Vietnam’s coal exports surged in April, with a significant 263.1% increase in volume and a 310.7% surge in value compared to the previous month, according to preliminary statistics from the General Department of Vietnam Customs.

From the beginning of the year, the country has exported over 241,000 tons of coal, valued at more than $46 million, marking an impressive 111.1% rise in volume and a 46% increase in value year-on-year.

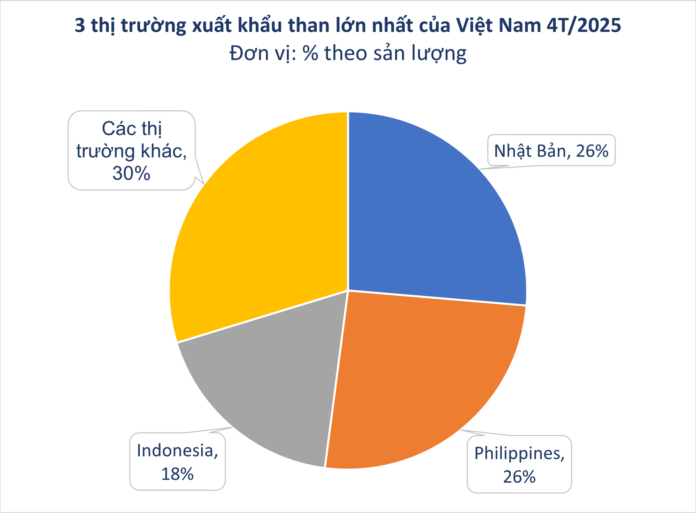

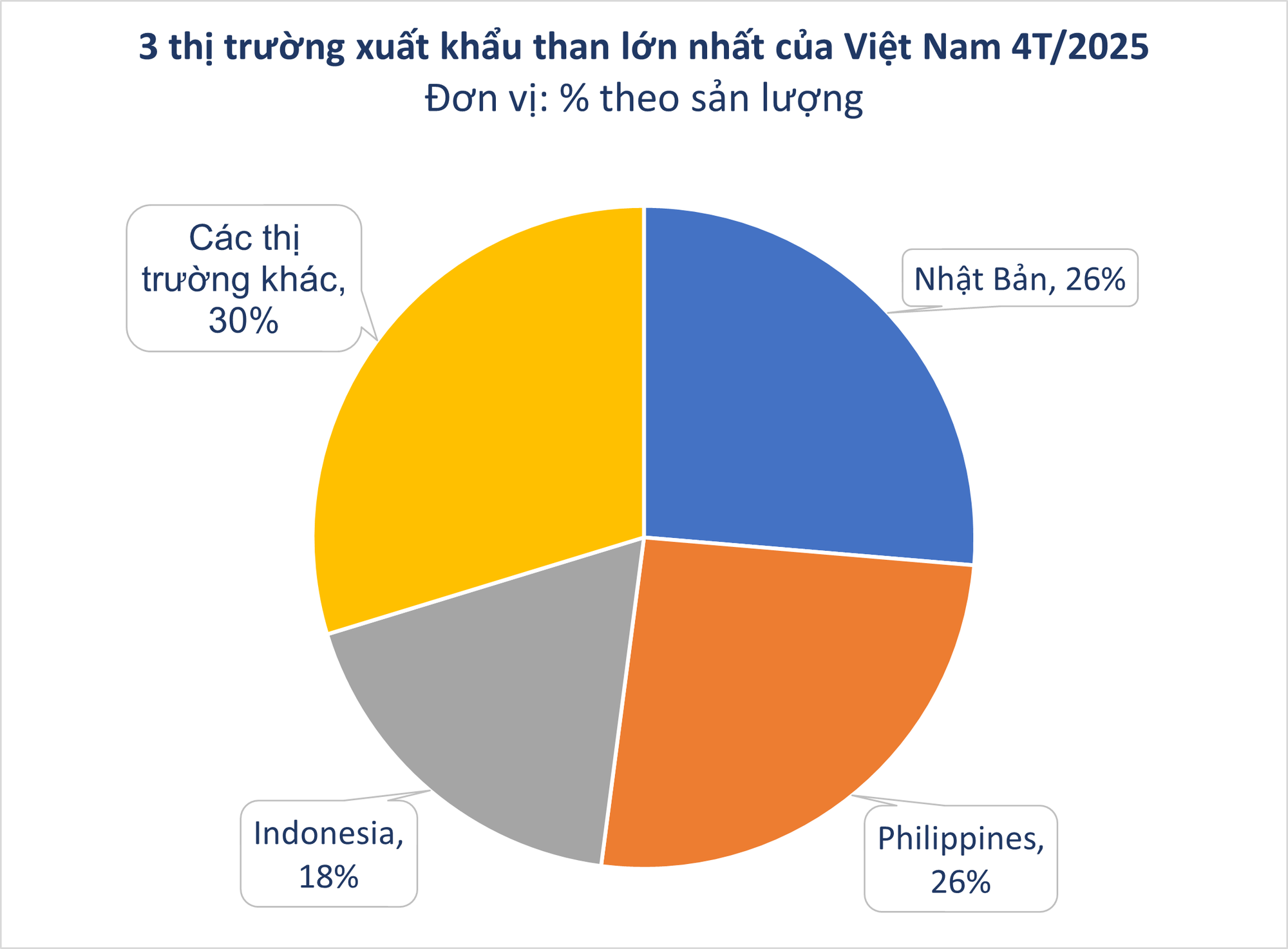

Japan remains the largest importer of Vietnamese coal during these four months, with imports totaling over 63,500 tons, valued at more than $12.6 million. This represents a 19% increase in volume and a 2% rise in value compared to the same period last year.

Remarkably, the Philippines has emerged as a significant importer of Vietnamese coal, witnessing a record-breaking growth. The country imported over 62,000 tons of coal, valued at over $10.7 million from Vietnam, an astonishing 51,645% surge in volume, despite a 80% drop in value. As a result, the average export price decreased by 15% to $173 per ton. The Philippines has the highest dependence on coal in Southeast Asia, due to its low adoption of renewable energy production.

Indonesia follows closely as the third largest importer, with nearly 44,000 tons of coal imported, valued at over $7.7 million. This is a notable change from the previous year, where there were no recorded exports to Indonesia. The average price stood at $177 per ton.

Vietnam is among the top five coal-consuming economies in Southeast Asia. According to the General Statistics Office, the country boasts approximately 50 billion tons of coal reserves. Quang Ninh province is home to the most significant coal mines in Vietnam, with operations dating back to 1839. With reserves of up to 8.7 billion tons and a strategic coastal location facilitating coal transportation to international markets, Quang Ninh has become the country’s foremost coal-producing region.

The Ministry of Industry and Trade forecasts an increase in coal mobilization capacity from now until 2030, reaching 43-47 million tons of commercial coal per year. This capacity is expected to gradually decrease in the subsequent years, from 2035 to 2045.

Demand for coal is projected to surge by 2035, reaching 94-127 million tons per year, primarily driven by the rising need for electricity generation and industries such as cement, metallurgy, and chemicals. However, this demand is expected to taper off to 73-76 million tons by 2045.

Meanwhile, domestic commercial coal production is anticipated to remain steady at 45-47 million tons per year between 2025 and 2035, before slightly decreasing to 42-44 million tons annually by 2045. To meet the burgeoning demand for coal, Vietnam is expected to import substantial quantities, estimated at 50-83 million tons during 2025-2035, with a gradual reduction to 32-35 million tons by 2045.

The International Energy Agency (IEA) predicts a rise in global coal prices to around $85 per ton by 2025. This anticipated price hike is attributed to the increasing coal demand in emerging economies like China and India, coupled with declining coal production in developed nations.