“**Non-Performing Loans: Navigating Challenges and Exploring Solutions**”

On May 27, at the seminar “Addressing Non-Performing Loans: Seeking Harmonious Solutions,” business representatives shared insights into the rising issue of non-performing loans in the real estate sector. They emphasized the need for breakthrough and comprehensive approaches to resolve this issue, warning that without effective measures, numerous stalled projects would continue to languish, creating a chain reaction affecting banks, investors, and employees.

Mr. Le Hoang Chau, Chairman of the Ho Chi Minh City Real Estate Association (HoREA), highlighted the escalating complexity of non-performing loans in the real estate industry. He underscored its significant impact on the stability of the financial market and the health of businesses. Mr. Chau advocated for a holistic and innovative strategy to tackle this challenge, arguing that a lack of decisive action would result in a slew of stalled projects, adversely affecting banks, investors, and employees alike.

Mr. Le Hoang Chau, Chairman of Ho Chi Minh City Real Estate Association (HoREA)

|

Mr. Chau proposed that addressing non-performing loans presents an opportunity not just for debt recovery but also for market revival. He urged the government to consider enacting special mechanisms for aggressive and synchronized debt resolution. He suggested a new approach that focuses on debt recovery, project rehabilitation, business rescue, and job preservation. One of the significant challenges, according to Mr. Chau, pertains to the legal framework for secured assets. Many high-value projects are entangled in procedural and legal disputes, preventing banks from enforcing their rights and businesses from restructuring. He recommended refining the legal framework for handling secured assets, emphasizing transparency and streamlined foreclosure processes, including public auctions or project transfers.

Mr. Chau suggested establishing a central-level inter-agency task force to review and categorize stalled real estate projects. This would enable the formulation of tailored policies for different categories of non-performing loans, avoiding a one-size-fits-all approach.

He also emphasized the importance of facilitating access to credit for businesses with viable projects, offering more flexible conditions to help them regain financial strength and complete their projects. This, he argued, would generate real cash flow to repay debts.

Mr. Chau concluded by underscoring the systemic nature of this challenge, requiring a comprehensive solution involving the entire political system, rather than leaving businesses to navigate the crisis alone.

Real estate enterprises face a “mixed bag” of fortunes

Mr. Vo Hong Thang, Deputy General Director of DKRA Group

|

Mr. Vo Hong Thang, Deputy General Director of DKRA Group, offered his insights on the matter. He cautioned that seizing secured assets is not always the optimal solution. In a volatile market, this approach could burden banks if not coupled with effective resolution strategies. Mr. Thang emphasized the importance of collaboration between banks, businesses, and regulatory authorities to untangle bottlenecks, enhance transparency in processes, and improve the efficiency of asset utilization. This, he believes, is key to sustainably resolving the non-performing loan conundrum.

As of May, Vietnam’s real estate credit outstanding stood at over VND 1.56 quadrillion, marking an increase of approximately VND 260 trillion since the end of 2024, equivalent to a 20% growth rate. If the credit growth target of 16% for the entire system is achieved this year, total real estate credit outstanding could reach VND 3.8-3.9 quadrillion. However, credit continues to flow predominantly to real estate businesses, while individuals remain reluctant to borrow due to high property prices.

Notably, the non-performing loan ratio in the real estate sector is rising rapidly. Statistics reveal that the total non-performing loans of 27 listed banks have surpassed VND 265 trillion, reflecting an 18.5% increase compared to the same period last year.

Real estate enterprises are facing a mixed bag of fortunes. On the one hand, they benefit from a more than 2% reduction in borrowing rates since the end of 2023, resulting in lower capital costs. Additionally, the introduction of a VND 120 trillion credit package for social housing and supportive credit policies from the State Bank of Vietnam (SBV) provide a welcome boost. However, they also grapple with stringent borrowing conditions, particularly as many companies’ financial statements reveal financial weaknesses. Banks are increasingly cautious about the risk of non-performing loans, and borrowing procedures remain cumbersome and time-consuming. Moreover, many banks insist on real estate as collateral, showing reluctance to accept other forms of assets such as stocks or property rights.

To enhance capital access, enterprises need to prioritize transparent financial reporting, embrace independent audits, and leverage technology for credit scoring. Simultaneously, alternative capital mobilization channels, such as bond issuance, collaboration with investment funds, and green credit, should be encouraged and expanded.

“Capital Crunch” as a Key Driver of Non-Performing Loans

Mr. Thang noted that faced with bond maturity and bank loan repayment pressures, several real estate businesses have proactively negotiated debt restructuring. As of May, over VND 178 trillion in bonds have been extended, providing some financial relief. A few enterprises have also returned to the bond market, issuing a total of VND 10 trillion in April.

Additionally, selling assets to repay debts, reducing bond interest rates, and negotiating with banks for loan restructuring are common strategies being employed. However, when banks seize collateralized assets, a new set of challenges emerge. In many cases, these assets are unfinished real estate projects with incomplete legal procedures, hindering the bank’s ability to auction or redevelop them. The resulting maintenance and preservation costs incur financial waste and risks for the banks.

This “capital crunch” remains a primary cause of stalled real estate projects and rising non-performing loans. To address this, Mr. Thang suggested improving credit policies, ensuring consistency in borrowing conditions and disbursement processes. Enterprises, he advised, should prepare transparent financial documentation from the outset, be forthcoming about their cash flow plans, and proactively engage in flexible negotiations with banks to avoid unexpected changes during the borrowing process. Diversifying funding sources by issuing bonds or seeking investment funds and non-bank financial institutions is imperative.

In developed countries like the US, Germany, and the UK, asset seizure procedures are conducted openly and transparently, with independent oversight to ensure fairness for all parties involved. In Vietnam, while the right of banks to seize collateralized assets was previously stipulated in Resolution 42 and has now been legalized, further adjustments are needed to align with practical realities.

Win a Mazda at the CentreVille Luong Son Grand Opening and Customer Appreciation Event

To express our heartfelt gratitude to our valued investors in the CentreVille Luong Son project, we are thrilled to announce that the project developer will be hosting a special event on May 31, 2025. This event will not only offer an exclusive opportunity to purchase units in the project but also present a chance to win exciting prizes, including a grand prize of a Mazda 6 Signature car. Join us at the CentreVille Luong Son urban area in Hoa Binh to be a part of this extraordinary occasion.

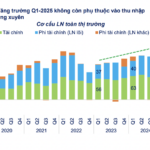

Enterprise Profits for Q1 2025: A Steady 12% Increase, Emphasizing Quality and Sustainability, Free from Reliance on Financial Income.

The net profit after tax for the whole market increased by 12% year-on-year, significantly lower than the average quarterly growth rate in 2024 (+20.5%/quarter). However, this growth reflects a more substantial and stable performance, as it is no longer heavily reliant on financial income contributions.

“Striking a Balance: Navigating Debt Collection and Borrower Protection”

“It is imperative to enshrine the successes of Resolution 42 into law to safeguard the legitimate rights of both banks and borrowers. The legislation should provide a framework that protects the ability of financial institutions to confiscate assets, while also ensuring that the property rights of borrowers are respected and upheld.”

The Widening of Nguyen Huu Tho Road to 60 Meters: New Developments in Nha Be and Can Giuoc’s Real Estate Market

With the expansion of Nguyen Huu Tho Road, a vital transportation corridor will be established, connecting the Ring Road 2 with the Ben Luc – Long Thanh Expressway, and eventually, the Ho Chi Minh City Ring Road 4. This strategic development addresses the critical need for efficient inter-regional transportation in the southern gateway of the city, facilitating seamless connectivity to the Eastern and Western regions of the South, as well as the network of seaports and the Long Thanh airport.