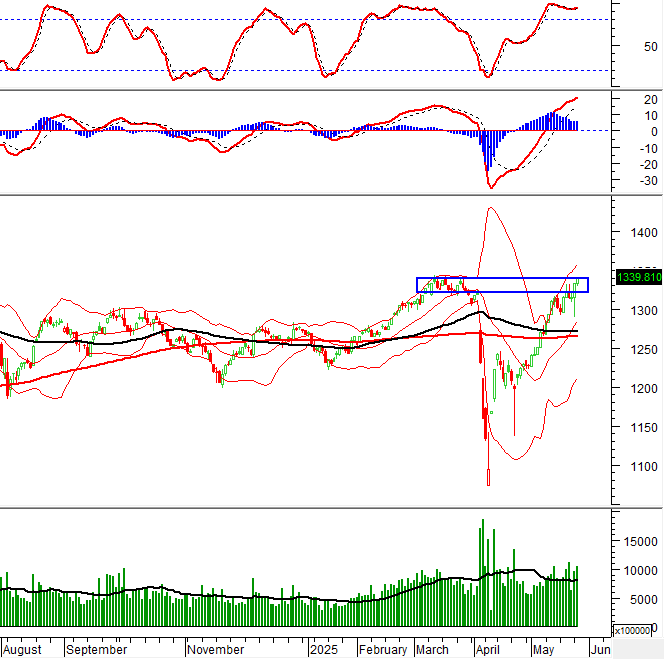

The VN-Index extended its winning streak while retesting the old peak of March 2025 (corresponding to the 1,320-1,340 range). Should the upward trend persist in the coming sessions, the VN-Index will have the opportunity to break out of this range. However, risks remain as this is a strong resistance level, and the VN-Index is likely to experience volatility. Currently, the Stochastic Oscillator indicator is venturing deep into overbought territory. Investors should exercise caution in the coming sessions if the indicator falls out of this zone.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Retesting the March 2025 Peak

The VN-Index extended its winning streak while retesting the old peak of March 2025 (corresponding to the 1,320-1,340 range). Should the upward trend persist in the coming sessions, the index will have the chance to break out of this range. However, risks remain as this is a strong resistance level, and volatility is likely to occur.

At present, the Stochastic Oscillator indicator is venturing deep into overbought territory. Investors are advised to exercise caution if the indicator retreats from this zone in the coming sessions.

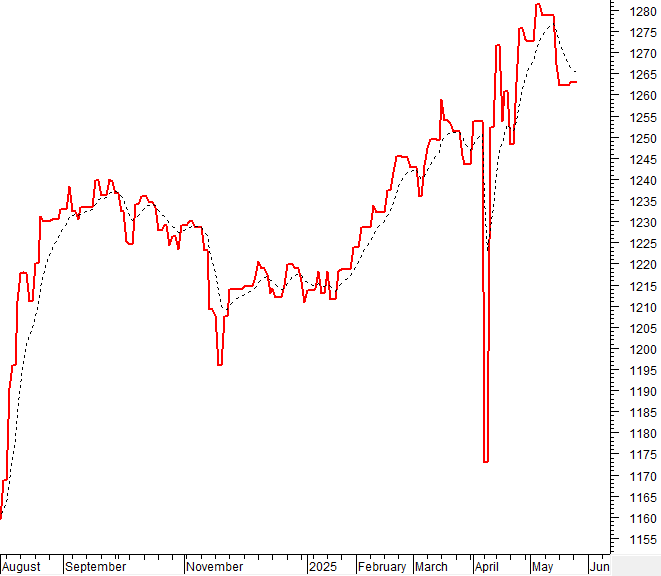

HNX-Index – MACD Indicator Crosses Above the Zero Line

The HNX-Index continued its upward trajectory, closely hugging the Upper Band of the Bollinger Bands. If this upward trend sustains in the coming days, the index is likely to surpass the SMA 50-day moving average.

Currently, the MACD indicator maintains a buy signal while crossing above the zero line, suggesting that the short-term optimistic outlook remains intact.

Analysis of Capital Flows

Movement of Smart Money: The Negative Volume Index indicator of the VN-Index dipped below the EMA 20-day moving average. If this condition persists in the next session, the risk of an unexpected downturn (thrust down) will increase.

Foreign Capital Flows: Foreign investors continued net selling during the trading session on May 27, 2025. If foreign investors maintain this stance in the coming sessions, the outlook may turn less optimistic.

III. MARKET STATISTICS ON MAY 27, 2025

Economic and Market Strategy Division, Vietstock Consulting

– 17:15 27/05/2025

The Expert’s Take: Only 154 Stocks Out of the 10% Losers Trailing VN-Index, Opportunities in Mid-Cap Space

The HoSE boasts an impressive performance with 42 stocks surging over 30%, and a further 215 stocks experiencing gains of between 10% and 30%. The remaining 154 stocks still managed a rise of under 10%. With over two-thirds of the market gaining under 30% and half of the HoSE’s stocks outperforming the VN-Index, it showcases a robust and diverse market.

The Stock Code: Unveiling the Sudden Sell-Off by Proprietary Trading Firms

The HoSE witnessed a notable development as proprietary securities firms recorded net sales of VND 243 billion. This significant activity underscores the dynamic nature of Vietnam’s securities market and highlights the pivotal role played by these firms in shaping the landscape of capital markets in the country.

The Cash Flow “Ditches” Blue-Chips: Small-Cap Stocks Surge Ahead

The lackluster performance of leading large-cap stocks is weighing heavily on the VN-Index, while the broader market continues to show resilience. This marks a reversal from previous weeks, when the index was propelled by these very same stalwarts, but investors saw limited gains as most stocks lagged.