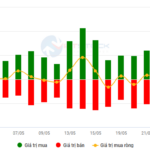

The stock market on May 26 surprised investors with a VN-Index drop of over 20 points at the opening bell, followed by a strong rebound of 18.05 points at the close, reaching 1,332 points. The total fluctuation was 40 points in just one day. This positive turn of events resulted from bottom-fishing funds and positive news following a statement about tariffs by US President Donald Trump.

An Abundance of Positive News

Specifically, President Donald Trump stated that his tariff policies aimed at producing large items such as military equipment and technology rather than sneakers and t-shirts. This caused a significant surge in the stock prices of industries such as textiles, footwear, and seafood.

Previously, the stock market had lost 20% of its value after the US president announced a 46% retaliatory tariff on Vietnamese goods. However, the VN-Index quickly recovered in a V-shape after the tariffs were temporarily suspended. At present, the index has surpassed the psychological threshold of 1,300 points, and the market is attracting strong capital inflows from investors.

Stock market experts hold positive views on the market from now until the end of the year. Photo: QUANG LIÊM

Speaking at a finance talk show on “Stock Market Fluctuations in the Second Half of 2025” organized by NLD on May 26, Associate Professor Dr. Nguyen Huu Huan, a senior lecturer at the University of Economics Ho Chi Minh City (UEH), analyzed the main factors influencing the international and domestic stock markets as the actions and information about tariff policies of US President Donald Trump. Most recently, Trump announced a possible 50% tax on goods from the EU, causing international stock markets to plunge. But a day later, the president announced a postponement of the tariff.

In the long term, stocks are influenced by capital flows. However, with the unpredictable policies of the US president, it is necessary to consider the direction of international investment capital flows: whether they will go to the US market to benefit from tariff policies or flow back to emerging markets, including Vietnam…

Another notable development is the recent fluctuations in VND interest rates and USD/VND exchange rates, which have had little impact on the stock market. According to Associate Professor Dr. Nguyen Huu Huan, the impact of tariff policies has overshadowed interest rates and exchange rates.

“When tariff information eases, interest rates will affect stocks. Currently, the VN-Index is positive due to low-interest rates and people seeking alternative investments. From another perspective, despite low-interest rates, deposits from the population into the banking system are still increasing, indicating that people and investors are still on the sidelines. This presents a significant potential for the stock market in the future,” the UEH expert said.

Why Haven’t Investors “Reached Shore” Yet?

Mr. Huynh Huu Phuoc, Director of Individual Customers and Director of Can Tho Branch – Dragon Capital Securities Company (VDSC), explained that although the market has recovered strongly in the past month, many investor accounts are still in loss.

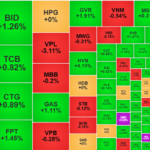

From the VN-Index drop on April 2 (the “tariff day”) when the index fell from around 1,315 points to a low of 1,097 points, the market has since recovered to its previous level. However, many stocks have not rebounded proportionally. In the VN30 basket, about half of the stocks have not returned to pre-April 2 levels, and on HoSE, with over 600 codes, more than 60% have not yet recovered.

Mr. Phuoc added that while the VN-Index has risen over 235 points from its April low, the Vingroup family of stocks (VIC, VHM, VRE, VPL) contributed more than 30% to this increase. This means that while the general VN-Index has “returned to land,” many investor accounts are still “adrift,” as the recovery has been concentrated in a few specific stock groups. “The strong differentiation among stock sectors during the market’s V-shaped recovery in the past two months explains why many investors have not yet ‘reached shore,'” the expert said.

Mr. Dao Minh Chau, Deputy Director of the Analysis and Investment Consulting Center – SSI Securities Company, said that from the beginning of the year to now, stock sectors have contributed about 45 points to the market’s upward trend, while the Vingroup family alone contributed 90 points. The strong recovery of Vingroup’s stocks is explained by their positive first-quarter business results, the listing of Vinpearl’s VPL stock on HoSE, and their minimal impact from tariff policies.

In contrast, most other stock sectors, such as exports, industrial real estate, and seaports, have not recovered as expected due to the influence of tariff policies. Mr. Chau also emphasized that the market’s P/E ratio is currently below the 10-year average, indicating attractive opportunities for foreign investors. Additionally, Vietnam has the important supporting factor of a potential upgrade from a frontier to an emerging market by the end of this year.

Bright Prospects for the Second Half

Commenting on stock market fluctuations in the second half and the outlook for stock sectors, Mr. Huynh Huu Phuoc said that technically, the market bottom was established during the sharp drop in early April. The VN-Index then retested the “bottom” a second time, falling to around 1,130 points before recovering quickly in a V-shape. Therefore, from now until July 8, when there is official news about tariff levels after the negotiations, the market will have priced in this information.

Mr. Phuoc predicted that from now until the end of the year, the VN-Index would fluctuate between 1,040 and 1,380 points, and the rest would depend on market reactions. With positive first-quarter business results and expectations for a favorable second quarter compared to the low base in the same period last year, export orders in April and May will increase to take advantage of the pre-tariff period. According to him, the most significant risk has been revealed, and expectations remain positive.

Mr. Dao Minh Chau believed that after a recovery of over 20%, with many stocks surging 40%-50% or even doubling, the VN-Index needed time to consolidate. The market might experience volatility in the next 1-2 months due to uncertain information related to US tariff policies and the risk of recession in some global economies. “However, if there is volatility, it is not too worrying because the April 2025 crash has already reflected much of the tariff information, and businesses have had time to prepare countermeasures,” Mr. Chau said.

SSI and VDSC experts believe that there are currently many investment opportunities in sectors such as banking, industrial real estate, retail, consumer goods, import-export, oil and gas, and fertilizers.

The Foreign Capital Exodus: Over VND 1,100 Billion in Outflows, Yet the Market Shines Brightly

The market experienced multiple shakes during the afternoon session, with blue-chip stocks being the primary drivers of volatility. Despite this, mid-cap and small-cap stocks shone brightly, with many witnessing impressive price gains and featuring among the market’s most liquid stocks.

“Market Signals: A Tale of Contrasting Fortunes”

The VN-Index extended its positive streak, retesting the old peak from March 2025 (around 1,320-1,340 points). If this upward trajectory persists in upcoming sessions, the VN-Index could break free of this range. However, risks loom as this level presents a strong resistance, and the VN-Index may experience volatility. Currently, the Stochastic Oscillator is venturing deep into overbought territory. Investors are advised to exercise caution if the indicator retreats from these levels in the coming days.

The Ultimate Guide to Dividend Stocks: Unlocking Yields Beyond Your Wildest Dreams

“High-yield dividend stocks offer a compelling opportunity for long-term investment strategies, catering to investors seeking consistent returns over time rather than those chasing short-term price fluctuations. “