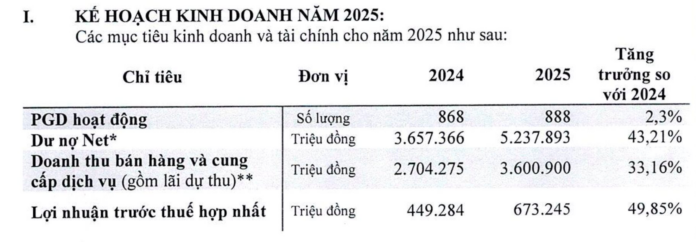

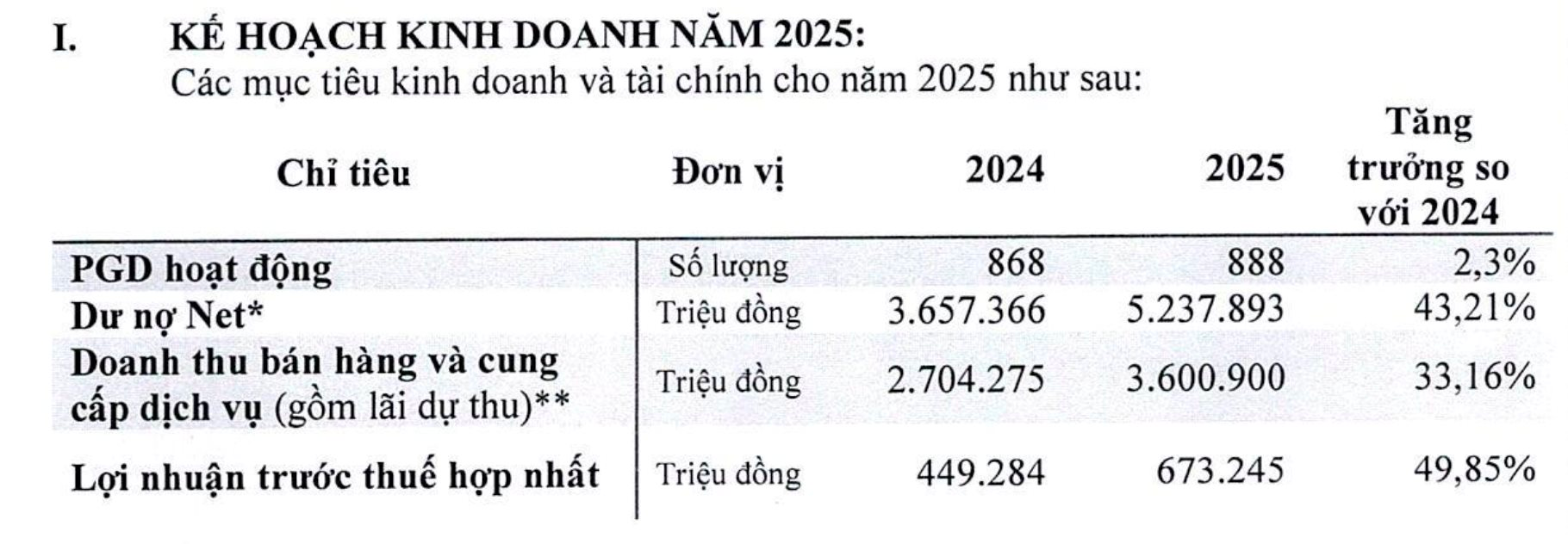

According to the documents of the 2025 Annual General Meeting of F88 Investment Joint Stock Company, the company sets a revenue target of over VND 3,600 billion in 2025, up 33.16% compared to the performance in 2024.

Consolidated pre-tax profit is expected to reach over VND 673 billion, an increase of nearly 50% compared to 2024.

The number of operating transaction offices is expected to increase to 888 points, an increase of 2.3%. Outstanding debt reached VND 5,237 billion, up 43.21% compared to 2024.

To achieve the 2025 target, F88 will continue to focus on several strategies such as: Network Business; Risk Management and Product Development; Developing strategic partner networks; Capital mobilization activities; Application of information technology, etc.

This General Meeting of Shareholders will also approve the Employee Stock Ownership Plan (ESOP) with the issuance price equal to the par value.

The 2024 ESOP program is expected to issue a maximum of 2.5% of the total outstanding shares of the Company, or 206,615 shares, equivalent to a value of over VND 2 billion. Accordingly, the expected number of shares to be issued is a maximum of 8.4 million shares, with a charter capital of VND 84.7 billion.

The 2025 ESOP program has a maximum bonus rate of 2% of the Company’s total shares in circulation as of December 31, 2025.

Notably, the F88 Board of Directors will present to the General Meeting of Shareholders a plan to issue shares to increase capital from owner equity.

The expected implementation time is in 2025 or Q1/2026, after the completion of the share issuance according to the ESOP program.

Specifically, the company will issue shares at a ratio of 1,200%, equivalent to 1 share will receive 12 shares issued additionally.

With 8.4 million shares expected to be in circulation, the expected additional issuance is 101.6 million shares, worth VND 1,016 billion to raise the charter capital to over VND 1,101 billion, 13.3 times higher than current.

The source of capital for the issuance is from the surplus capital based on the audited 2024 financial statements of over VND 1,640 billion.

After being officially approved to complete the public company registration on May 6, 2025, F88 is responsible for ensuring transparent, sufficient, and timely information disclosure in accordance with legal regulations before trading on the UpCom exchange.

The 2025 Annual General Meeting of F88 is expected to be held on June 9, 2025, in an online format.

“SHB’s Market Capitalization Surpasses $2 Billion: A Testimony to its Robust Financial Foundation and Relentless Pursuit of Excellence”

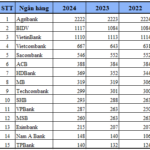

With a robust and ever-growing financial foundation, Saigon-Hanoi Commercial Joint Stock Bank (SHB) sets its sights on an ambitious goal: to reach VND 1 quadrillion in total assets by 2026. This bold target underscores SHB’s determination to solidify its leading position in Vietnam’s financial landscape and expand its regional presence, all while supporting the nation’s journey into a new era of prosperity.