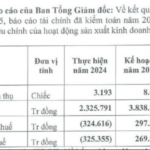

Deo Ca Joint Stock Group recently published its 2024 audited consolidated financial statements, with notable figures.

Accordingly, revenue from sales and provision of services in 2024 reached over VND 9,375 billion, an increase of VND 3,017 billion, or 47.5%, compared to the previous year. Cost of goods sold also increased by 50%, to VND 7,610 billion, resulting in a gross profit increase of only VND 483 billion, reaching nearly VND 1,766 billion.

Financial income of nearly VND 271 billion came from interest on deposits, loans, dividends, and profits; profits from joint business ventures, etc. In contrast, financial expenses amounted to nearly VND 868 billion, mainly interest expenses (nearly VND 848 billion).

During the period, management expenses also increased by 24% compared to the previous year, reaching nearly VND 321 billion.

Image: Deo Ca

Notably, other income in 2024 reached only VND 6.5 billion, while in the previous year, the company recorded over VND 152 billion. According to the financial statement notes, this was because in 2023, Deo Ca earned nearly VND 125.5 billion from the purchase of a company at a discount and profits from the disposal of fixed assets, tools, etc.

After deducting taxes and fees, the company reported a net profit of VND 735 billion in 2024, an increase of 14.5% compared to the previous year.

As of December 31, 2024, Deo Ca’s total assets increased by more than VND 3,631 billion from the beginning of the year, to VND 50,041 billion. This included cash and cash equivalents of over VND 2,471 billion; short-term receivables increased by approximately VND 1,095 billion to VND 5,368 billion; and inventory increased by VND 60 billion to over VND 843 billion, mainly comprising construction work in progress for unfinished construction projects (nearly VND 674 billion).

According to the 2024 consolidated financial statements, Deo Ca recognized long-term financial investments of nearly VND 1,355 billion (as of December 31, 2024), mainly investments in joint ventures and associates (Deo Ca Khanh Hoa BOT Investment Joint Stock Company, Cam Lam – Vinh Hao Expressway Joint Stock Company; Deo Ca Expressway Management and Operation Joint Stock Company, etc.).

On the other side of the balance sheet, as of December 31, 2024, the company’s payables stood at VND 34,507 billion, an increase of VND 825 billion from the beginning of the year, mostly long-term debt (VND 28,780 billion). This included total loans and finance leases of VND 20,362 billion, mainly long-term debt to banks.

According to the financial statement notes, VietinBank Hanoi Branch is Deo Ca’s largest credit partner, with short-term loan balances of VND 804 billion and long-term loan balances of nearly VND 17,037 billion as of the end of the year.

It is understood that Deo Ca’s borrowing limit at VietinBank Hanoi Branch is VND 22,841 billion with a term of 180-312 months, secured by the fee collection rights of the BOT project.

In addition, Deo Ca’s other credit partners listed in the financial statements include: Tien Phong Commercial Joint Stock Bank – Thang Long Branch (VND 666 billion); Vietnam Development Bank – Nam Ha Noi Branch (VND 439 billion); Vietnam Thriving Bank (VND 246 billion); and VietinBank – Da Nang Branch (VND 110 billion), among others.

Deo Ca’s 2024 consolidated financial statements also noted that the company had fully repaid its bond debt, while at the beginning of the year, it still had outstanding bonds of VND 200 billion. According to information on HNX, in 2024, Deo Ca repaid a total of over VND 223 billion in principal and interest on the DCA12101 bond.

It is known that the proceeds from the issuance of the above bond were used by Deo Ca to finance the construction of the Cam Lam – Vinh Hao section of the project “Investment in construction of some sections of the North-South expressway in the eastern phase 2017 – 2020 under the form of BOT contract” based on the Construction – Operation – Transfer Contract No. 316/HD.BOT-BGTVT dated July 30, 2021, between the Ministry of Transport, the Joint Venture of Deo Ca Joint Stock Company – Deo Ca Construction Joint Stock Company – Construction Joint Stock Company. Corporation 194, Cam Lam – Vinh Hao Expressway Joint Stock Company.

“TMT Motors Invests Nearly 100 Billion VND in Electric Vehicle Charging Station Venture”

“TMT Motors is proud to announce a significant investment of 98 billion VND in the establishment of TMT Electric Vehicle Charging Station Investment and Trading Joint Stock Company. With this investment, TMT Motors now owns 98% of the company’s charter capital, solidifying its position as a leading player in the electric vehicle industry. This bold move underscores TMT Motors’ commitment to driving innovation and sustainability in the automotive sector, as it gears up to revolutionize the way people power their vehicles.”

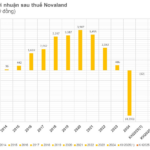

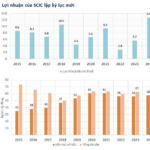

Novaland to Reward Employees with Millions of Shares After Two Years of Hard Work

With the completion of this offering, Novaland’s chartered capital is expected to rise to an impressive 20,476 billion VND.

“Vietnamese Billionaire Nguyen Thi Phuong Thao: Vietjet’s Commitment to Being a Growth Connector Between Vietnam and the World.”

On May 30, Vietjet Aviation Joint Stock Company (HOSE: VJC) held its 2025 Annual General Meeting, setting its sights on the continued expansion of domestic services and investment in its aircraft fleet for long-term growth.