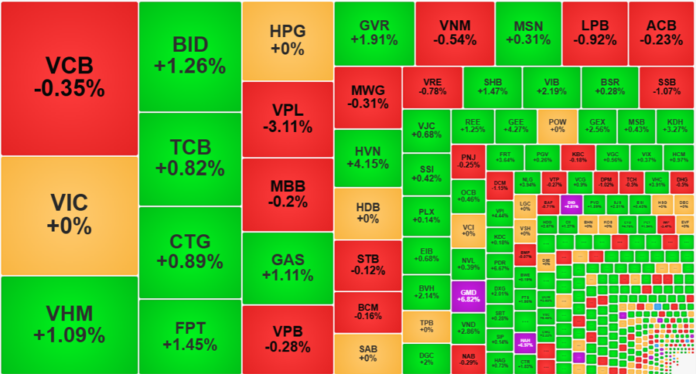

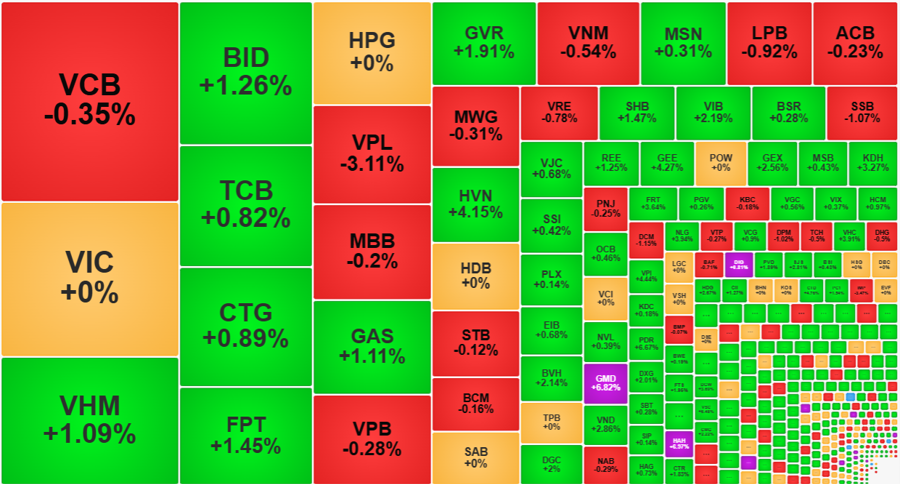

The market experienced multiple fluctuations during the afternoon session, with blue-chips being the main source of volatility. Mid-cap and small-cap stocks, however, witnessed a brilliant performance, with many stocks entering the market’s most liquid group with impressive gains.

Today’s surprising highlight was the immense selling pressure from foreign investors. In the morning session, they net sold 800 billion VND, and in the afternoon, they continued to sell another 306 billion VND. Today, the market witnessed another session of net foreign outflows exceeding one thousand billion VND since April 17.

Stocks in the VN30 basket experienced a net sell-off of 725 billion VND, with many stocks witnessing intense selling: HPG -157.2 billion, VIC -136.4 billion, VCB -100 billion, VRE -97.6 billion, VNM -79.7 billion, STB -71.3 billion, MWG -53.7 billion, SSI -51.4 billion, and MBB -50.3 billion…

The VN30 group faced significant pressure from foreign investors today, as the total value of stocks sold accounted for 33.6% of the liquidity. From this perspective, the resilience of the buying side was commendable. The VN30-Index closed up 0.25% with 14 gainers and 11 losers. Only a few stocks witnessed a large-scale sell-off from foreign investors, such as MBB, which decreased by 0.2%, MWG down by 0.31%, VCB down by 0.35%, VRE down by 0.78%, and VNM down by 0.54%… Some others, like HPG and VIC, despite experiencing heavy selling pressure, managed to maintain their prices. Moreover, the magnitude of the decline was insignificant.

For stocks outside the blue-chip basket, unaffected by foreign selling pressure, the upward momentum spread widely. Although the number of gainers and losers at the end of the day was 219 gainers and 80 losers, not much different from the morning session (210 gainers and 92 losers), the price level was higher. Specifically, HoSE had 113 stocks rising over 1% in the morning session, compared to 132 in the afternoon, with 75 of them rising over 2%. The VN30 basket contributed only two stocks to this group, VIB with a gain of 2.19% and BVH with a gain of 2.14%.

Twenty stocks in the mid-cap and small-cap group achieved a price increase of more than 2% and liquidity of over 100 billion VND. This group attracted the most money and demonstrated the most evident price performance. DIG, GMD, HAH, and TCM even closed at the ceiling price. VND, DXG, GEX, PDR, VSC, HHV, and CTD each matched over 200 billion VND in trading value. Although there were only 75 stocks in this group, they accounted for about 29% of the total matched orders value on the HoSE. This indicates the effectiveness and concentration of the money flow.

While the liquidity of the VN30 basket today decreased by nearly 4% compared to yesterday, the mid-cap group increased by 23%, and the entire HoSE increased by almost 11%. Almost the entire increase in liquidity on this exchange came from the mid-cap group (2,177 billion VND out of a total increase of 2,247 billion VND). The mid-cap index closed up 1.56%, outperforming the small-cap index, which rose 1.34%, and far surpassing the VN30-Index’s gain of 0.25% and the VN-Index’s gain of 0.55%.

It is noteworthy that the mid-cap index is still quite far from its March peak, about -3.55%. The small-cap index is also about 4.26% lower, while the VN-Index has returned to its previous peak, and the VN30-Index has surpassed its peak by about 2.33%. Additionally, many mid-cap and small-cap stocks are still far from their recent highs. This could be a driving factor for stronger money inflows into these stock groups.

Currently, the VN-Index is being supported and balanced by large-cap stocks. Today, the index even experienced three adjustment phases, with two phases in the afternoon session pulling back to the reference price. This was also the time when VIC and VHM fluctuated significantly. Fortunately, by the end of the session, VHM was pulled up, and VIC returned to the reference price. The support and balance from BID, TCB, CTG, and FPT also contributed to the VN-Index closing at the day’s high.

In such a stable environment, money flow has a favorable context to actively participate in potential stock groups. However, the risk also arises from this stability. When the pillars undergo a strong adjustment phase, the VN-Index will lose many points, impacting the overall market sentiment.

The Ultimate Guide to Dividend Stocks: Unlocking Yields Beyond Your Wildest Dreams

“High-yield dividend stocks offer a compelling opportunity for long-term investment strategies, catering to investors seeking consistent returns over time rather than those chasing short-term price fluctuations. “

Foreign Block Remains Net Sellers Despite Market’s Spectacular Recovery, Dumping Nearly $100 Million Worth of Stocks

“VHM witnessed a robust buying trend in the market, with a total net purchase value of VND 148 billion, standing out as the most actively traded stock for the day.”

The Expert’s Take: Only 154 Stocks Out of the 10% Losers Trailing VN-Index, Opportunities in Mid-Cap Space

The HoSE boasts an impressive performance with 42 stocks surging over 30%, and a further 215 stocks experiencing gains of between 10% and 30%. The remaining 154 stocks still managed a rise of under 10%. With over two-thirds of the market gaining under 30% and half of the HoSE’s stocks outperforming the VN-Index, it showcases a robust and diverse market.