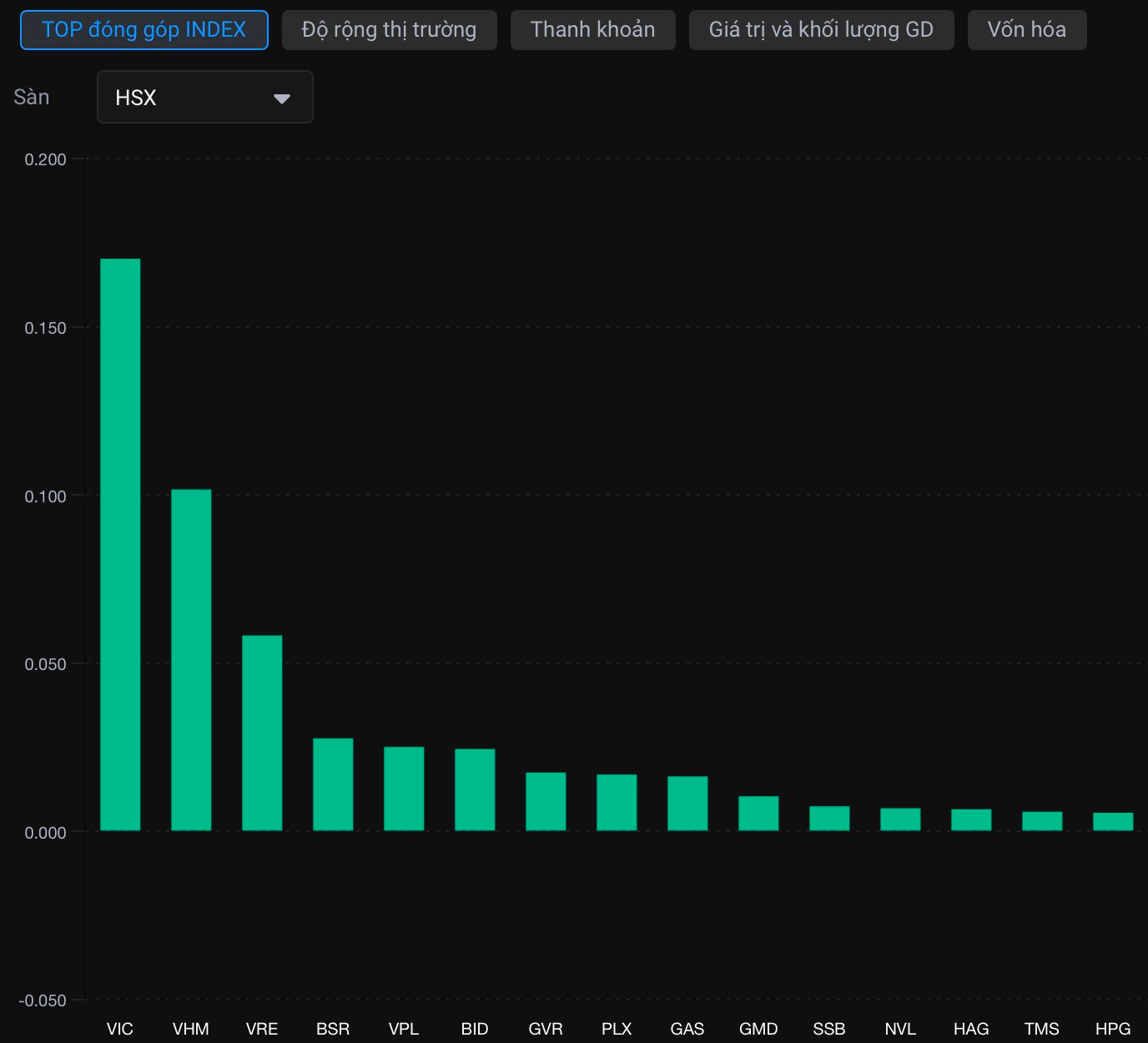

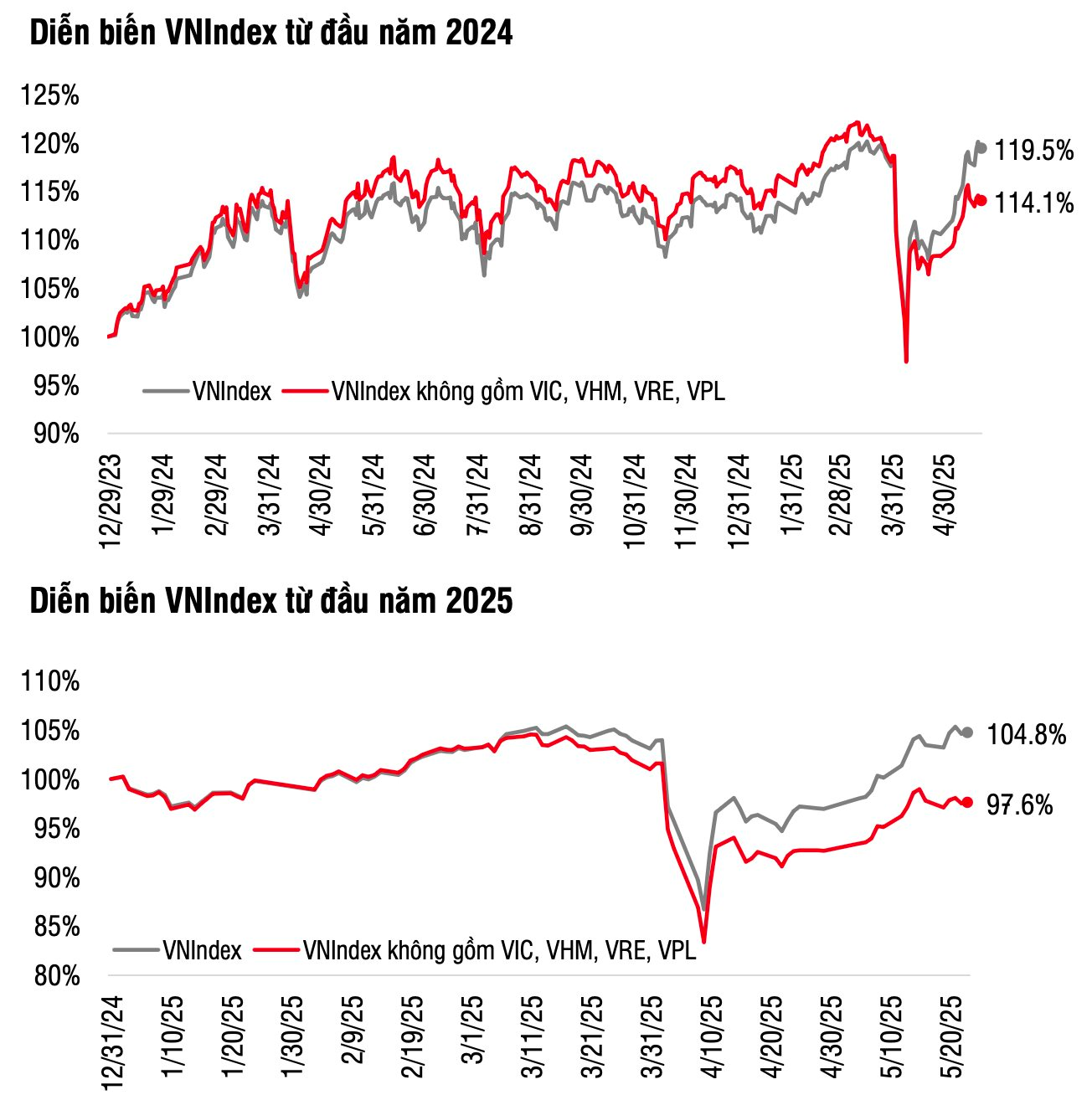

The Vietnamese stock market witnessed a mixed performance, with a familiar scenario of “green on the outside, red on the inside.” Vingroup’s stocks, owned by billionaire Pham Nhat Vuong, including VIC, VHM, VPL, and VRE, posted strong gains, significantly contributing to the VN-Index. However, the overall market was dominated by red, indicating declining stocks.

On May 28, these four stocks contributed a total of 4.7 points to the VN-Index, while the index only rose by 2.06 points (+0.15%).

It is not an exaggeration to say that billionaire Pham Nhat Vuong is “carrying” the stock market. This situation has been recurrent due to the surging prices of Vingroup’s stocks. Since the beginning of the year, the super quartet of VIC, VHM, VPL, and VRE has contributed almost 107 points to the VN-Index, while the index has only gained 75 points.

In the Cafe cung Chung column earlier this week, Mr. Nguyen Luu Hung, Chief Economist at SSI, remarked that without the contribution of the Vingroup stocks, the VN-Index would have likely dipped significantly and would not be above 1,300 as it is now. However, Mr. Hung also emphasized that the price increase is not entirely unreasonable.

Explaining the upward trend of some large-cap stocks, Mr. Hung attributed it to investors’ expectations regarding Resolution 68 on promoting the private sector. “Resolution 68 is not just about large enterprises; small and medium-sized enterprises can also benefit. However, Parts 5 and 6 of the Resolution specifically mention building large private enterprises and supporting their participation in important national infrastructure projects,” he added.

In other news, Vingroup, owned by billionaire Pham Nhat Vuong, recently approved a resolution by its Board of Directors to provide payment guarantees and use the corporation’s assets as collateral for corporate bonds issued by VinFast, a subsidiary, in 2025, with a total face value of up to VND 5,000 billion.

Earlier, on May 15, Vingroup issued 20,000 bonds with a face value of VND 100 million each, raising VND 2,000 billion. The bonds have a term of 24 months and will mature on May 15, 2027, with an interest rate of 12.5% per annum.

Thus, in just over a month, the conglomerate of billionaire Pham Nhat Vuong has issued six bond lots, raising a total of VND 15,000 billion. While the VIC12502 bond has a term of 38 months and will mature in June 2028, the other bond codes will have a term of two years. Interest rates fluctuate around 12-12.5% per annum.

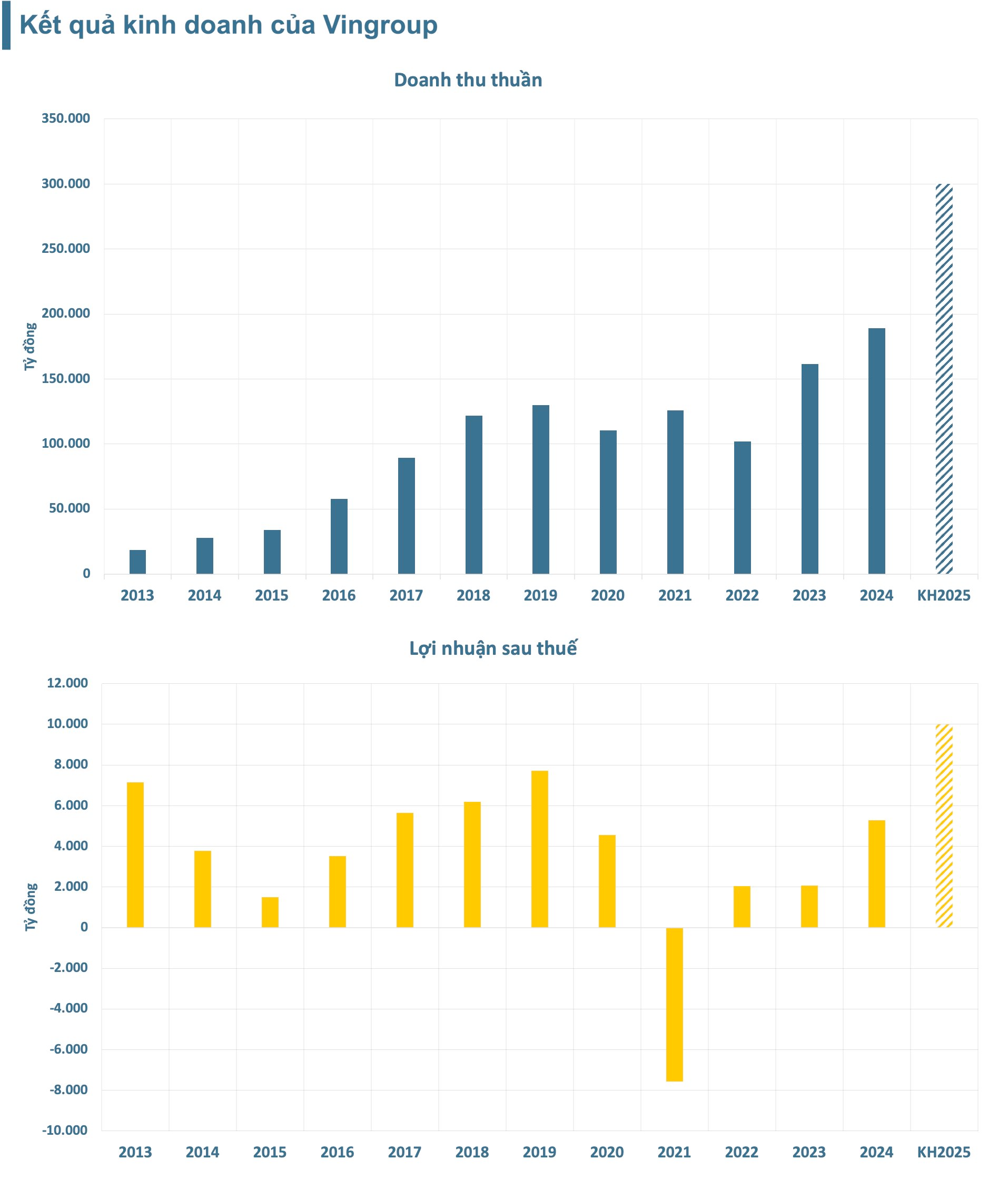

In 2025, the conglomerate of billionaire Pham Nhat Vuong aims for approximately VND 300,000 billion in revenue from production and business activities and VND 10,000 billion in after-tax profit, representing increases of 56% and 90%, respectively, compared to the previous year’s performance. With these results, Vingroup has achieved 28% of its revenue target and 22% of its profit target for the year.

Regarding first-quarter financial results, Vingroup reported consolidated net revenue of VND 84,053 billion, a remarkable 287% increase compared to the same period last year. This exceptional growth was driven by the positive performance of its industrial production and real estate development and investment sectors. Vingroup’s after-tax profit reached VND 2,243 billion, up 68% year-over-year.

Vingroup’s first-quarter financial results demonstrated a significant improvement, with consolidated net revenue reaching VND 84,053 billion, reflecting a remarkable 287% year-over-year growth. This outstanding performance was attributed to the positive trajectory in its industrial production, real estate development, and investment sectors. Consequently, Vingroup’s after-tax profit climbed to VND 2,243 billion, marking a 68% increase compared to the same period in 2024.

“Vingroup Backs VinFast’s Issuance of up to VND 5,000 Billion in Bonds”

Over the past month, Vingroup, owned by billionaire Pham Nhat Vuong, has issued six bond offerings, raising a total of VND 15,000 billion (approximately USD 640 million).

High-Speed North-South Rail Project: Why is VinSpeed Willing to Take a Loss?

VinSpeed has proposed the development of a high-speed rail network connecting the North and South of the country, with a bold promise to expedite construction and accept the risk of financial losses to achieve a historic feat in Vietnam’s infrastructure landscape.