In the Vietnamese stock market, it’s not uncommon to hear stories of stocks surging in a single session, yielding returns that surpass years’ worth of bank savings. The latest name to join this rare feat is PTG, belonging to Phan Thiet Export Garment Joint Stock Company. This stock recently soared by nearly 29% in a single trading session, equivalent to approximately five years’ worth of bank savings (based on current interest rates).

The dramatic surge in PTG’s stock price can be attributed to the Regulations on the Organization and Management of the Unlisted Public Company Market at the Hanoi Stock Exchange (HNX), as stipulated in Decision No. 236 dated April 24, 2015, by the HNX General Director. According to these regulations, for stocks on the Unlisted Public Company Market (UPCoM) that have not been traded for 25 consecutive sessions, the price fluctuation band on the first day of resumed trading is ±40% compared to the reference price.

Prior to this sudden surge, PTG had experienced a prolonged period of stagnant trading activity. The last transaction involving this stock occurred on August 19, 2024, when it surged by 28.6% with 100 shares matched. History repeated itself on May 27, as the stock skyrocketed once again, this time with a mere 100 units traded.

PTG, a textile and garment company established in 2002, is the successor to Phan Thiet Garment Enterprise. The company currently has a charter capital of approximately VND 50 billion. According to the 2024 Annual General Meeting report, there are seven major shareholders holding nearly 2.8 million shares, representing 55.78% of the total shares, while minor shareholders hold more than 2.2 million shares, or 44.22%.

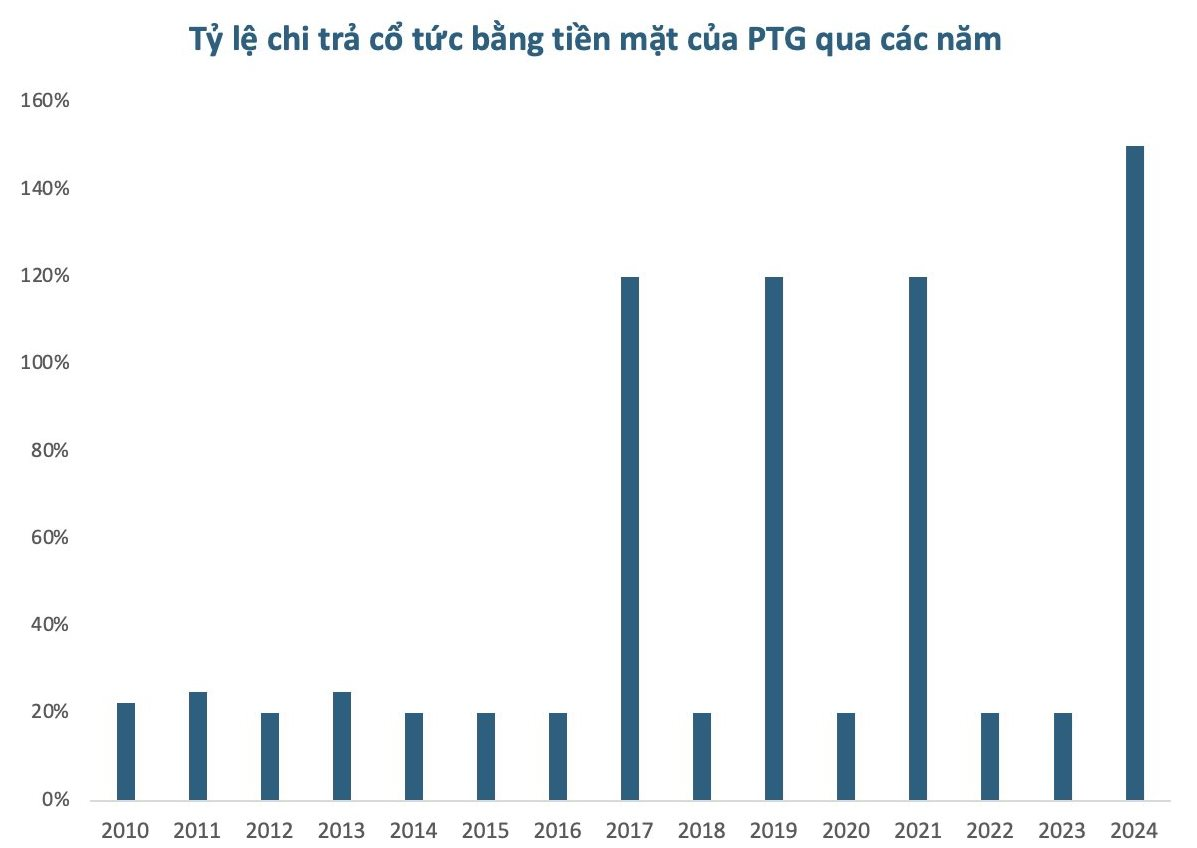

Most recently, PTG finalized its list of shareholders to receive the second dividend payment for 2024 in cash, with a rate of 100% (equivalent to VND 10,000 per share). The company plans to make this payment on June 13, 2025. Previously, in June 2024, the company had paid an interim cash dividend for 2024 at a rate of 50% per share, or VND 5,000 per share. With the completion of the second payment, the company will have achieved a total cash dividend payout of 150%, in line with the approved profit distribution plan (150% in cash).

Compared to the current market price (VND 900 per share), the dividend amount per share is more than 11 times higher. Since its listing on the UPCoM in early 2010, this garment company has consistently paid cash dividends every year. The 150% dividend payout is also the highest cash dividend rate PTG shareholders have ever received.

In terms of business performance, PTG set a target of VND 488 billion in revenue for the full year 2024, achieving 95% of its plan. However, its after-tax profit exceeded the target by 15%, reaching over VND 52 billion. For 2025, PTG aims for VND 525 billion in revenue and nearly VND 42 billion in after-tax profit.

Market Beat: Vingroup Leads the VN-Index’s Green Charge

The market remained in the green throughout the morning session. By the mid-session break, the VN-Index had gained over 6 points (+0.45%), climbing to 1,345.86; while the HNX-Index rose nearly 1%, reaching 223.97. Market breadth was positive, with 415 advancers, 250 decliners, and 919 stocks trading unchanged.

“Binh Dien Fertilizer to Dish Out Nearly VND 143 Billion in Dividends to Shareholders”

“Binh Dien Fertilizer plans to spend over VND 142.9 billion on dividends for its shareholders for the fiscal year 2024, with a generous payout ratio of 25%. The record date for shareholders to be eligible for this dividend is set for June 12, 2025.”