Specifically, NVL plans to issue nearly 48.8 million ESOP shares from surplus capital and 48.8 million ESOP shares at a price of VND 10,000/share to 25 employees. The total issuance volume is over 97.5 million shares, equivalent to 5% of the total circulating shares.

|

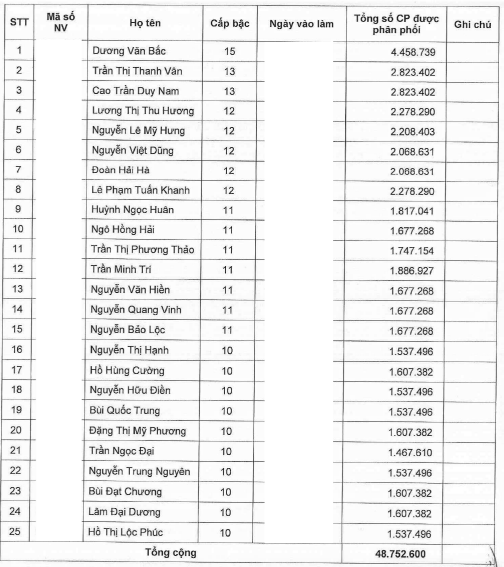

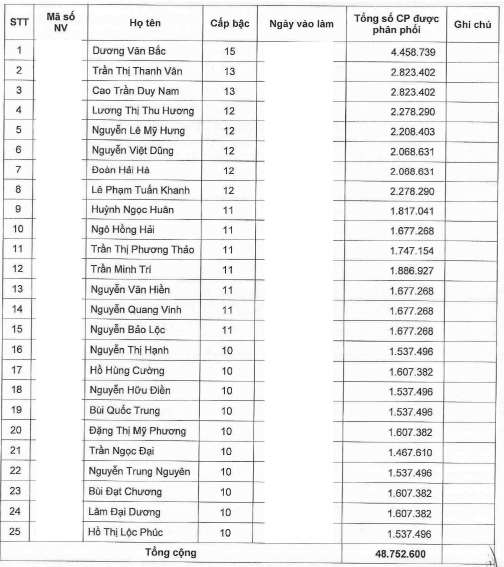

ESOP allocation list of NVL

* The list of employees participating in the ESOP offering program also includes 25 individuals with the same number of shares as listed above. Source: NVL

|

The expected timeline for the issuance is in the second or third quarter of 2025, after the State Securities Commission notifies the receipt of complete issuance report documents. The shares will be restricted from transfer for one year after issuance. Any unallocated shares will be issued to other members or employees.

NVL stated that the 2025 ESOP program is carried out to replace the planned issuances that could not be implemented in the past three years due to unfavorable market conditions.

According to trading data, NVL’s share price has maintained a positive upward trend since April 10, 2025, increasing by nearly 75% and reaching VND 14,200/share as of 10:24 am on May 30, 2025.

Returning to NVL’s ESOP program, the purpose is to recognize the contributions of the leaders during the company’s business operations, especially in the past two challenging years, while attracting and encouraging long-term commitment from personnel.

After the issuance, NVL is expected to increase its charter capital to VND 20,476 billion. The proceeds from the offering will be used to supplement the company’s business activities and working capital.

Using assets as collateral for a loan of nearly VND 1,800 billion of a subsidiary

Prior to approving the 2025 ESOP program, on May 28, NVL’s Board of Directors agreed to use the company’s owned assets, after being released from mortgage, as collateral for a loan of its subsidiary, Nova Riverside Real Estate Company Limited, from the Vietnam Maritime Commercial Joint Stock Bank (MSB).

The loan has a maximum limit of VND 1,750 billion and a term of 57 months. The purpose of the loan is to carry out development activities and distribute profits at the Novaworld Phan Thiet project, which is invested by Delta – Valley Binh Thuan, another subsidiary of NVL.

The assets used as collateral for the loan include the 1.01 commercial service area (first floor) of the Novaland Orchard Garden project (Phu Nhuan District, Ho Chi Minh City); 313B and 315 Nam Ky Khoi Nghia, District 3, Ho Chi Minh City; 1F and 359F Do Xuan Hop, Phuoc Long B residential area, Thu Duc City; and 34 Street 37, Thao Dien Ward, Thu Duc City.

According to Novaland’s 2024 Annual Report, Nova Riverside is the investor of the Sunrise Riverside project in Nha Be District, Ho Chi Minh City. Lots G1-5 and E1 were handed over in Q3 2018, and lots G1, G3, G4, and G5 received land use right certificates in 2024. Lots G6 and E2 were handed over from Q3 2024 onwards and will continue to be handed over until Q3 2025. The project is expected to receive land use right certificates for the entire project in 2025.

– 11:12 30/05/2025

“Dong Nai Approves Adjustment to 1/5000 Planning for Sub-area C4: A Boon for Nam Long, Novaland, and DonaCoop”

On May 29, 2025, the People’s Committee of Dong Nai province approved a local adjustment to the 1/5000 subdivision planning of subdivision C4 under the master plan of Bien Hoa city in Long Hung commune and a part of Tam Phuoc ward, encompassing prominent urban areas such as Waterfront, Aqua City, Cu Lao Phuoc Hung, and the Long Hung residential area.